The stock market has consumed my life since college.

I’ve studied every aspect of it. From various valuation methods to watching every tick during the day, and I loved it all.

But, over the years, I’ve been busy perfecting one specific craft that gives me an advantage over the average Joe when it comes to beating the market — technical analysis.

It is at the core of any short-term profitable trading strategy that is successful.

Think about it…

Outside of an earnings event and an economic data release, not much is really happening in the stock market.

Prices swing widely based solely on what another investor is willing to pay for a stock — the price. Not by fundamentals, a change in the economic outlook or any other big developments.

Those developments only impact price when you are looking out six months or longer.

Even the No. 1 metric fundamental investors track, the price-to-earnings ratio, doesn’t carry much weight in the short term. Price tends to carry more weight than earnings. Just look at the thousands of companies that have established a price for their stock, yet report no earnings.

With technical analysis at the root of profitable short-term trading strategies, it’s time to break down the root of technical analysis — spotting the trend.

Focus on the Trend

When I show you the easiest way to spot the trend, you are going to think it is a no-brainer.

Sticking to the trend is so easy, my 7-year-old daughter could do it. Here’s how…

You draw two lines. That’s it.

A “trend” is defined by higher highs and higher lows.

If you’re a visual person, all you have to do is connect the peaks and troughs. This is where even my daughter can simply connect the dots, so to speak, and find where the stock is going.

If the lines are headed higher, it’s in an uptrend. If they are headed lower, it’s in a downtrend. It’s really that simple.

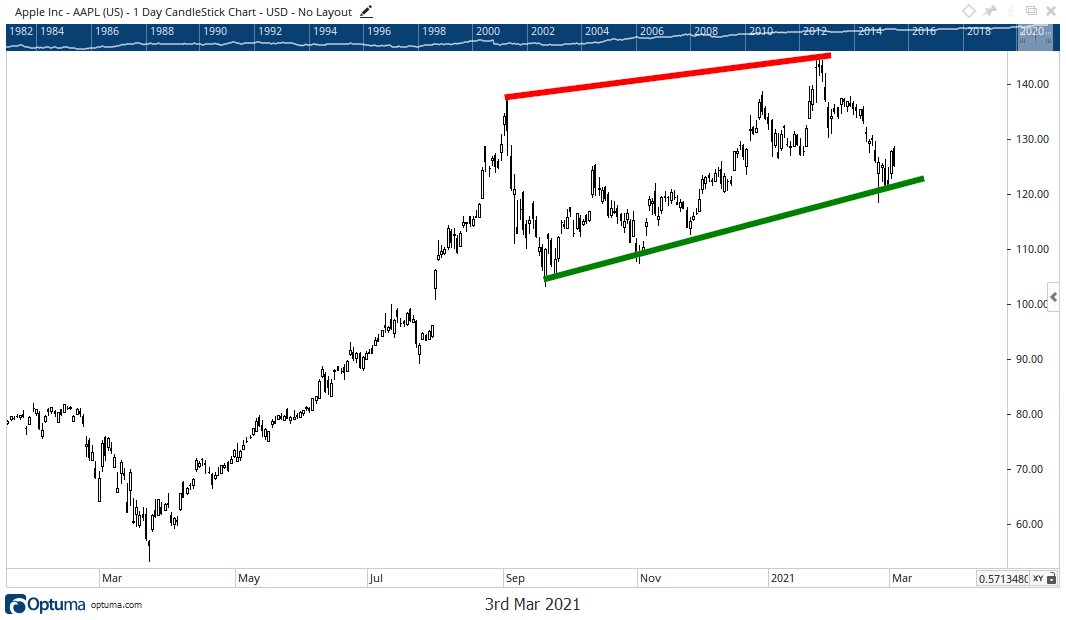

Take a look at Apple.

Over the last several months, it has continued to make higher lows on the chart (highlighted by the green trend line). And the peaks, the previous highs, have been higher as well, indicated by the red trend line.

So, clearly, this stock is in an uptrend.

Here’s an example of a stock in a downtrend…

General Mills, the consumer staples giant, has been making lower lows and lower highs for months now.

This stock is in a clear downtrend.

If you just look at a stock’s chart, you can see these trends as clear as day. But you wouldn’t believe how many people want to fight the trend. They’ll place bearish bets on stocks trending higher or jump into bullish trades on stocks that are trending lower.

This is a challenging game. It’s like betting on the underdog to win it all or the hottest team to suddenly take a bad loss. It will happen from time to time, and it’s fun to brag about when you get it right. But it’s not a bet you want to make all the time.

When I see an uptrend, no matter what is going on with the stock or the economy, I know investors are willing to pay more for the stock than the last guy.

So, there’s no reason to fight it.

The Tool That Complements Any Trading Strategy

Keep in mind, trends don’t last forever. But since we’re looking at trades in the short term, that’s just fine with us.

Take the Apple example above.

If you were long the stock (expecting the stock to climb) and saw a 15% drop, should you sell your shares?

No.

Because the stock is still in an uptrend. A 15% drop from the most recent peak is still within the uptrend channel — it’s still inside those two lines you can see on the chart.

And as long as that remains true, you should hold on for higher prices.

This is one of the key ways I use technical analysis to support my trading strategies.

The trend is an important part of our strategy. We always look at where the stock is headed before making a trade.

I also let it guide me after I’ve jumped in…

Sometimes, a trend breaks and it tells me to get out of a stock early. Other times a drop in the stock is near a key trend line, like Apple, and I know to give it some time.

At the end of the day, technical indicators like the trend are invaluable tools to complement any trading strategy.

But you still need a proven method to follow so that you are not winging it and drawing a thousand trend lines on every chart.

My No. 1 trading strategy is the one I use in my options-based research service Quick Hit Profits. To learn all about it and how I use earnings to spot consistent profits, click here.

Regards,

Editor, Quick Hit Profits