Last week Microsoft Corp. (Nasdaq: MSFT) announced a $70 billion acquisition.

It’s the largest tech deal in history.

Microsoft’s target? Video game company Activision Blizzard Inc. (Nasdaq: ATVI).

You might be thinking…

“Really, a video game company?”

But I’m not surprised one bit.

It’s clear that Microsoft sees the opportunity too.

Microsoft Doubles Down on Gaming

There are 2.5 billion gamers in the world, and 60% of them play at least four hours per week.

In other words, the world collectively spends a lot of time playing video games.

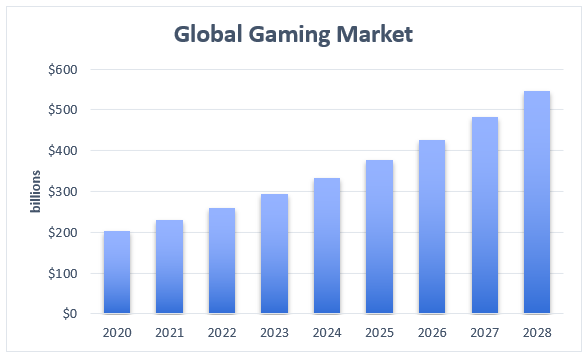

This has helped the video game market blossom into a $229 billion industry.

And the market is set to double in size over the next several years.

(Source: Fortune Business Insights.)

Microsoft already has an established video game business, which it started in 2001.

Since then, it has sold roughly 200 million gaming consoles and surpassed 100 million paid online users.

Now, two decades later, its gaming segment has generated $15.9 billion in revenue over the past year.

This should’ve been even higher. But supply shortages limited sales of its newest Xbox console.

Even though Microsoft’s video game business has grown so large, its gaming segment only accounts for 9% of its total revenue.

But by buying Activision Blizzard, Microsoft is doubling down on its video game business.

The Gaming Market Has Huge Untapped Potential

Microsoft’s move indicates there’s huge untapped potential in both the gaming market and Activision Blizzard, specifically.

Activision Blizzard has developed an extremely loyal gamer base across its franchises. The company now has 400 million monthly active players across 190 countries.

Its loyal customers have helped the company generate $9 billion in revenue across its franchises Call of Duty, Warcraft and Overwatch, among others.

Microsoft also sees its deal with Activision Blizzard as an opportunity to bolster its Game Pass service.

Game Pass is a paid monthly subscription that lets users play games for free.

In just over four years, Game Pass has reached 25 million monthly users.

It very well may be the future of gaming.

A No-Brainer for Consumers

The service is part of the gaming-as-a-service model, where companies provide a large selection of games for a monthly fee.

But users still have to download the games before playing them.

This can take a long time, especially for larger games.

But Microsoft has a solution to this problem. It has begun incorporating cloud games in its Game Pass service.

This lets users play games directly from the internet.

Soon, major games like Activision Blizzard’s should be available to play in cloud format.

When this happens, I expect the purchase of Microsoft’s Game Pass to be a no-brainer for consumers.

This will transform the video game market as consumers move away from buying games.

A Smart Way to Bet on the Gaming Industry

Any time an industry changes, there are winners and losers.

Right now, it looks like Microsoft’s gaming business will be a winner.

It could make more gaming acquisitions in the future.

As this happens, I expect gaming stock prices to rise to higher levels.

To get exposure to gaming stocks, you can buy the Global X Video Games & Esports ETF (Nasdaq: HERO).

The ETF holds 40 gaming companies across the U.S., Japan and other countries.

With HERO, you can bet on the gaming sector as a whole rather than risk your money on one company.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

Exterran Corp. (NYSE: EXTN) is a systems and process company that provides various solutions in the oil, gas, water and power markets worldwide. It is up 51% this morning on the news of its merger with rival, Enerflex, in a deal worth $1.5 billion.

Kohl’s Corp. (NYSE: KSS) the department store operator is up 34% this morning. The stock jumped after it received its second takeover bid from private equity firm Sycamore two days after it received a bid from Acacia Research.

China Evergrande Group (OTC: EGRNF), the struggling Chinese property developer, is up 12% today. The move came after the firm appointed a state official to its board, fueling hopes of growing government intervention in the property sector.

Adtalem Global Education Inc. (NYSE: ATGE) is a workforce solutions company that provides access to education, certifications and upskilling programs at scale. The stock rose 11% on the news that the company is selling its Financial Services segment for $1 billion.

Akouos Inc. (Nasdaq: AKUS) develops gene therapies to restore, improve and preserve physiologic hearing for individuals. It is up 11% this morning, breaking its downtrend from last week, with no significant news to report.

Macy’s Inc. (NYSE: M), the department store giant, is up 7% today. The stock is trading in sympathy with Kohl’s on the news of its competing takeover bids.

Amylyx Pharmaceuticals Inc. (Nasdaq: AMLX) develops therapeutics for amyotrophic lateral sclerosis (ALS) and other neurodegenerative diseases. It is up 7% this morning with no significant news driving the move.

Dillard’s Inc. (NYSE: DDS), the department store operator, is up 7% this morning. It is another stock that trading higher on the news out of Kohl’s.

Unilever PLC (NYSE: UL), the international consumer goods giant, is up 6% today. The stocked moved on reports that activist investor Nelson Peltz has built a stake in the company amid recent concerns over its strategy after the failed pursuit of GSK’s consumer health care segment.

Casper Sleep Inc. (NYSE: CSPR) designs and sells mattresses, furniture and related sleep products. It is up 6% today, continuing its momentum from late last week when it rose on the news that Durational Capital Management is taking the company private.