Last week, the Dow Jones Industrial Average completed a near-record losing streak. The index fell eight days in a row before delivering a gain on Friday. This happened just five other times since 1900.

This losing was unusual. The Dow is above its 200-day moving average (MA). That means we’re in an uptrend.

Losing Streaks

Losing streaks like this usually happen in downtrends. In fact, there have been 23 eight-day losing streaks when the index is below that MA.

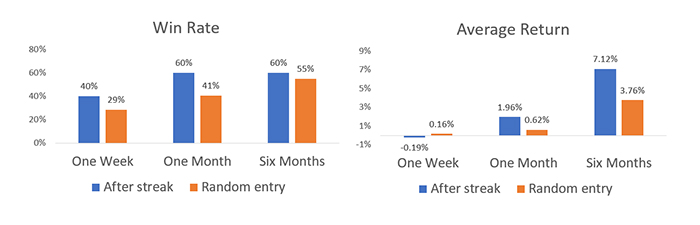

In the past, a losing streak like this was a great buy signal. The chart below shows how the index fared after previous losing streaks (the blue bars) compared to a random entry (the orange bars).

After the streak, over the next one to six months, we have a better-than-average probability of gains. Over the next week, though, expect more weakness.

In addition to the fact that the Dow was in an uptrend when this losing streak unfolded, there’s something else unusual about the recent market activity.

Other indexes, like the S&P 500 Index or Nasdaq Composite Index, didn’t fall like the Dow did. So, we need to dig deeper to understand the losing streak.

Aircraft maker Boeing Co. (NYSE: BA) accounted for much of the Dow’s decline. Heavy-equipment maker Caterpillar Inc. (NYSE: CAT) also pushed the Dow down.

These two stocks were casualties of trade war talk. They both depend on exports for large sales. And they have a large impact on the Dow.

The Dow is a price-weighted average. Boeing is the highest-priced stock in the index. It accounts for 9.5% of the Dow’s price moves on any given day. Caterpillar accounts for 3.9% of the index.

Other indexes use different weighting schemes. That tends to dampen the impact of any one stock. Boeing accounts for just 0.7% of the S&P 500, and Caterpillar represents less than 0.4% of that index.

Despite the differences in the indexes, the Dow is still important. In this case, its losing streak tells us what to expect in a trade war.

If the trade war moves beyond threats, stocks will suffer. For now, that seems unlikely, and we should expect better-than-average gains over the next one to six months.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader