“That math we’ve been doing really paid off,” my son said as he hopped into the car.

What I’m about to share may make my wife and me sound like horrible parents. But we hope it will make our kids better in the long run.

To keep them doing something productive over the summer, we make them read and do math once a day.

They think it’s the end of the world to take a break from playing to do a little work. But down the road, we know it will pay off.

The more our kids are prepared and create these habits, the more this information will become instinct — something they react to without even thinking.

And for our oldest son, it’s already paid off.

Coming out of hockey practice, he explained his last goal:

“I was pinned down behind the net, holding off the defender. There was no real angle for the shot. Then I noticed the angle of the goalie’s skates and used that to bounce the puck into the net.”

The play-by-play makes it sound like he did a lot of thinking. But I watched his last shot: It happened in a split second after he caught himself behind the net.

It was a reaction, not an elaborate thought process.

And that’s what your trading approach has to become — reflexive, instinctual.

You still need the research and due diligence behind every trade, of course. But when it’s time to pull the trigger, you can rely on instincts instead of missing out on the latest opportunity.

Today, I want to share with you the most important component of an option that you’ll want to know by heart before you trade.

Don’t Skip This Step

Implied volatility.

I know it sounds confusing, but stay with me.

We don’t have to dive into the formulas or definitions. We can boil it down to a simple fact: options pricing.

It sounds like common sense — options pricing is the most important part of picking an option. But many investors skip this step.

They find a trade they like, expecting the stock to rise or fall.

They buy an option, regardless of the price, to benefit from it.

Then they lose money, hate options and never trade again.

So, when we think about an option, the first thing that should come to mind is the implied volatility, or option’s price.

It doesn’t get more straightforward than that.

Whenever you buy an option, the price is what determines your ultimate profit potential.

See, implied volatility represents the expected movement of the underlying stock for the duration of the option. (If you expect a stock to rise over a three-month period, you might buy a call option that expires in about 90 days.)

All we have to look at is the price to understand what’s going on with implied volatility.

The metric works both ways — with call options and put options. Because the market doesn’t know in which direction the move will happen. The market only knows an approximate swing amount can be expected before the option expires.

As an option buyer, we want an option price that allows us to profit if the stock hits our price targets.

In other words, it doesn’t matter if it has low implied volatility or high. Because certain stocks at certain times of the year will have different levels of volatility.

All we care about is how much money we can make on this trade, and pricing is everything.

Example: Implied Volatility and Facebook Stock

Let’s use Facebook (Nasdaq: FB) from my latest Bank It or Tank It video as an example.

Based on my insights into Facebook, I decided to put it on my Bank It list, meaning I expect shares to head higher over the next 12 months.

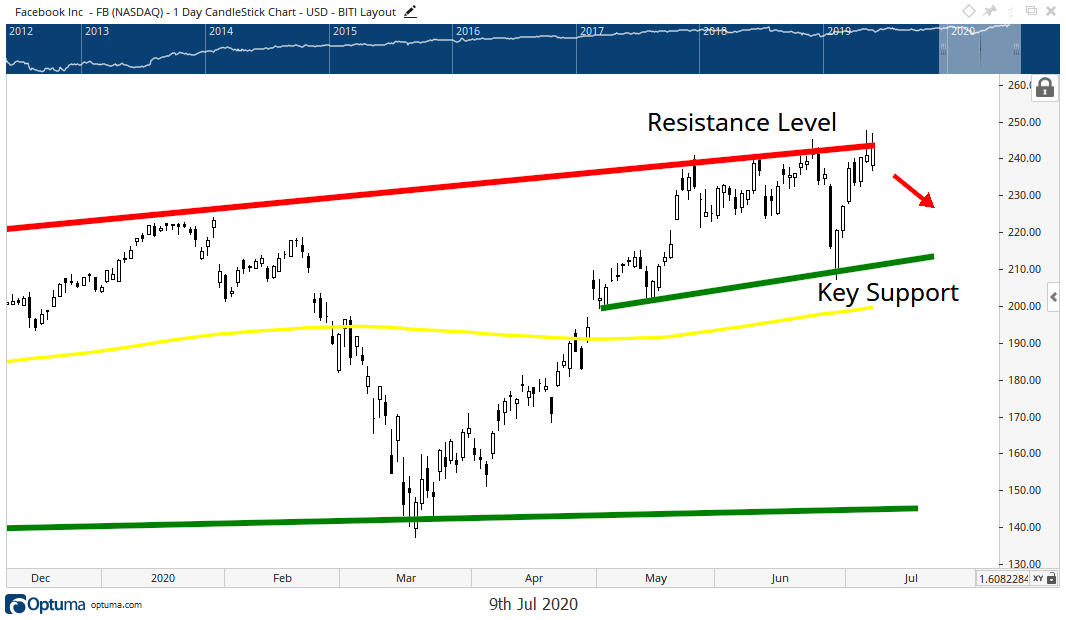

But right now is not a good time to buy call options because the stock is sitting against a resistance level on its price chart (the red line):

Facebook: Don’t Buy Call Options Today

A short-term pullback seems more likely at the moment. Since we expect the stock to decline, let’s take a look at the October 2020 $235 put option on Facebook.

The price for that option as I write this is $18.50 — essentially the implied volatility.

This tells us the options market shows an expected move of $18.50, up or down. Based on the price chart, I lean toward the stock heading lower. This would bring Facebook’s stock down to $216.50, an 8.5% decline.

As you can see on the chart above, my key support line is around $215. This doesn’t give us much running room to make a profit.

Just looking at the implied volatility (or the price of the option), I know right away this is not a trade I want to take.

If I expected shares to fall to $200 or lower before the option expired, then this trade would make sense because we’d have a chance to double our money.

Many factors ultimately decide if an options trade is worth making. But by far the most important is understanding the implied volatility of an option’s price.

Once you nail that down, you’ll have the instincts to know when to place a trade … and when to pass on one.

I put together a short options training video walking you through everything you need to know about trading options — including how to pick the perfect option. It shares specific details about my No. 1 options strategy as well.

Click here to get up to speed with how to trade options.

Regards,

Chad Shoop, CMT

Editor, Quick Hit Profits