There’s a specific emotion at market bottoms.

To me, it feels like existential dread. It’s a feeling of total uncertainty. With no idea what tomorrow may hold, it feels like the world is ending.

This is exactly how I felt when Lehman Brothers went under in 2008.

A few days prior, it was one of the biggest banks on Wall Street. It had a storied history and $600 billion in assets.

Then, in an instant, the 160-year-old bank was gone.

Back then, no one could even imagine the collateral damage this would do to the financial system.

All of Lehman’s counterparties (mainly other banks on the Street) were forced to write off billions in losses. This wiped out their profits for several years.

When a massive pillar of the financial system falls like that, it really does feel like the damage cannot be undone. Yet of course, it was. A few months later, the market bottomed and a decade-plus of bull market followed.

Once COVID hit in 2020, I felt that same despair that I did went Lehman went bust in 2008.

The stock market had dropped over 30% in a month. Schools and businesses were shut down. Families were quarantined in their homes, disinfecting groceries with Clorox wipes.

No one knew how badly the virus would disrupt the economy or our health … or how long it might last.

It was like a night that kept getting darker. There was no sign of the sun coming up again.

But after that initial shock, I remembered the Lehman collapse.

I recognized that feeling I had back then, and remembered that the last time I had it … markets were about to bottom.

So just a month after the COVID bottom, I stuck my neck out and made the biggest call of my career.

I predicted that the “mother of all bubbles” was headed our way.

It was clear to see. The stock market had been purged of weak hands, and the Fed and government took unprecedented steps to strengthen the U.S. economy.

I called it right. In the following 20 months, the S&P 500 rallied 83%.

Cryptos fared even better, with Ethereum moving up over 20X. Solana rallied 100X. And LUNA, almost 200X!

Right now, crypto is experiencing one of these moments of total uncertainty. But just like with Lehman and COVID, these moments of uncertainty are exactly when you should be buying … not selling.

Here’s why…

Crypto’s Bear Year

Crypto has been in a brutal bear market over the past year.

The trouble began last May, when terraUSD collapsed. The stable coin was supposed to be pegged to the U.S. dollar. Its failure spread to its sister token, LUNA.

But the disaster didn’t end there.

Soon after, major crypto hedge fund Three Arrows Capital declared bankruptcy.

Their failure, like the collapse of terraUSD, spread to crypto firms with exposure to them. In June, leveraged lenders Celsius and Voyager were forced to halt customer withdrawals and eventually also declare bankruptcy.

The underlying assets were worth less than what the lenders owed customers. This sparked fear of mass liquidations, which caused even more selling.

Lower prices triggered decentralized finance contracts, which executed automatic sell orders. This drove prices even lower.

It seemed like things were starting to spiral out of control. But then came November.

FTX, one of the world’s largest cryptocurrency exchanges, collapsed in the span of a week. Industry titans Gemini, BlockFi and others started dropping like flies in the aftermath.

Like Lehman collapsing several months after Bear Stearns in 2008, this was crypto’s “second shoe to drop.”

At the bottom of the bear market, bitcoin dropped 76% from its highs. Ethereum was down 75%. Solana — which had ties to FTX — had fallen a massive 95%.

It was a deeply painful time to be a crypto investor, especially those that didn’t sell near the highs and watched a large portion of the bull market gains slip through their fingers.

But it’s only when everyone is rushing for the door at the same time, that we see the most incredible buying opportunities…

Crypto Is Nearing a Turning Point

It’s no secret — the collapse of FTX, on top of other crises, had a massive impact on the entire sector.

But as painful as it’s been: This crash was necessary.

It was the final shakeout the crypto market needed. Clearing out the bad actors — and opening the door to the next level of opportunity.

It’s similar to what happened back during the dot-com crash.

Just like crypto, the internet was a brand-new technology at the time. There was a lot of excitement surrounding it. By 1998, there were over 7,500 dot-com companies.

And after the crash, over half of those companies disappeared. But those that survived went on to become life-changing investments.

Amazon’s a great example. After the crash, it went on to return over 37,000% in the next 20 years.

When you shake out those bad apples, there’s more room for the real opportunities to thrive.

That is exactly what we are seeing play out in the crypto market.

Here’s the important thing to keep in mind. The crash of the dot-com companies didn’t destroy the internet; it’s still very much with us.

And the crash of FTX won’t destroy crypto.

As billionaire Bill Ackman recently put it: “Crypto is here to stay.”

Just like the internet, the technology behind crypto — blockchains, decentralized finance, smart contracts, digital collectibles — is still working just as intended.

The market’s done us a huge favor. By shaking out the bad actors and the weak coins, the cryptos that remain are likely the strongest opportunities in the market.

And right now, I’m tracking key indicators unique to the crypto market that show me that, despite the pessimism and negativity in the headlines, we’re actually at the very beginning of a major new bull market.

Most investors don’t even know it yet. But they will soon.

Because historically, every time crypto comes out of a downturn like this, the market has always gone on to hit record price after record price.

I’ve even called it.

Back in December 2020, I told viewers in a special presentation that: “This new crypto bull market is going to keep getting bigger — and will last longer — than anything we’ve seen before, or since […] Prices across the entire sector are set to rocket in the months ahead.”

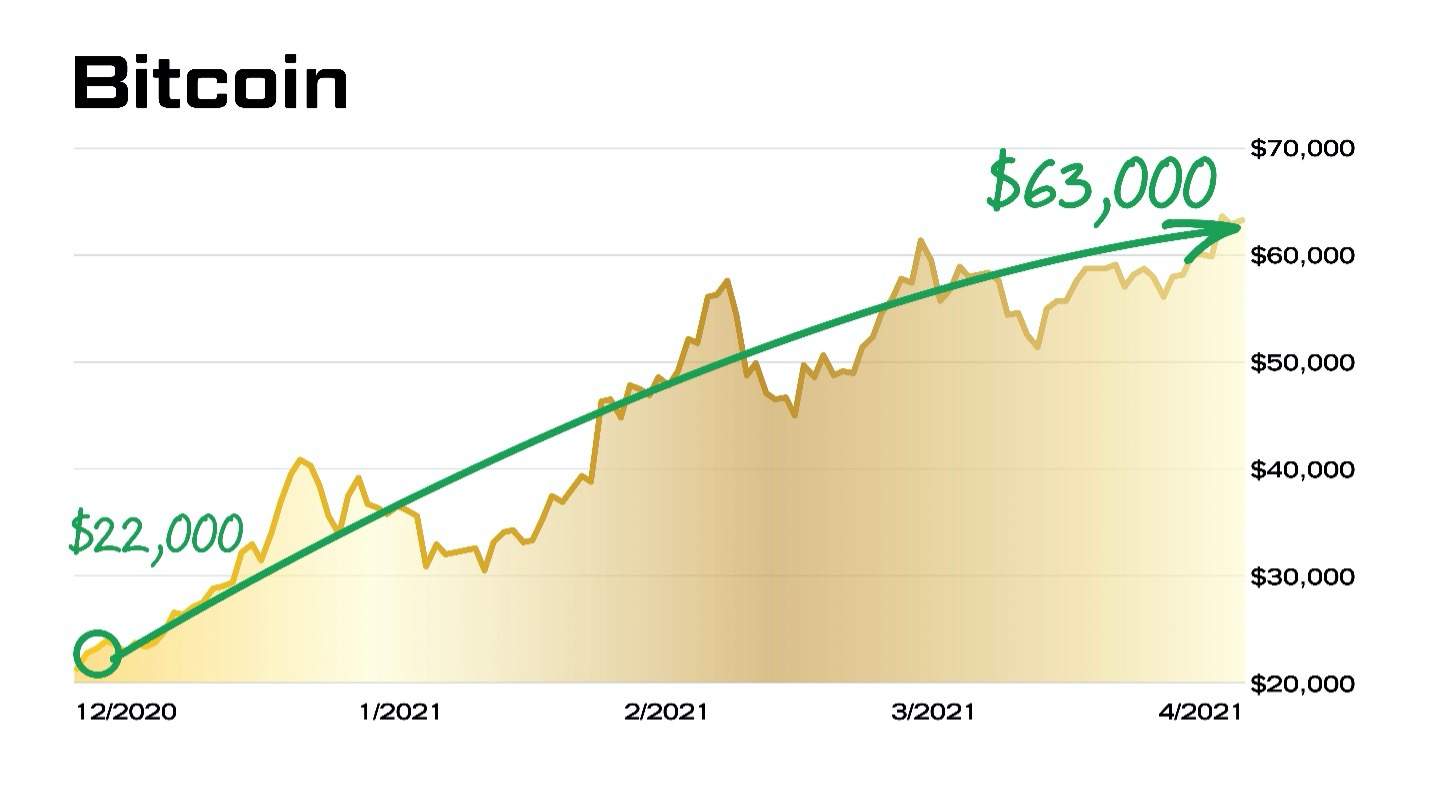

That same month, bitcoin broke through $22,000 and ran all the way up to over $63,000 five months later.

And the rest of the crypto market followed…

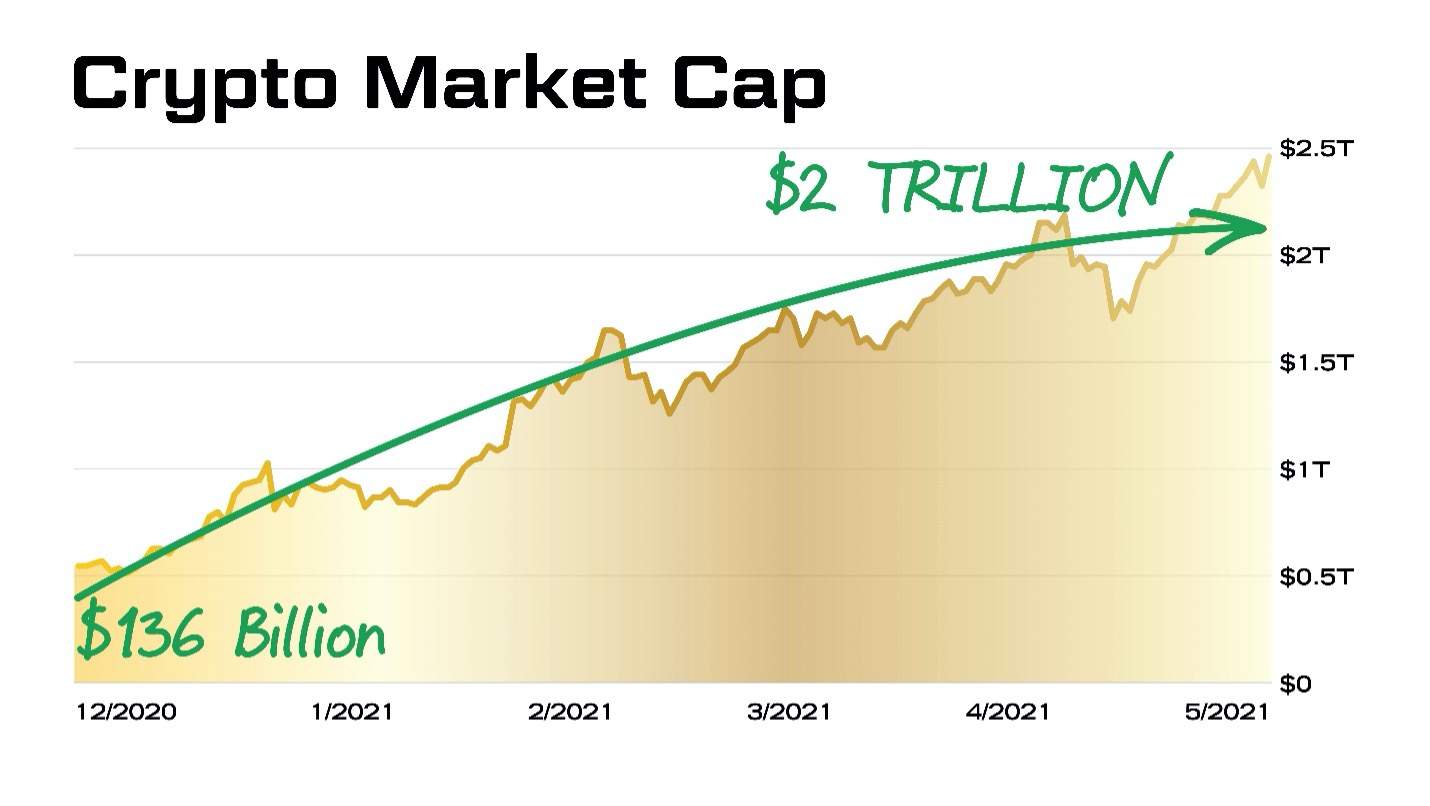

Running from a beaten-down market cap of $136 billion to a value of more than $2 trillion.

It’s like I always say: The best time to make money is in a down market.

That’s why, as I see crypto starting to turn the corner from bear to bull…

I’m putting together a special webinar especially for my Banyan Hill readers.

Mark Your Calendar for Crypto’s Turning Point

On Wednesday, February 22, I’m holding a special event called “Crypto’s Turning Point.”

I’m going public with new research — and I’m revealing the indicators that show we’re entering a brand-new bull market in cryptocurrencies.

Make sure to add this special event to your calendar by clicking below.

Regards, Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Read Strategic Fortunes reviews from real subscribers here!