Economists often write dense papers. Advanced math makes their arguments almost impossible to understand.

Sometimes, an economist speaks clearly.

Herb Stein, chairman of the Council of Economic Advisers under Richard Nixon and Gerald Ford, did that once. He explained the entire world with just nine words.

“If something cannot go on forever, it will stop.”

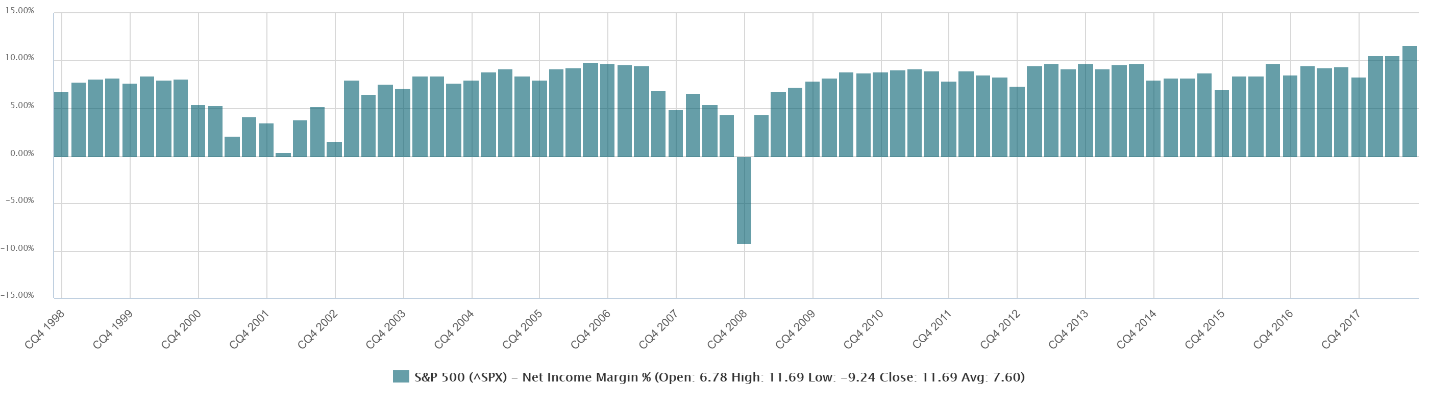

Stein’s Law says the current trends in the stock market will stop. The net income margins chart below shows why.

It’s the net income margin of the companies in the S&P 500 Index. Margins reached a record high last quarter. And that sets up the next bear market.

(Source: Standard & Poor’s)

Net income margin shows how much profit each dollar of sales generates.

Last quarter, 11.7% of sales ended up as profits for companies in the index. The long-term average margin is 7.7%.

Analysts expect even higher margins. Current earnings forecasts imply a net income margin of 12.4% in 2019 and more than 13% in 2020.

To increase the net income margin, companies usually lower expenses. But that’s unlikely to happen.

On calls with analysts last quarter, many companies’ management teams warned about rising costs. Labor costs are finally rising. At the same time, tariffs are increasing costs and disrupting supply chains.

On top of that, revenue growth is declining as the global economy slows. Lower revenue also reduces the net income margin.

Analysts’ estimates are just too optimistic. They don’t reflect higher costs and slower growth for next year.

That’s a problem for the stock market.

That means next year, analysts will either lower forecasts or companies will miss expectations. Either way, stock prices should fall.

The net income margin is yet another data point explaining why the bull market cannot continue.

It’s been a good run for the bulls. But if something cannot go on forever, it will stop. And bull markets simply cannot go on forever.

Regards,

Michael Carr, CMT, CTFe

Editor, Peak Velocity Trader