In the few moments before I wrote this, I posted three things to Facebook (New Yorker cartoons, if you’re wondering).

You know who has never posted a single thing to Facebook?

My teenage daughter.

And that’s a big problem for the company now known as Meta.

Last year, founder and CEO Mark Zuckerberg decided he didn’t want his brainchild to be called Facebook anymore.

The company’s ticker is still FB.

But ever since the name change, the company has stopped talking about traditional “Facebooky” things.

Instead, Zuckerberg tells the world his goal is to transform his company from a social media platform into humanity’s gateway to the metaverse.

The core idea of the metaverse is that people will interact with avatars of each other in a digital version of the physical world.

For example, instead of sending an instant message to your mom, you’ll walk up to her “front door” and knock. She’ll answer, and your avatar will “speak” the message to hers (even if she’s offline). When she gets a notification, she’ll open the door and there you will be … her digital progeny, who’ll deliver the message.

Call me an old fogey, but that sounds like a dodgy business plan to me.

If Mark Zuckerberg showed up at my office pitching that idea, I’d tell the secretary to send him away. It’s an overly complicated way to do simple things.

But Zuckerberg is desperate to convince the world that the metaverse is the future.

My daughter is the reason why…

Oh, ****

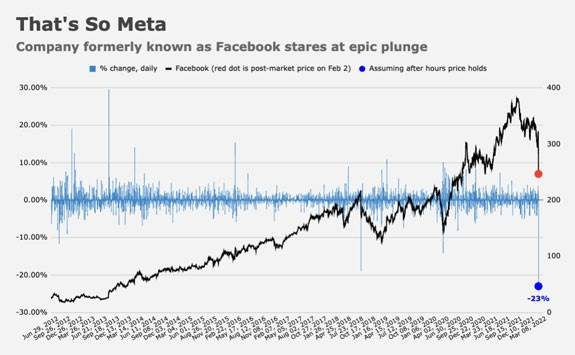

There’s no other way to describe what happened to Meta (Nasdaq: FB) stock yesterday:

(Click here to view larger image.)

Just before market close on Thursday, Meta’s one-day loss was approaching 26.5%.

That’s the single biggest drop since the company went public a decade ago.

It lost about $235 billion in market capitalization in a single day. That’s more than the entire Greek economy. It dragged down the S&P 500 by 2.5%.

Here’s how that looks in the context of the stock’s history:

(Click here to view larger image.)

The proximate cause of the plunge was the first quarterly drop in daily active users in the company’s history.

The problem — one over which Zuckerberg surely loses sleep every night — is that there’s no way to reverse that.

Meta’s revenue comes from targeted advertising. To make money from that, its Facebook product needs a big and growing user base. Otherwise, advertisers will spend their money elsewhere.

But Facebook is past its prime. It isn’t popular among people like my teenage daughter.

She says Facebook is for “grandmas and grandpas.” She’s never had a Facebook account and has no desire to have one. She’s an active social media user … but on platforms that emerged long after Facebook, like TikTok and Roblox.

As Facebook’s existing (and aging) users move on, there’s no one to replace them.

On top of that, its advertising revenue will decline by $10 billion this year thanks to privacy changes by Apple, whose iPhones now automatically block targeted advertising tracking like Facebook’s.

Savvy investors know this. So even though the decline in Facebook’s daily users was modest — fewer than a million people worldwide — they punished Meta stock severely.

Maybe Nobody Wants a Reinvented Wheel?

Zuckerberg looks like a hunted and haunted man.

He knows the business model that made him a zillionaire is dying.

Facebook is like a passenger train company about to be crushed by airlines. It brought social media to the masses. But social media and the masses have moved on.

He has two choices.

He can try to invent a new social media platform. He’s unlikely to succeed. Other companies do that every day. It’s hard to see how anything his company could produce would outdo the growing number of alternatives.

Even worse, it’s clear that social media platforms rise and fall quickly, with young users moving to new ones after a few years.

His other option is to transform his business into something else entirely. That’s where his bet on the metaverse comes in.

Now, I’m no psychologist. But I have a strong suspicion that Zuckerberg confuses a future he can imagine with a future that’s practical and marketable right now.

When you’re a gazillionaire who owns a big chunk of Hawaii and strives to avoid ordinary people, there’s nothing to stop you from indulging those thoughts … even betting the future of your company on it.

But what if ordinary people — the people who sign up to use the products that earn revenue right now — aren’t interested in communicating with their moms via digital avatars? What if they’re perfectly happy with Facebook posts?

In that case, by betting on the metaverse, Meta is going from a market leader to an experimental startup.

And given the way experimental startups have fared since they topped in the first quarter of 2021, it’s clear that the market isn’t interested in them.

Unless Meta can make the metaverse work immediately — something that’s almost certainly not going to happen — Meta stock may be headed for the dustbin of history.

My advice?

There are much better places to invest your money for big gains. The latest edition of The Bauman Letter shares the details of the latest one I’ve uncovered. Click here to learn more.

Kind regards,

Ted Bauman

Editor, The Bauman Letter