It’s election day!

Outside of electing a president, government and local officials, it also means the fundraising text messages will stop and our email inboxes will no longer be filled with election predictions.

As with the past election cycles, I expect some market volatility no matter who wins.

That’s because big investors will start to wager on what industries will flourish and who will wither under the new administration.

And this could come sooner than later.

Here’s a chart from The Economist that shows a long delay in election results are outliers:

Frankly, I have no idea who wins this race when all the votes are tallied. But here’s what I can report: The S&P 500 has climbed higher in 19 out of 24 election years.

As I’m typing this, the S&P 500 is up 21% for 2024.

Here’s four mega trends that will continue no matter who wins:

The AI Boom: Of course, the market has been led this year by the artificial intelligence boom which will continue under either administration.

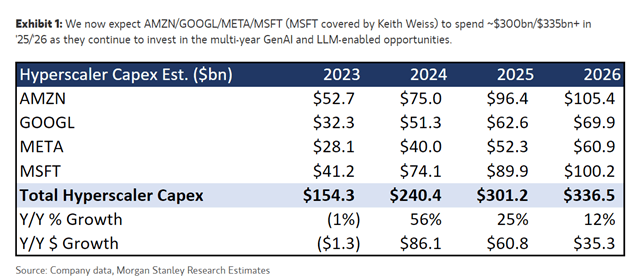

Mega-cap tech companies are spending hundreds of billions in an AI arms race. There are no signs of this slowing down. Morgan Stanley expects these hyperscalers to spend 25% more on AI next year, which amounts to over $300 billion!

The key here is that once AI is fully developed in the center, it will lead to a massive upgrade cycle at the “edge”. I believe this will lead to a renewed upgrade cycle in consumer technology, as our devices need to be faster to run advanced AI computation.

The Transportation Revolution: The way we get around the earth will go through a dramatic change in the next few years.

Globally, electric cars accounted for around 18% of all cars sold in 2023, up from 14% in 2022 and only 2% five years earlier, in 2018. Under Harris, current EV incentives will stay. And I think the Trump / Elon Musk alignment means they’ll likely stay under Trump as well.

Not only are EVs continuing to grab market share, but we are speeding toward fully autonomous vehicles. Google reported its autonomous unit Waymo is completing 150,000 trips per week.

That’s triple what the self-driving taxi company was completing in May! Moreover, Musk said he will “probably” have his robotaxi on the roads in 2026.

Also, we are on the verge of eVTOL (electric vertical take-off and landing) travel with a number of companies set to debut next year. Neither president is going to derail this technology, and I think they will be a big part of the 2028 games as athletes soar across Los Angeles over the dreaded rush hour traffic.

The Renewable Revolution: Most analysts are getting this completely wrong. They think it’s simple: Trump equals oil boom, Harris equals green energy surge. But there’s a plot twist nobody’s talking about.

The numbers tell an unexpected story. Under Trump, energy stocks plunged 40%. Under Biden? They rocketed up 105%. But don’t let those figures fool you — they had more to do with global supply chains and pandemic recovery than political policies.

You see, the clean energy sector has $200 billion in new factory investments on the line. A Harris win keeps that momentum going. A Trump win? Those investments could freeze faster than a winter storm in Texas.

But I don’t see that happening — Trump won’t cut those factory investments because it means cutting American jobs.

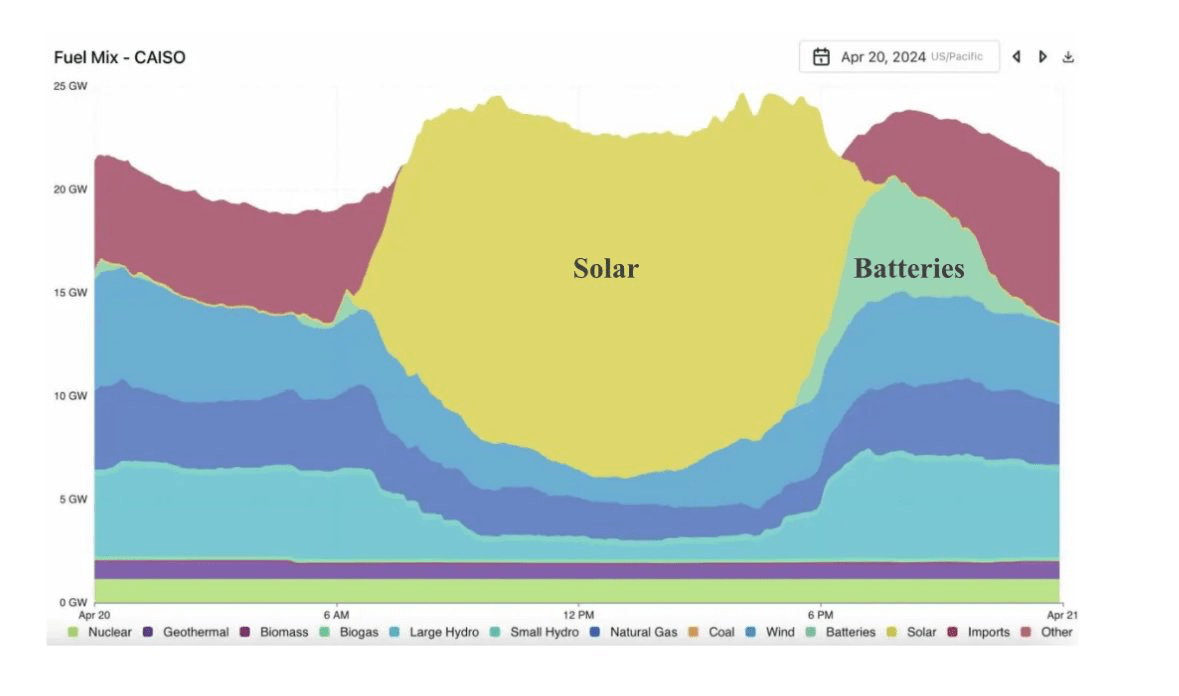

The renewable revolution is here. Take a look at this graph of fuel mix from California.

Most of the state’s midday power comes from solar. And then in the evening, the batteries kick on when the sun goes down.

Batteries didn’t even exist 10 years ago, and now instead of fossil fuel generation, batteries discharge electricity stored during the day.

This is going to continue no matter who is president!

The Crypto Revolution: Everyone knows the SEC has come down hard on crypto operators under the Biden administration.

And the good news — under either administration this will change.

Trump, once a bitcoin skeptic, is a self-proclaimed crypto candidate. He’s even sold multiple sets of his own NFTs and supported the launch of a new decentralized finance exchange (which didn’t do so well).

Moreover, he promised to fire crypto boogeyman and SEC Chairman Gary Gensler and protect bitcoin miners.

While Trump is crypto’s favorite candidate, Harris promises a different approach than Biden — although we haven’t heard much overall.

Harris told donors at a fundraising event that she would encourage growth in the digital assets space.

The campaign also tapped billionaire and crypto enthusiast Mark Cuban, who said that Harris was “far more open” than Biden.

The bigger story here is that no matter which candidate wins, the main driver of bitcoin’s supercycle is here to stay.

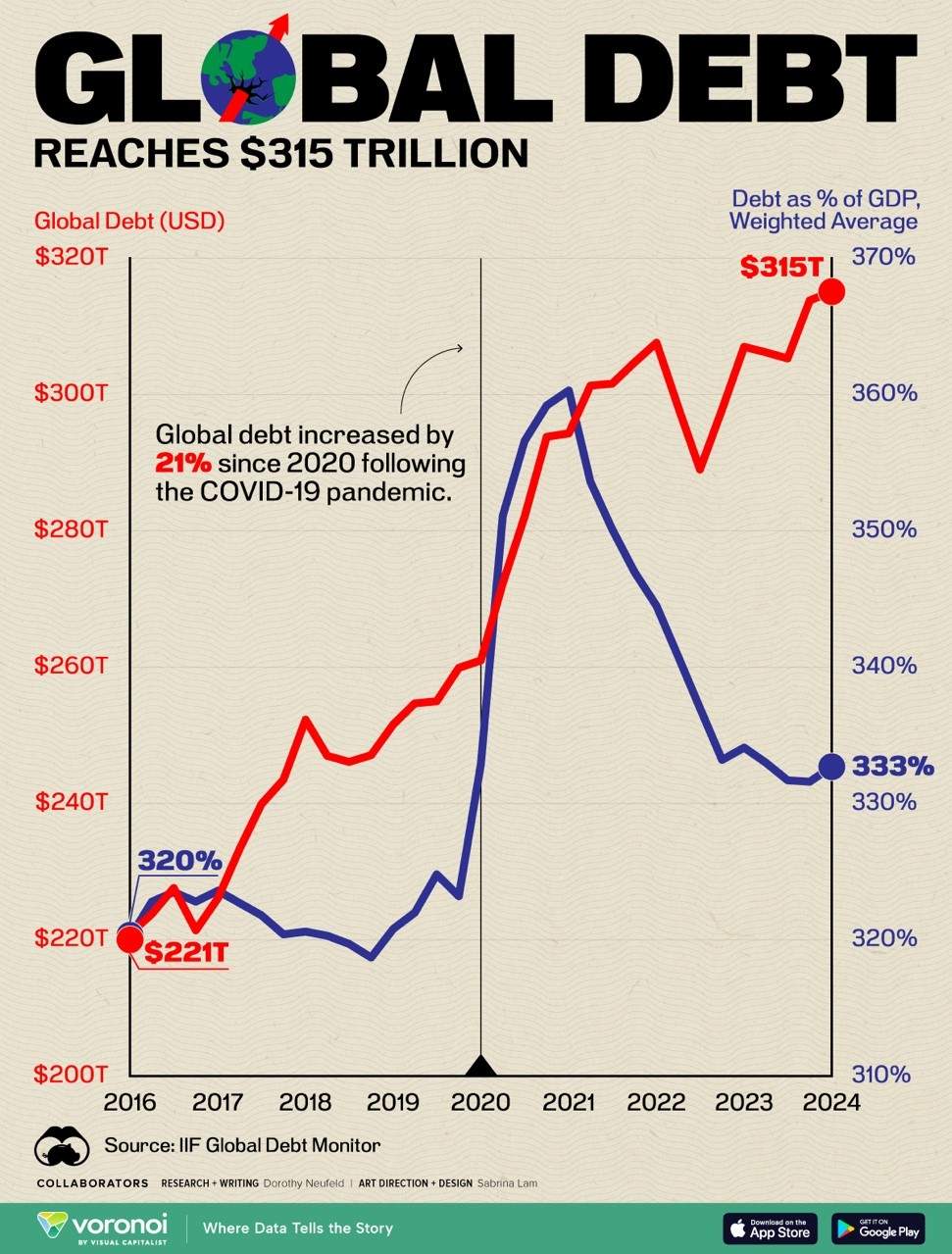

That’s because the post-World War V (Virus) world is awash in debt. Here’s a chart that illustrates how that debt skyrocketed starting in 2020.

Even though Debt to GDP has come down from the anomalous reading in 2020 (GDP was zero or negative), it’s still running at an all-time high.

To get rid of the debt overhang, governments either have to grow their economies or inflate them by printing more money. The latter is usually what happens.

When more money is printed to pay down debt, it leads to a rise in hard assets — gold, commodities, real estate, etc.

This time, it will lead to a surge in the price of bitcoin as global citizens can protect their fiat currencies with digital currencies that can’t be devalued due to more printing.

While a Trump win might lead to an immediate spike in the price of bitcoin, this longer term trend is going to happen no matter who wins the presidency.

The bottom line? Stop watching the political theater and start following the money. The real winners will be investors who position themselves for massive industry transformations, not campaign promises.

Until next time,

Ian King

Editor, Strategic Fortunes

good insights