Stress. To us, it is measured by our pulse. Our economy, however, isn’t as easily tracked.

That’s why the St. Louis Federal Reserve has done its best to create a Financial Stress Index that tells the stress level of the economy.

The stress index, which is comprised of 12 weekly data indicators, is used to show when the economy is in certain stress situations — either above- or below-average stress.

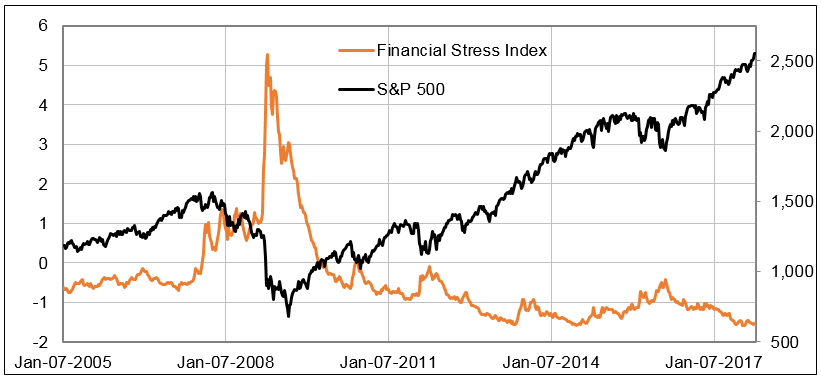

Take a look:

(Source: Federal Reserve)

The average is the zero line, so if the index is above zero, it’s above-average financial stress. Below zero, and below-average financial stress.

Right now, the index is at a reading of about -1.5, well below the zero line. In fact, it’s only been this low twice before, once in 2013 and once in 2014.

When the financial stress of the economy is higher, there’s a threat of a pullback in the stock market.

Take a look at the inverse relationship between the index and the S&P 500.

Clearly, as the stress index (orange line) spikes higher, there’s almost always a pullback in the S&P 500 (black line).

Since we are at very low levels for the index, we know at some point financial stress will get worse.

So, what are some possible reasons for it to be worse?

Well, based on the indicators it uses, interest rates and yield spreads are the biggest factors. And President Donald Trump is eyeing John Taylor as the new Fed chair. Taylor is considered to be the most hawkish candidate on policy, meaning he is looking to raise rates at a more rapid pace than we have seen.

Trump’s decision will create moves in the interest-rate market over the next three to six months, so it could easily be the catalyst that creates a bottom in the stress index — and therefore a possible top in the stock market.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert