I made a call on September 6…

In a video to my subscribers, I said:

“Nvidia is having a rough time lately. But over the next decade, it is going to be the premier chip company. I don’t think the cycle is over.” (Watch the clip here.)

Nvidia (Nasdaq: NVDA) is a microchip maker. It specializes in GPUs, better known as the chips used to make elite video game graphics.

The kind of graphics that make 2D animation look almost like 3D reality — definitely a step up from old-school Galaga.

Now, my forecast is coming true. NVDA closed on about 22% gains for the week last Thursday. A massive spike.

That’s a great sign for the microchip sector. I explained why in my latest report here.

And in today’s video, we’ll dive into how chips are the new “AI superpower.”

You’ll see how microchips are spearheading an AI gold rush in 2023 and why these stocks could be the best for your portfolio…

(Or read the transcript here.)

Hot Topics in Today’s Video:

- Market News: Nvidia’s shares skyrocketed 22% last week. Find out how it’s leading the AI gold rush! [0:50]

- Reader Question: “When Ethereum (ETH) bound Web3 comes out and challenges Meta and Alphabet, will these behemoths take it lying down?” [8:40]

- World of Crypto: Blockchain tech can actually put AI in check by validating deep fakes. [11:50]

- Mega Trend: Agricultural technology is feeding the world. It’s also experiencing massive growth from $15.5 billion in 2022 to $32.4 billion by 2028. Want to invest? Here’s our top exchange-traded fund revealed… [15:35]

If you have any questions about microchips, artificial intelligence or agricultural tech — let us know at BanyanEdge@BanyanHill.com.

See you soon,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

The Fed Isn’t Done Yet

You might have missed it with all the debt ceiling noise over the past week, but we got fresh inflation and consumer spending numbers for April.

And if you thought that maybe — just maybe! — the Federal Reserve was done raising rates, that seems a lot less likely in light of the new data.

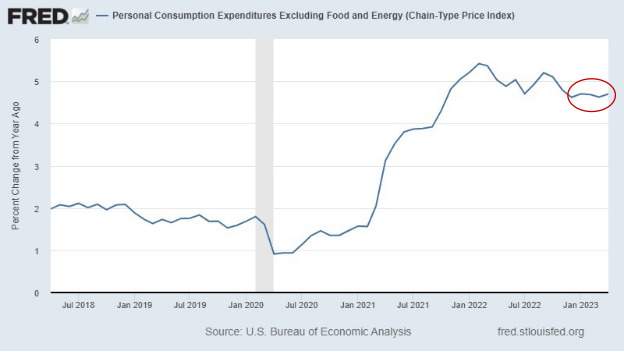

After steadily falling since last June, the PCE (Personal Consumption Expenditures) inflation rate rebounded in April, up 0.4% for the month and 4.4% over last April.

The “core” PCE rate is the Fed’s preferred inflation gauge. Though it excludes food and energy, the PCE also rose to 4.7%.

We’ve really seen no progress on inflation coming down since December.

And that’s not all…

Consumer spending also enjoyed a pop in April, rising 0.8%. Economists expected a lower increase of 0.4%. This reversed sluggish spending growth by only about 0.1% in both February and March.

Granted, almost half of that increase is due to inflation. Inflation-adjusted spending was up about 0.47%. But that’s still significant growth, all things considered.

The Fed is tasked with the conflicted dual mandate of keeping inflation low and keeping employment high.

Well, employment is looking incredible right now. At 3.4%, the unemployment rate is the lowest it’s been since the 1950s.

So until something changes, the Fed’s key priority is hacking away at inflation.

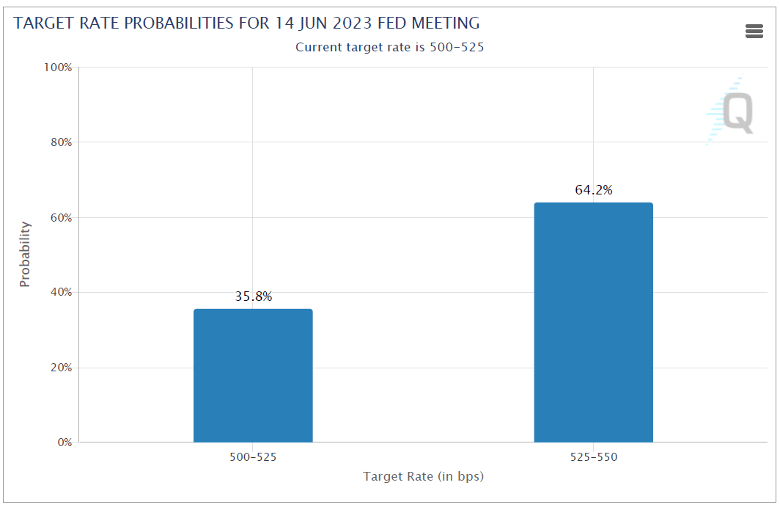

The Chicago Mercantile Exchange publishes a “Fed Watch” tool that calculates the probabilities of rate hikes based on pricing in the options market.

And right now, the smart money traders are putting the odds of a rate hike next month at 64/36.

Of course, the odds change as new data comes in. And the data has been a mixed bag of late, with quarterly earnings from Home Depot, Target and Walmart all suggesting that the American consumer is slowing down.

But my bet would be that the Fed opts to raise interest rates in June. If that prediction comes true, there will be another rate hike at the following Fed meeting.

In the long term, the Fed is going against the wind here. It’s fighting excess demand by raising rates, while the bigger, structural problem is supply constraint. We don’t have enough workers, and the workers we have lack the tools they need to boost their productivity.

It won’t be the Fed that ultimately slays inflation.

It will be the private sector … and specifically artificial intelligence. As I mentioned on Saturday, and Ian breaks down today, chipmaker Nvidia’s earnings call essentially told you everything you need to know.

We have an AI arms race: “As companies race to apply generative AI into every product, service and business process,” according to Nvidia CEO Jensen Huang.

You could simply buy Nvidia and call it a day. But it’s also one of the world’s largest companies and already commands a massive premium price. Meanwhile, Ian lives and breathes AI, and he has identified even better ways to play this trend.

If you want to learn more about investing in the chip software behind AI, go here to watch Ian’s webinar, “The Fourth Convergence.”

It’s a truly massive opportunity you don’t want to miss out on this year…

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge