There is a critical concept that too many investors forget when they jump into the fray with their money.

When it comes to uncovering the best companies, cash is still king.

The idea can be easily overlooked when it comes to flashy new products and big promises for the future, but the power of cash and dividends defines what makes a strong company.

The most powerful concept in investing is cash. It is integral to a company’s ability to reward its shareholders through dividend payouts.

And at times like this, owning stocks that can pay you is critical to your investing.

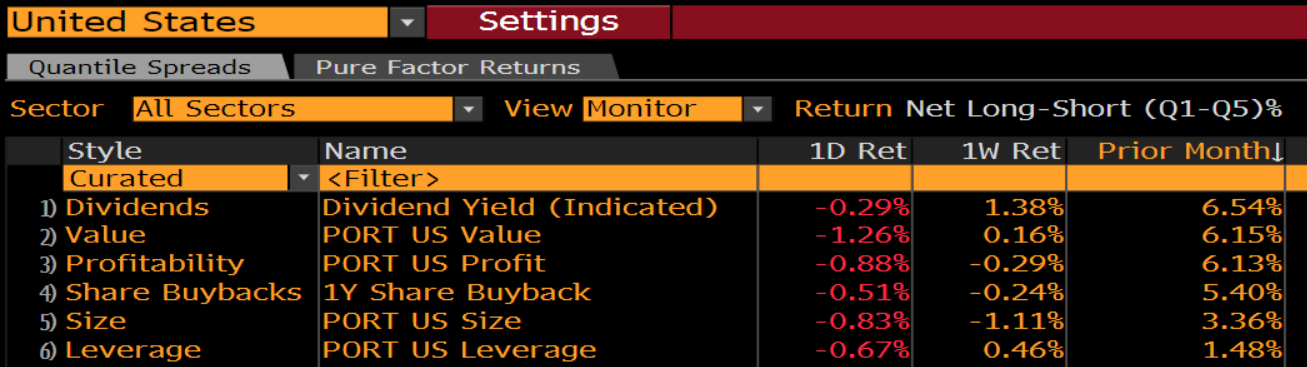

The data backs up this idea. Over the past month, the highest-yielding stocks have returned the most of any investing style Bloomberg tracks.

(Source: Bloomberg)

The next two best performers were value and profitability. In other words, the cheapest stocks and the ones with the highest returns followed behind dividend stocks. These three styles were the only ones that returned more than 6%.

When investors don’t know what’s going to happen next, they fall back on substance over hope and that can have a critical impact on your next investments.

Focus Opportunities for Investors

Investors are seeking tangible results over potential growth right now.

The FAANG stocks — Facebook, Amazon, Netflix and Google (now known as Alphabet) — have suffered a cumulative loss of nearly 3% over the past month. And if you add Apple (as many like to do), it gets even worse. Those five stocks are down nearly 20% in total.

Many worries have hit these names, from censorship-seeking politicians to valuation. But the main issue is growth. Investors aren’t sure these companies can achieve the lofty expectations they have for them.

So, traders have started to replace the FAANG stocks with companies that already reward investors. Dividend-paying stocks don’t rely on hopes of future cash … they already flow with it.

That is appealing to investors in the face of today’s questions.

These ETFs Are Benefiting

Three value-focused exchange-traded funds (ETFs) have seen the greatest inflows of funds over the past week. They’ve each raked in more than $100 million.

They are:

- iShares Russell 1000 Value ETF (NYSE: IWD).

- Vanguard Value ETF (NYSE: VTV).

- iShares Russell 2000 Value ETF (NYSE: IWN).

FAANG stocks are down and the market, as a whole, has dropped. Yet these value ETFs are in positive territory for the year.

These Sectors Are Benefiting

And if you are wondering which sectors are benefiting the most, it may not surprise you to learn that one is utilities. These stocks earn predictable cash flows.

The sector has seen more than $1 billion in net fund flows into its ETFs thus far in November (through November 23, 2018).

Another sector that has seen significant inflows is health care. Investors have poured nearly $1.2 billion into its ETFs this month.

Both of these sectors generate a lot of cash … and pay solid dividends.

By the way, consumer staples have also benefited over the past month. They’ve seen more than $800 million of net inflows thus far this month. This isn’t a surprise. These stocks have historically benefited from market uncertainty, too.

What Does this Mean for Your Portfolio?

The market churn we’ve seen recently isn’t showing any signs of ending yet.

Given this, it makes sense to consider putting your money into the investments that are doing well now.

Good investing,

Brian Christopher

Editor, Insider Profit Trader