Japanese investors know what a bear market is. The Nikkei 225 Index, a benchmark index for the country, peaked in 1989.

Japan’s central bank has added to investors’ distress. Long-term rates have been below 1% for more than five years and have even been negative at times. This makes it almost impossible for investors to make money.

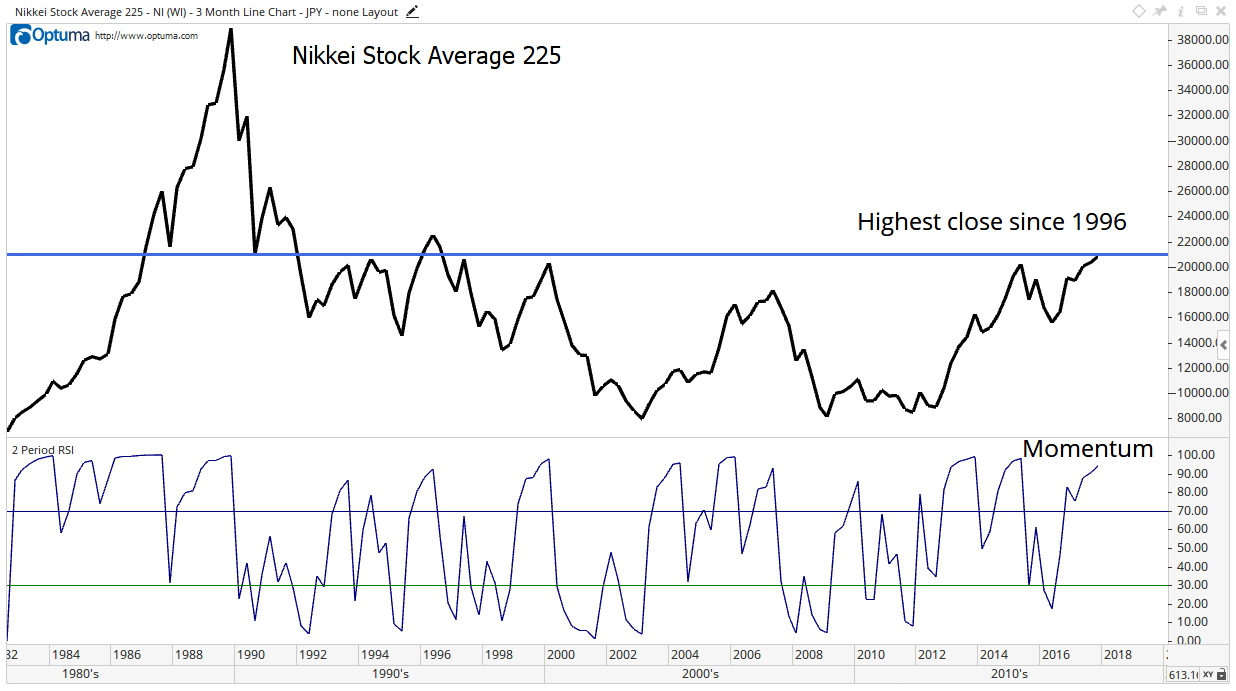

But stocks are now rallying, closing at a 21-year high this week. A momentum indicator at the bottom of the chart below shows the gains should continue.

The two-period Relative Strength Index, or RSI(2), measures momentum. This indicator responds quickly to the market action and provides timely signals.

RSI(2) is at 95. That’s high, but it has room to climb. It reached 99 at previous market peaks.

RSI(2) is telling us the gains should continue.

There’s also a fundamental reason stocks should continue higher.

To stimulate economic growth, the Bank of Japan started buying stocks. It now owns about 5% of the total stock market.

The central bank won’t sell, even in a market downturn. This provides support for stock prices and limits downside risks.

U.S.-based investors can buy Japanese stocks with the WisdomTree Japan Hedged Equity ETF (NYSE: DXJ). This exchange-traded fund provides exposure to the stock market and hedges’ currency risks. That means the ETF closely tracks the Nikkei rather than the value of the yen.

Other Japanese stock ETFs reflect changes in the exchange rate. DXJ is a pure trade on Japanese stocks. And Japan is where investors want to be right now.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader