A lot of folks are assuming the banking crisis is over.

But what if it’s not? Are you prepared?

Look, I’m certainly no “doomsdayer.” I’m a cautious optimist. I’m also an opportunistic trader.

So today, I hope you’ll allow me to offer a level-headed warning … and a way to profit from what I believe will be the “next shoe to drop.”

Then you can decide for yourself what to do about it.

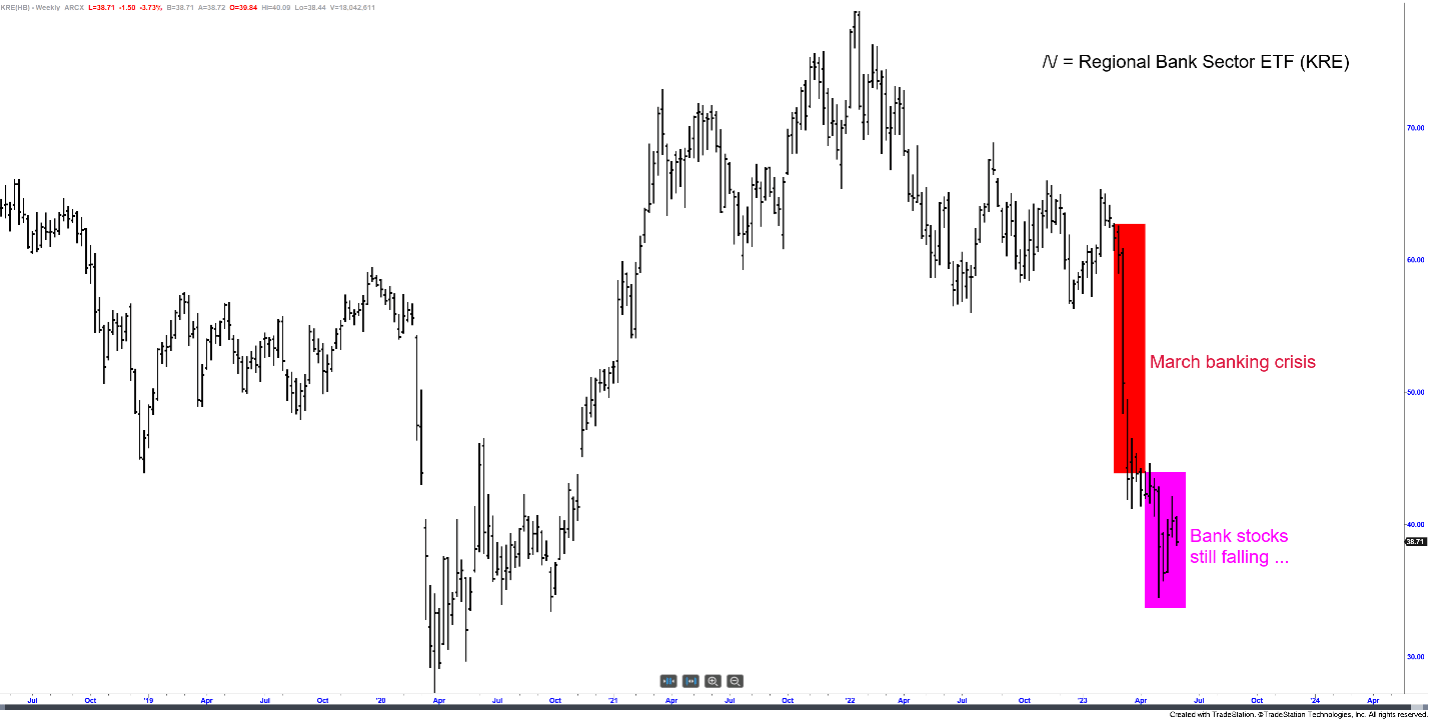

First, let me tell you that shares of the Regional Bank Sector ETF (NYSE: KRE) are lower today than they were at the height of the bank-failure panic in March.

Typically, prices rebound in the weeks following a crisis’ climax. Short sellers buy shares to lock in profits. Bargain hunters buy shares at a “discount.” And all that buying pressure pushes up prices.

But that didn’t happen with KRE…

A full month had passed since the epic failure of Silicon Valley Bank. The media had moved on to other stories, as if the banking crisis was “over”…

But smart-money investors weren’t buying it (myself included).

In an April 14 note to my Max Profit Alert subscribers, I asked the rhetorical question: “Where’s the bounce?”

Shares of KRE weren’t even an inch higher. To me, it was a clear indication that the crisis is far from over and will eventually spread well beyond a small handful of “one-off” bank failures.

I recommended an actionable trade, and just two weeks later we locked in profits of 75% on a portion of it (we hold the remainder of the position still today).

I don’t share this with you today to impress you, but to impress upon you that the banking crisis is still ongoing … and that there are actions you can take, today, to prepare for it … even profit from it.

2023’s “Lehman Moment” Is Coming

There has been a lull in the crisis’ developments and media headlines. That’s actually typical of financial crises. They progress in waves.

Think about it… What is the Great Financial Crisis most known for? Probably the collapse of Lehman Brothers in September, right?

Yet in March 2008, a full six months prior … Bear Stearns had narrowly avoided bankruptcy in a fire sale to JPMorgan, for a piddly $2 a share.

Everyone assumed that the worst was over when the dust settled on Bear Stearns’ collapse.

Six months passed before anything else substantial happened … which left any head-in-the-sand investors unprepared and utterly shell-shocked when the failure of Lehman Brothers triggered the real “fireworks” of the crisis.

I was in wealth management at a Fortune 500 firm at the time. I saw the whole thing go down, almost in slow-motion. And I hate to have to admit this, but there was little I could do to help my clients … only because I was hand-cuffed to my company’s party-line advice, which was simply to “stay the course and hope for the best.”

I knew there was a better way to manage risk … even to profit from the crisis. And I vowed that year to break free from those handcuffs … to do everything in my power to help my clients navigate the next crisis with success.

Humbly, I believe my Max Profit Alert subscribers are already benefitting from that vow I made in 2008. And I sincerely hope I can reach you, too.

I promised to show you actionable steps you can take to prepare for and profit from the “next shoe” of this banking crisis. So let’s get down to business…

The Lazy Man’s Bank Trade

I fully realize most investors don’t like to “short” stocks. I get it. It feels uncomfortable. And it can be risky, especially if you don’t know what you’re doing.

So that’s not what I’m recommending you do. It’s not necessary.

If you want to position yourself for profits on the ongoing banking crisis, the “lazy man’s” trade is to simply buy shares of the Direxion Daily Financial Bear 3x Shares (NYSE: FAZ).

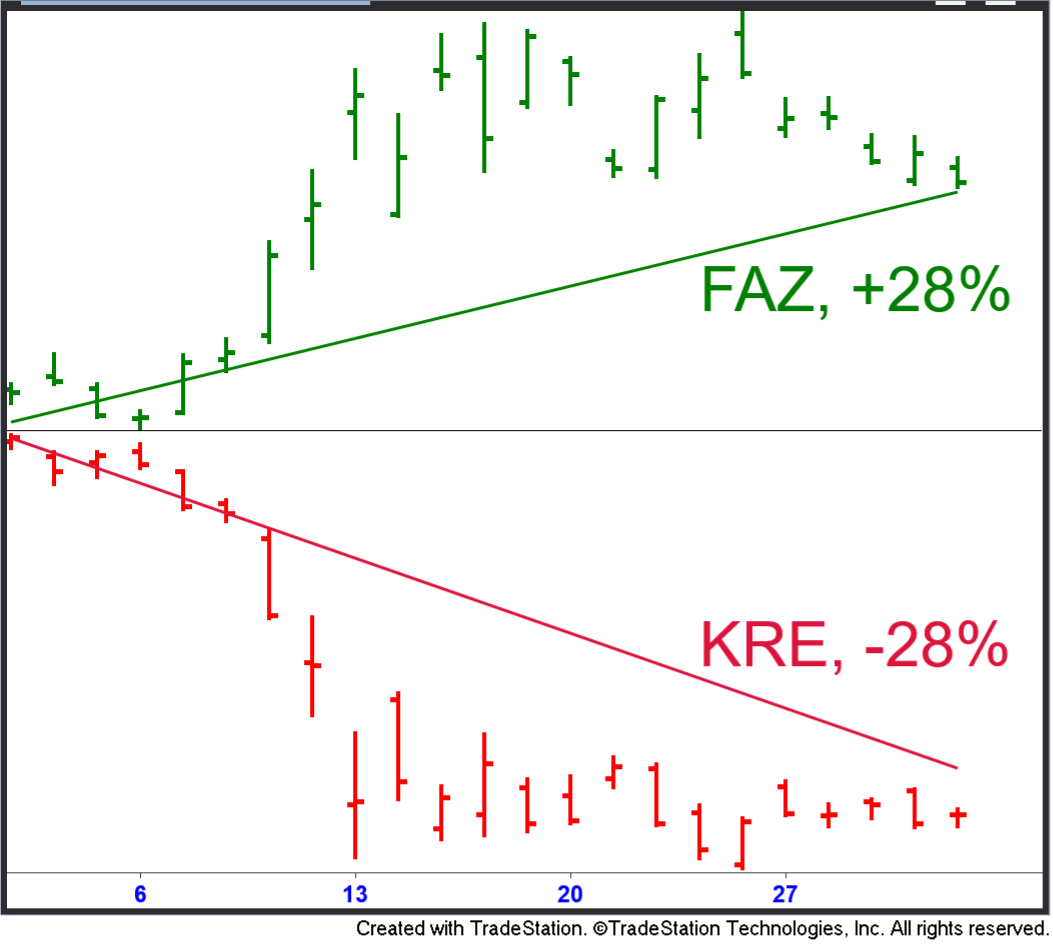

This is an “inverse” exchange-traded fund you can buy if you want to profit from declines in the price of a basket of financial stocks. It worked wonders alongside the bank failures in March:

While shares of the Regional Bank Sector ETF (KRE) lost 28% that month, shares of FAZ gained 28%.

But as I said, I see buying FAZ as the “lazy man’s” way to play the banking crisis.

I believe you can do far better when you watch my short presentation — it just went LIVE — and gain access to a report on the 282 financial stocks that my research shows are a high risk of failure.

I’m confident this report will help you in a number of ways:

- If you bank with one of the banks on my high-risk list, you can consider moving your deposits to a safer bank.

- If you own shares of one of the financial stocks on my high-risk list, you can sell them immediately (and I’ll strongly encourage you to).

- If you join my Max Profit Alert service and commit to profiting substantially from the coming crisis, I’ll show you easy-to-make trades (no “shorting” shares) that can benefit from the collapse of any 1 of the 282 stocks on my high-risk list.

And all this aside, there’s value in being a truly informed American and investor. Even if that value can’t be quantified in the dollars and cents of profits.

Imagine being able to offer well-researched, level-headed warnings to your friends … your family … your clients or associates … whomever you care about.

Don’t you wish you’d had someone like that in your camp back in 2008?

Perhaps this is your chance to play the hero — to be informed and prepared, whether or not you decide to make the trades I’m targeting profits of 200% or more on!

All you need to do is watch my short presentation and keep an open mind.

I promise you’ll learn something new…

For instance, there’s another sector — outside of the regional banking sector, but intimately tied to it — that is just as much at risk of being the “next shoe to drop” as the banks are.

I haven’t even touched on that sector today, but I call it by name and spell it all out in my presentation. And among the 282 financial stocks on my high-risk list are some of the biggest and most-trusted names in the space.

As I said from the beginning, I’m no “doomsdayer.” And I most certainly don’t hold myself out as someone with a “crystal ball” view on the future.

But I will say that I’m growing more concerned about this under-the-surface crisis by the day. And my conviction that shorting stocks tied to this crisis grows along with it.

Today, in fact, shares of KRE are down 4%. Four percent! (And FAZ shares are up 5%).

And with the Fed’s next rate hike liking coming on June 14 — which was precisely the trigger that brought Silicon Valley Bank’s investors to their knees — the time to act is now.

All the details are right here.

To good profits,

Adam O’DellEditor, 10X Stocks

Adam O’DellEditor, 10X Stocks

P.S. If you take nothing else from watching this presentation, please write down the names of the four banks on my shortlist and, at the very least, consider your relationship with them.

The last thing I want is another 2008 to impact hardworking American families. If even one person is able to withdraw their money from a failing bank before things really go south, all this research will be worth it.

Again, you can hear the names of those four banks at this link, right now.

6 Ways the Biden-McCarthy Deal Affects You

(From Bnn.)

There is a deal brewing for the debt ceiling … at least in principle.

It still needs congressional approval, and that promises to be messy. But assuming the debt ceiling agreement gets approved, let’s take a look at what it includes and how that might affect us as investors:

- It avoids the U.S. defaulting.

This is, of course, the biggest benefit of the deal — as well as major disruptions like late Social Security checks or furloughed government employees.

For now, the question of: “What happens to the Treasury bonds in my portfolio if the government defaults?” will remain theoretical. That alone is huge, and the news was enough to ignite a multiday rally in the stock market. Everything else is incidental.

All the same, let’s see what else the bill includes.

- The debt ceiling would be suspended until January 1, 2025.

We’ll have to deal with this again depending on how the 2024 election shakes out. But the metaphorical “tin can” is at least kicked down the road. There is no risk of default for at least the next year and a half.

- Government spending is also capped for the next two years.

I have my doubts here, as I’m all but certain Congress will find creative ways to cheat. (Mainly by spending more than agreed, while simultaneously beating the drum of fiscal discipline.)

But it’s a start. Spending growth will be curtailed.

Naturally, that’s good for the long-term health of the country. It potentially saddles our children with less debt. But it also suggests that if we do get a recession in the coming months, we’ll have less government largesse to cushion the blow.

Overall, we’ll call the spending cap a positive, though in the immediate short term, it’s not going to have any real impact.

Several other provisions of the debt ceiling deal are mostly superficial, but will have at least some impact…

- The freeze on student loan payments will finally be lifted.

It’s baffling that a freeze on loan repayments dating to the pandemic is still in effect years later given how hot the labor market is, and it’s long past time that was fixed.

But every dollar spent on debt repayment is now a dollar not available to be spent in the economy. Millions of student loan debtors have yet to restart payments, so we are talking about a potentially significant bite coming out of consumer spending.

In terms of the immediate economic outlook, we’ll have to call this a negative.

- There would be new work requirements for Americans receiving welfare assistance.

This might at least help chip away at the labor shortage we have today. We’ll call this a small positive.

Now, there’s one final provision that won’t have much of an immediate impact. But in the long term, it should be an unambiguous positive.

- There would be an overhaul of the energy permitting process.

This provision should make it significantly easier to get new energy projects approved and started.

This is good for traditional oil and gas projects, but it’s also true of wind farms, solar panel arrays and the endless miles of transmission lines needed to make it all work.

Adam O’Dell has been bullish on both green energy and traditional oil and gas for several years now, and this development makes the energy story all the more compelling.

Now, Adam’s brand-new webinar is just as fascinating. It details a trade opportunity that thrives in market volatility. It has the potential to double, or even triple, your return on investment.

Want to learn more? Go here for all the details.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge