Chair Jay Powell did a masterful job convincing the markets this week that the Federal Reserve would address inflation.

But can the Fed actually do anything about it?

In this week’s video, I review the history of the Fed’s easy-money policies to show why it can probably do no such thing.

The Fed is following the same playbook as after the great financial crisis, which was followed by a decade of below-average inflation.

There’s no reason to think that COVID-era inflation was caused by the Fed either.

I reveal the two drivers of current inflation … neither one of which have anything to do with the Fed.

And I argue that pundits comparing the situation to the 1970s are looking in the wrong decade … with potentially dire results.

Click here or click on the image below to watch.

VIDEO TRANSCRIPT

Today, the big topic is the Fed and obviously it’s pivot to becoming hawkish.

Before we do that, let’s talk a little bit about the history of the Fed’s activity in the economy, going back to the Great Financial Crisis.

Here’s a chart from Bloomberg that shows basically the Fed’s benchmark interest rate that’s in red and then the S & P 500, that’s in black. And then it shows you where the Fed has intervened at different points.

Now, remember, it’s not just about interest rates. It’s also about buying bonds and Treasury bonds and mortgage-backed securities out of the market in order to pump liquidity into the market.

The critical thing here, though, is just how big a role the Fed’s rate cuts have played … and also its QE has played in helping to prop up the market.

Two Examples…

Now we have two examples of the Fed’s activities in relation to two different crises. One was the Great Financial Crisis of 2008 and 2009. In that case, the Fed created a lot of money through quantitative easing while the governments didn’t really spend. In fact, the government response was to try to cut deficits and enact austerity.

The result of that was that inflation and economic growth actually fell well below previous rates and targets, despite protestations from Goldbergs and other inflation Hawks that all this Fed money printing was going to cause inflation. It didn’t cause inflation. I’m going to show you just now in a chart why that’s the case.

The next thing that happened of course, was the pandemic. That’s the second time that the Fed came in with a sudden massive boost of QE. Now the Fed issued a lot more quantitative easing money in the sense, I’m explaining the mechanics just now, but instead of austerity, governments around the world decided to join the party and they pumped about $10.8 trillion worth of fiscal stimulus into the global economy, equal to about 10% of global GDP.

The United States was probably the most generous in terms of pumping in stimulus. That happened twice last year and once at the beginning of this year, and the result has been high inflation.

Here’s a chart that shows inflation going back to the 2000s.

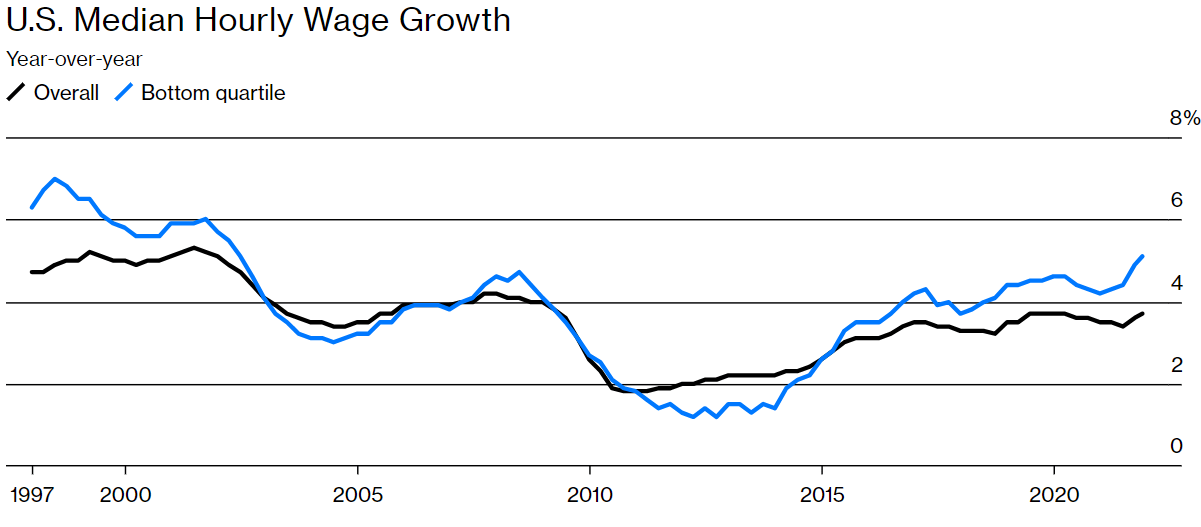

What you can see very, very plainly here is that, after having fallen during the Great Financial Crisis and afterwards, inflation picked up to a steady average of about 2% this year, and then it has taken off at the same time we’ve seen, in this next chart, that wage growth after the 2008/09, Great Financial Crisis, was already falling.

It was falling before that, but it fell even more substantially, particularly at the bottom end. And it only started really picking up at about 2015. But wage growth, you can see in the far right hand side, has picked up substantially during 2021, although it’s still not back to where it was in the late 1990s.

Now, what all of this tells us is that we had two different types of attempts at response to major economic crisis. One was the Great Financial Crisis. That one was the Fed only. That did not result in inflation or wage increases.

The second response was to COVID and that did result in inflation.

Did the Fed Cause Inflation?

The big question is, does that have anything to do with the Fed and QE?

The market has been implying that yes, it does, because they’ve been saying, “You’ve got to raise rates.” You’ve got people like Mohamed El-Erain, who’s been very hawkish and Larry Summers and others basically saying the Fed has got to raise rates in order to tamp down on inflation. That means they assume that the big jump of inflation is really driven by Fed monetary policy.

So what has the Fed done? Well, here’s the chart that shows you the dot plot.

This shows the Federal Open Market Committee members’ projections for where they think interest rates will be going up to a 2025. And the critical thing is that the median is a little over 2% by 2024.

That’s a pretty shallow increase, but it’s an increase, nonetheless. It’s definitely an increase over where we are right now, which is really less than 0.25%.

The critical point here is that the Fed has agreed with the market, that they’re going to raise interest rates in order to try to squash inflation.

Stocks Saw This Coming

The stock markets certainly expected this as well as the bond markets. Here is a chart that shows the implied rates based on bond market activity on Wednesday versus Tuesday.

And it only really increased slightly. So clearly the Fed communicated, I think since Chairman Powell’s testimony to Congress a couple weeks ago, when he said that he was retiring the term transitory, that basically the market has already priced all this in.

So that leaves us with two questions. And I think it’s critical at this point to start thinking about them because we may not be getting what we are wishing for.

First question is why did we get inflation this time and not after the Great Financial Crisis?

Well, let’s look at the mechanics of QE. In other words, what the Fed does. QE is just the Fed transferring bonds from the banking sector to the Fed’s balance sheet in exchange for cash. In other words, the Fed says we will buy Treasury bonds and mortgage-back securities from you, and we will create cash reserves for you. And on that basis, the Fed or the banks can then increase their own cash reserves because they’re able to operate on the bank basis of a multiple of their reserves.

There is no automatic mechanism to transfer that cash that is created by those transactions into the real economy. It’s just a swap of money and debt within the financial system, between the Feds and the banks. It doesn’t have anything to do with main street.

So I believe, and I think history shows, the chart that I showed you earlier, that the QE on its own does not cause inflation.

The Fed buying assets out of the banking system in the form of treasury bonds and MBS does not cause inflation because the only way it could is if the banks used the extra cash to lend.

But banks didn’t use that extra cash to lend during the 2010s because they did not see a strong growth in the economy. Instead they saw stagnation, they saw growth rates hovering less than 2%, which was much over than the long-term trend after the Great Financial Crisis, they saw unemployment remaining high. And so they were reluctant to lend.

As a result, that QE money did not end up getting back to main street. So there was no inflation.

Data Suggests the MMTs Could Be Right

However, after COVID, there was an expansion of fiscal stimulus, which is very different. Now the Fed does play a role. What happens is the Fed buys bonds issued by the Treasury, and the Treasury then issues that money in the form of stimulus checks.

That money went straight into people’s pockets, which they then spent on things, which led to an increase in demand for certain kinds of things (I’m going to talk about them in moment). And in conjunction with problems on the supply side, that led to inflation.

So the critical difference is that, whereas the Fed’s traditional QE, which is a swap of debt for cash between banks and the Fed did not lead to inflation.

But when the Fed started monetizing Treasury expenditure in the form of fiscal stimulus, it did lead to inflation.

Here’s the interesting thing: That challenges the old fashioned monetarist notion, the notion popularized by Milton Friedman that inflation is always a monetary phenomenon. It instead suggests that inflation is in fact a fiscal phenomenon based on the balance of government spending and taxation, which is exactly what a group of people called the Modern Monetary Theorist predicts it to be.

Now, I’m not saying that I’m an MMT person myself, but the data is really starting to suggest that the old notion that the Fed’s expansion of the overall money supply is not the driver of inflation. What matters is when money gets in the hands of ordinary people, that is what matters, and that can only happen through fiscal policy.

So the first question I think the answer is that the big difference is because fiscal policy came to the party after COVID in the way that it didn’t after GFC.

Now that raises the question of whether the Fed’s interest rate hikes are going to make any difference. If the Fed’s QE didn’t cause inflation, will raising interest rates, peel it back?

Can Raising Rates Help?

Well, it depends on the primary cause of inflation, doesn’t it?

One argument is that it reflects changing composition of consumer demand. Here’s a chart that shows GDP going from before COVID to where we are today.

Now, the reason this chart is so interesting is because overall it shows that GDP has not exceeded its long-term trendline. We are back to where we would have been prior to COVID. Had COVID not happened, we’d be about in the same place. And fiscal policy helped us do that.

But fiscal policy has not caused GDP to exceed its long term trend, which means that overall, since demand and income in the economy are equal by definition, it means that demand in the economy has actually not exceeded its long-term trend.

What We Spend Money on Matters

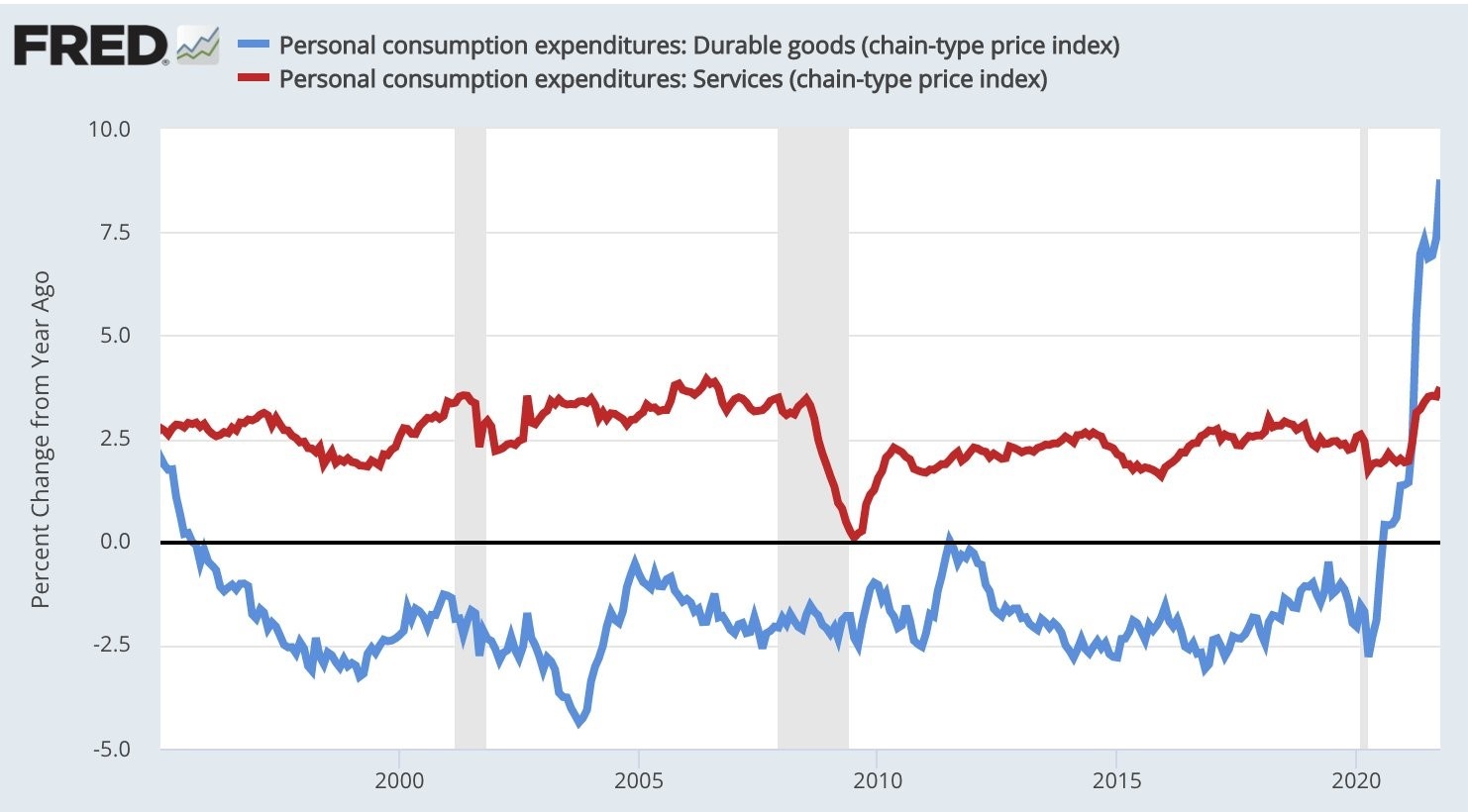

The problem is that the composition of that demand has changed. Here is a chart that shows personal consumption expenditures on services.

It’s still way below its long-term trend, prior to COVID.

Here is the next chart that shows personal consumption expenditures on durable goods.

And it shows that, for durable and non-durable goods, expenditures are way, way above the long term trend line.

So here’s the result.

You get on the top, you get services, which is basically the percentage change in service versus durable and other consumer goods in blue. Clearly, although there’s been a jump in prices in both, the jump in durable goods is far more.

The whole point of this is to show that the fact that the Fed and the government pumped money into the economy after COVID does help to explain inflation, but it’s not just the money. It’s what people spent the money on that caused inflation.

And in respect, what people were spending money on is they allocated a huge amount of money that would normally have gone to restaurants, bars, and trips, to Disneyland and other things into buying goods.

You know, the famous story of buying the Peloton bike, as opposed to a gym membership. All that changed around and that wasn’t due to the Fed and it wasn’t due to fiscal stimulus. It was due to COVID. It was due to the fact that people were reverting to buying goods as opposed to services because of concerns about being exposed to the virus.

Now that’s the first possibility. The second question is where bottlenecks contributed to inflation. Here’s a chart that comes from the World Economic Forum that shows that in both the U.S. and in the Euro area, CPI has increased significantly, but it has increased more particularly in the United States because of bottlenecks in both production industries and also in transportation.

The solid line is actual CPI. The dotted line is CPI if there were no bottlenecks. So according to the WEF, bottlenecks have actually contributed the entirety of the additional, basically CPI increase above and beyond what it normally would’ve been, given fiscal policy.

Shipping Troubles Aggravate Inflation

At the same time, we do know that there has been a dramatic increase in goods expenditure. I just showed you that. So here’s a chart that shows imports of containers into the United States.

Now you can see that although there was a drop in 2020, this year’s increase is just way beyond, not just erasing the drop in 2020, it’s gone way beyond anything even before.

So it’s not just a question that we’re having transport bottlenecks, but we are importing more goods than we normally do.

The upshot from those two points, i.e. That we haven’t seen an overall increase in GDP or overall expenditure, but we’ve seen a change in its composition towards goods suggests that inflation is really caused more by the specific characteristics of COVID, i.e. people preferring goods to services and not so much the fact that there’s additional money in the economy.

Because a lot of that money that went into the economy simply replaced money that was being lost through wages and lost through business income that wasn’t happening because of COVID, remember. So it’s not like there was additional GDP being generated by this money. It just got spent differently. And of course, that led to bottlenecks, which has caused inflation.

So, what is the overall take on where inflation is coming from and what is the Fed’s attempt to deal with it likely to do?

Resembling the Past

Well, today’s inflation, kind of resembles what happened after World War II and after the Korean war. Between 1946 and 1948, we had a whole bunch of people who were coming back from the war who had saved a lot of money during the war because there were shortages and rationing and they had money saved up and they wanted stuff.

The economy had not yet transitioned from a wartime economy, making tanks and airplanes, going back to making cars and washing machines. So it took a couple of years. And during those two years, inflation exceeded 20% in both years.

After the Korean war, it went up to about 10%, but the cause was the same that you had restrictions on consumption. You had excess savings, which is like fiscal policy in the sense that all this, what they called dry powder, that consumers had to spend in the post-war period.

It came from savings in the post COVID period, it came from the Federal government, but the effect has been the same … that you get this big boost in inflation. In our case, though, the big difference is that the only thing that people have been able to spend a lot of money on is physical goods, which leads to shortages, which leads to increase in prices.

That leads the question: Will that cause long term inflation through what economists call the expectations channel? The expectations channel is when businesses and workers start saying, “Well, I expect inflation to be high going into the future. So I’m going to start baking in larger price increases in next quarter and next year,” which in turn feeds the inflationary impulse and makes it a self-fulfilling prophecy.

Now, if you look at any chart of forward inflation expectations, whether they come from consumers, from product or production managers that the PMI indices, whether they come from bond markets, everybody expects inflation to narrow back down to under 3%, probably by the end of next year.

It’s Transitory

There isn’t an expectations problem.

What that leaves us with, if it turns out that inflation is really a transitory phenomenon, the way it was after World War II, the Fed’s tightening might not actually do anything to inflation because it’s not going to take any money out of the economy, right?

QE and interest rate cuts didn’t pump money into the economy. So how can reversing that take money out the economy? The money that has caused inflation came from fiscal policy, it didn’t come from monetary policy.

So the question is, what will the Fed’s policy do?

Well, if it doesn’t do anything to calm inflation, but inflation subsidizes on its own, thanks to COVID fading away, and thanks to changes in the pattern of consumption, the Fed will probably get credit for it. And people will not realize that it was actually because inflation really was transitory in the way that it was after World War II and the Korean War.

But it could have a big downside. And that is because we have become a highly indebted economy. If you get rising interest rates as a result of the Fed, trying to address inflation that it didn’t cause, and that it probably can’t change because it doesn’t have any way to affect supply chains or people’s spending patterns, then you will probably see a decrease in economic activity and a decrease in revenues over time as interest rates rise. And as the economy slowly does cool down that’ll put pressure on debtors.

Here’s a chart that shows the combined household and business borrowings going back to before the Great Financial Crisis.

Clearly there’s a huge spike in ‘20 and ‘21, which is taken us above the benchmark or rather long term trend.

Here’s the next chart that shows refinancing and the refinancings that are coming up within the next five years.

This chart shows the amount of money that is going to be refinanced by government in black junk bonds, junk loans in red and blue. Those are basically where you get the biggest danger. Because if interest rates rise for the kinds of companies that are basically borrowing to roll over interest payments for previous debt and all of a sudden those interest rates rise, but their revenues don’t because rising interest rates are causing the economy to slow down, then you can start to get the makings of a potential financially-driven risk session.

So the overall message is that yes, the Fed did raise rates, it made the market happy by doing that by indicating that it was paying attention to inflation. But my guess is that the Fed knows full well that these interest rates increases on their own are not going to stop inflation.

It’s really just a question of signaling, messaging, virtue signaling to financial sector, if you like. And in fact, we may see inflation continue into next year because it’s not caused by monetary policy. It’s caused by fiscal policy and it’s caused by the way people are changing their spending under COVID conditions.

If that’s the case, and if the Fed continues to raise interest rates, we could see a slowing economy, as well as the potential for a big squeeze on a big chunk of the indebted part of the U.S. economy, particularly in vulnerable companies that are excessively indebted and paying high yielding bonds already.

If that’s the case, the Fed could have the paradoxical effect of actually tightening us into a problem.

I’m not guaranteeing it, but I think it’s something to bear in mind. And the only way you can understand it is by understanding that this inflationary problem is not the Fed’s doing and the Fed can’t fix it.

If you like today’s video, leave a comment or email us at BaumanDaily@BanyanHill.com.

Kind regards,

Ted Bauman

Editor, The Bauman Letter