The U.S. stock market is a giant con game … and unless you’re following our advice, you’re the mark.

We’re regularly told the market is “bullish.” Despite the trade wars, interest-rate hikes, danger signs in the Chinese economy and increasing political chaos, stocks keep going up.

That means everything is OK, right?

Wrong.

Here’s the funny thing about the current “bullish” market: The only investors who are acting like bulls are individuals … the people bombarded with “bullish” talk day after day. They have been net buyers of stocks in 2018.

By contrast, institutional investors and hedge funds have been net sellers of stocks in 2018.

Let that sink in for a moment: We’re told the market remains bullish, but the very people whose only business it is to generate yield from that market are net sellers.

So, who’s doing all the buying that’s pushing stocks up?

Here’s the reality:

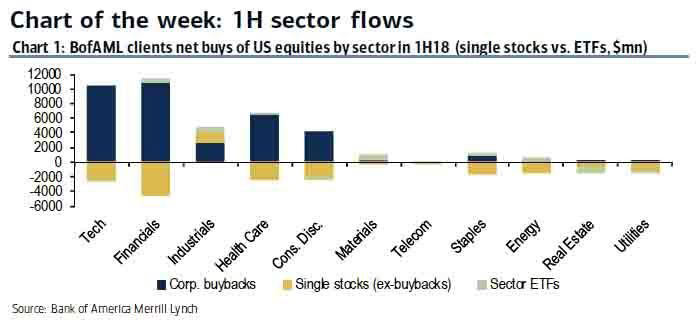

Apart from industrial stocks, share purchases — and thus prices — in every major U.S. economic sector have been driven entirely by share repurchases.

What do the hedge funds know that you don’t?

Corporations Are in a Big Hurry

U.S. corporations are required by law to announce their intention to repurchase outstanding shares — one of the few checks left on this once-illegal activity. In the first quarter of 2018, they announced $242.1 billion in planned transactions. In the second quarter the figure was a record $436.6 billion

This means stock repurchases in the first half of 2018 amounted to $680 billion.

In January, JPMorgan estimated that share repurchases for 2018 would amount to $842 billion. Well, U.S. corporations are in a big hurry for some reason, because we’re already over 80% there.

If this keeps up, we’re looking at $1.35 trillion for the year.

That’s a lot of money. As one market watcher put it: “The amount of money committed to buybacks last quarter could fund 6.8 million $1,000 bonus checks to U.S. workers every single trading day.”

Buybacks Are Slow-Motion Disinvestment

I’m no fan of buybacks. I make no bones about that.

Sometimes critics will argue that buybacks are OK because “businesses are supposed to return money to investors one way or the other.”

If that’s the case, why not just sell off the firm and be done with it? This is exactly what share repurchases do — it’s just in slow motion. It’s nothing less than disinvestment.

If a corporation’s executive leadership wants to give money back to shareholders, they should declare a cash dividend.

We’re the Marks in This Game

Buybacks are a tool corporate boards and CEOs use to push up the prices of their own shares for their own enrichment. They’ve been doing this at a fantastic clip in July:

This is bad for everyone.

There is solid empirical evidence of a link between buybacks and declines in investment and employment. And they contribute to our nation’s dangerous levels of inequality by enriching shareholders — who tend to be affluent already — at the expense of workers and the broader economy.

Even worse, a Bloomberg Intelligence analysis shows that many buybacks involved buying back shares at unsustainably high prices. Subsequent declines in price leave shareholders worse off.

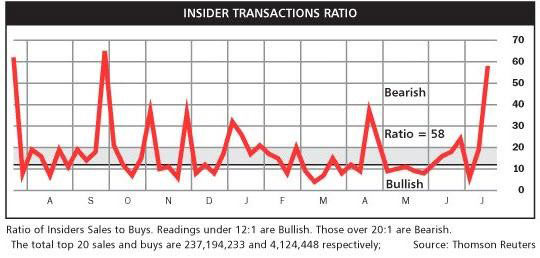

Why would executives do such a thing? Simple: It allows them to cash in their own shares at high prices before reality sets in and prices fall back to earth.

In effect, insiders are dumping their shares to retail investors. Company executives manipulate the timing of buyback announcements so they can sell their own holdings immediately after the news.

Legal Doesn’t Mean Right

Like so much else that ails us today, the Securities and Exchange Commission began to allow share repurchases during the Reagan administration. The practice had been illegal since the Great Depression.

That doesn’t make it right. Share buybacks are financial manipulation and damaging to the entire U.S. economy.

For individual investors like us, it’s even more dangerous. We don’t have the money to waste on such shenanigans … and we’re not privileged insiders.

The demand side of the U.S. equity market is an illusion. This is why it’s so important to follow the advice of knowledgeable analysts like us here at Banyan Hill. We track the actual value of our investments and advise you accordingly.

And services like my Smart Money system are specifically designed to counter this sort of financial manipulation to identify real value.

Remember, in any con game, the last to know what’s up … is the mark.

Don’t be the mark — stick with us.

Kind regards,

Ted Bauman

Editor, The Bauman Letter