Supply is down, demand is up…

That’s good news for oil companies. The headlines lean bullish for oil lately.

The supply of oil in storage fell 761,000 barrels last week, according to the American Petroleum Institute. Turkey threatened to shut down oil production in Kurdistan. OPEC continues to talk about new cuts to production … and demand for oil is rising across the world.

The fact is, fundamentals appear to be moving back toward balance in the oil industry. That’s in spite of the fact that the oil price remains locked below $55 per barrel. This early uptrend can be missed by investors focused on the underlying commodity.

However, there is money to be made in the energy sector right now.

The Giants of the Oil Industry

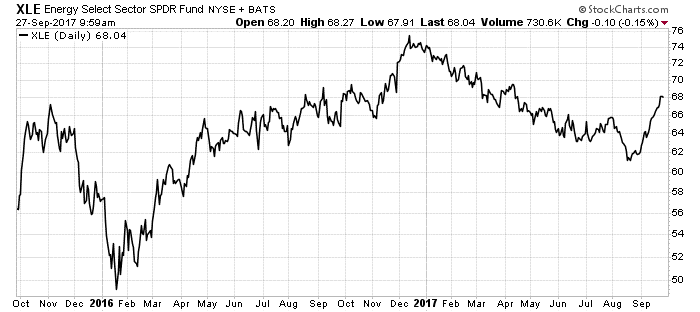

The shift drove the energy sector to break out last week, as you can see from the chart below:

The XLE Energy Select Sector SPDR ETF (NYSE: XLE) owns the giants of the oil industry. It holds about 22% of its capital in Exxon Mobil, 17% in Chevron, 8% in Schlumberger and 5% in ConocoPhillips.

Over 50% of its holdings are those four companies. The managers spread the other half of the capital over a basket of other companies.

As the chart above shows, that was a bad bet for most of 2017. On August 18, XLE closed at $62 per share, the lowest price since April 2016.

That was the bottom. Since then, the trend soared upward.

The great trading service, SentimenTrader.com, published this earlier this week:

A month ago, more than half of energy stocks had plummeted to a 52-week low. Since then, the sector has enjoyed a historic cluster of positive days, and the S&P 500 Energy Sector has closed above its 200-day average for the first time in more than six months.

The writer at SentimenTrader also pointed out that this kind of trend usually results in double-digit gains over the next few weeks.

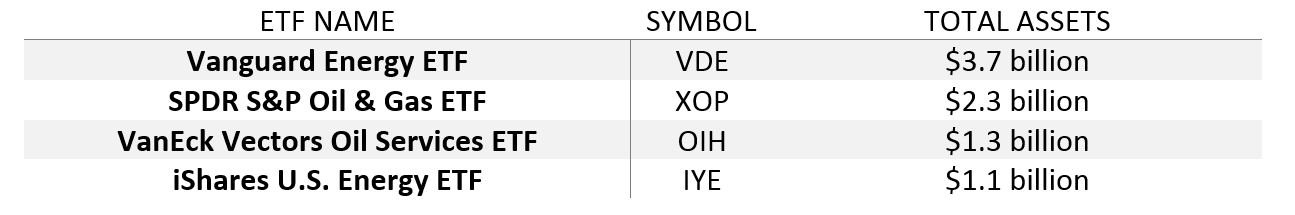

That means we speculate in energy stocks. XLE is a good way to do that. Here are some other exchange-traded funds that would work as well:

All these funds show similar recovery since mid-August.

Don’t look to buy and hold this sector for long. Take the gains as they come, but be ready to jump out if the trend turns against us.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist