Friday morning was a sight to behold.

Our biggest snowfall this winter left a glistening white landscape everywhere you looked around my house … not to mention three very excited kids getting an extended weekend after schools closed.

But the beauty on the surface masked treacherous conditions below.

A thick layer of ice and sleet had come down first.

Getting around in the snow may be difficult, but it’s doable. Driving on ice is nearly impossible … and very dangerous.

Over the past year, the stock market has been staging a similar dynamic: dazzling and exciting scenery hiding the hazards beneath.

Signs of Bad Conditions

In 2021, the S&P 500 returned nearly 27%.

That’s fantastic … on the surface.

But just like ice beneath the snow, conditions were worsening for most publicly-traded companies, even though major indexes were delivering strong gains.

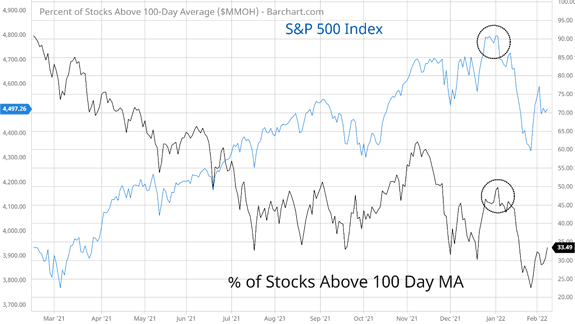

When you dig down into that blanket of snow, you find that most stocks are stuck in long-term downtrends. Just take a look at the percentage of stocks trading below their 100-day moving average:

(Click here to view larger image.)

Even as the S&P was jumping to new heights at the end of December, fewer than 50% of stocks were trading above their own 100-day moving average. In other words, the average stock was plunging below key measures of trend.

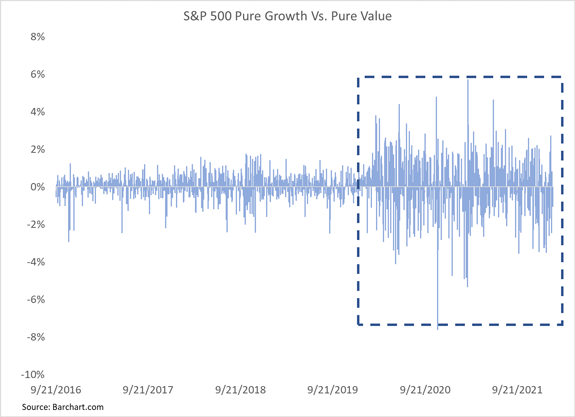

Next consider the persistence of trends … or lack thereof. That’s because sector volatility is exploding as you can see in the chart below, which looks like a seismograph of a terrible earthquake:

(Click here to view larger image.)

It shows the daily percentage difference in returns between growth and value stocks. It’s just another sign of the quick sector rotation that continues to play out in the market, which is why it’s so difficult to spot a trend.

And those large swings across sectors make trading difficult … kind of like overcorrecting your vehicle on icy roads and swerving from side to side. Or trying to drink a cup of coffee while the ground shakes violently beneath you.

This type of return dispersion picks up during periods of heightened volatility … as we saw with the Great Financial Crisis.

The indexes wouldn’t be able to avoid worsening conditions indefinitely, and now this year is showing just how treacherous it has become.

Venture Out, but Tread Carefully

So far, 2022 is showcasing just how difficult it has become to navigate in these conditions, with the major stock indexes correcting as well.

But just because selling pressure is spreading to the indexes, that doesn’t mean there aren’t opportunities to be found.

Take the aftermath of the dot-com bust for example. During the start of the meltdown in 2000, the S&P 500 fell 9%. But small-cap value funds gained over 18% that year!

In this week’s Your Money Matters, I showed you the corners of the stock market where true carnage is now creating opportunities.

And now The Bauman Letter is launching a new tactical exchange-traded fund subportfolio to take advantage of these Big Picture opportunities. In fact, we just launched our first round of trades today!

Best regards,

Clint Lee

Research Analyst, The Bauman Letter