Black Friday is the biggest shopping day of the year in the United States … and that’s typically great news for consumer stocks.

But back in August, I spotted an interesting dynamic between two sectors of the market.

Despite higher interest rates and a lackluster economy, stocks in the S&P 500’s consumer staple sector were vastly outperforming their consumer discretionary cousins.

Inflation started to cool in August, leading more Americans to become bullish about what excess income they had.

I dug into both the Consumer Staples Select SPDR ETF (NYSE: XLP) and the Consumer Discretionary SPDR ETF (NYSE: XLY).

While XLP outperformed XLY, consumer discretionary stocks rated higher in Adam’s Green Zone Power Ratings system.

What if I told you that further research shows the consumer discretionary sector is gaining more steam, and recent events could help propel stocks in the sector even higher?

Let me explain.

A Key Distinction: Staples vs. Discretionary

Back in August, I mentioned that XLP had gained 8.1% since the start of the year, compared to a 2% loss for XLY.

Consumer discretionary stocks experienced a strong recovery rally in early May. However, when investors started rotating out of Big Tech stocks, they moved into more defensive positions, such as consumer staples, at the end of July.

But the trend has flipped again…

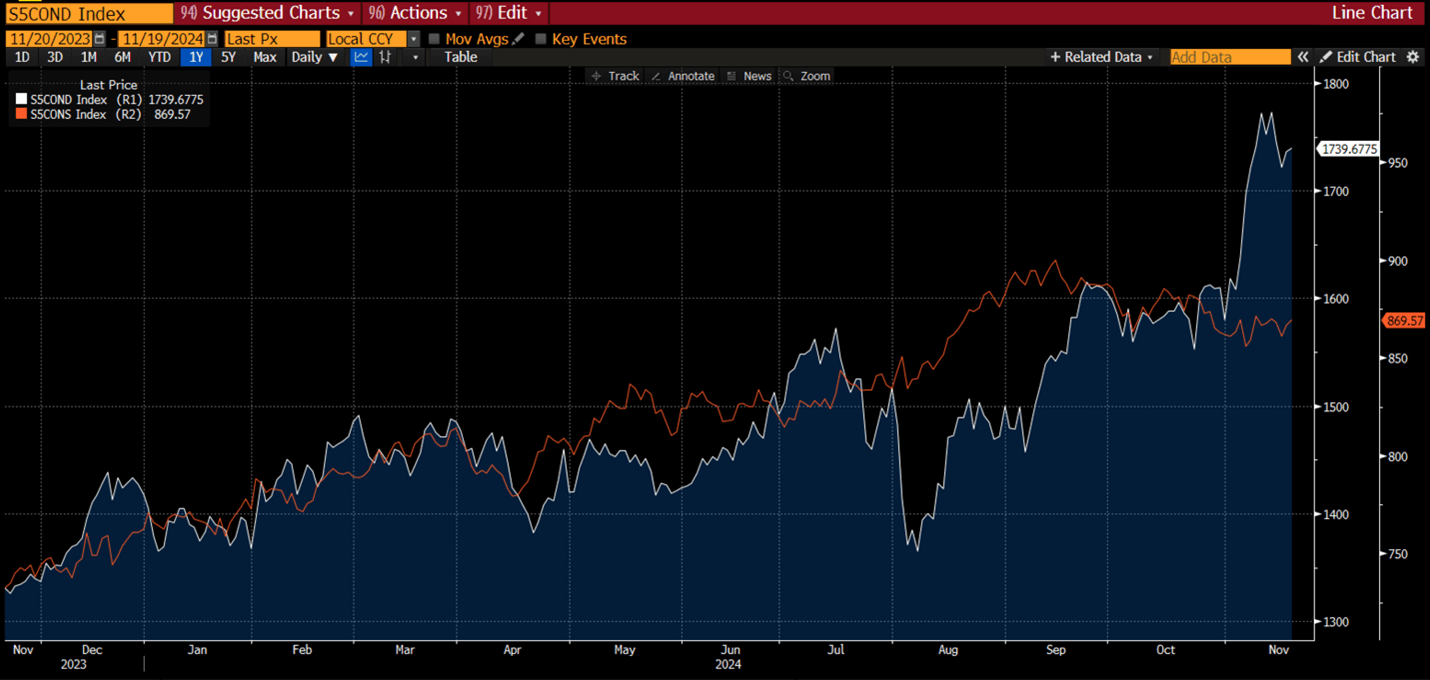

Since July, consumer discretionary stocks have roared ahead:

XLY Up 30% in 2024

The S&P 500 Consumer Discretionary Sector GICS Index (the blue-shaded portion in the chart above) recovered from its late summer dip and rocketed from down 2% to up 30.7% for the year.

On the other hand, while the S&P 500 Consumer Staples Sector GICS Index (the orange line) also rallied, the gain was much smaller, from 8.1% to 18.7%.

The gulf between the two sectors is nearly as wide as it was in August … only in reverse. Consumer discretionary stocks are well above consumer staples.

One big reason for the shift is the Federal Reserve’s decision to cut its benchmark fed fund interest rates twice since September.

These rate cuts vastly improve consumer discretionary stocks … without really hurting consumer staples.

Diving Into XLY

Because of this massive shift, I wanted to run another ETF X-ray of the Consumer Discretionary SPDR ETF (NYSE: XLY) to see if there are any differences between now and August.

This is when I take all of the holdings of an exchange-traded fund (ETF) through our proprietary Green Zone Power Ratings to see how its individual stock holdings stack up.

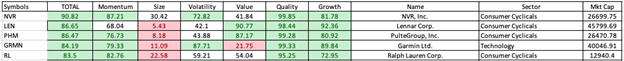

In August, the average overall rating of stocks listed in XLY was 49 out of 100.

When I ran the numbers again this week, the overall rating increased to 51.

XLY Rating Ticks Up Since August

That isn’t a massive change, but even a small swing to the upside is a good sign.

The ETF maintained a 78 out of 100 on our Quality factor, and its Momentum jumped seven points to 56.

That strong momentum is the biggest reason why the overall score of XLY went up.

The top five holdings by rank in XLY also changed from August.

Back then, three of the highest-rated stocks in XLY were homebuilders.

Top 5 Holdings in XLY

While two of the homebuilders are still in the top 5, one has been replaced by lifestyle product company Ralph Lauren Corp. (NYSE: RL).

What It All Means: Back-to-back Fed fund rate cuts did wonders to turn things around for the consumer discretionary sector.

Data before the cuts supported the sector, and the cuts supercharged the advance.

Walmart Inc. (NYSE: WMT) kicked off the retail section of earnings this week and showed that holiday shopping is already off to a strong start. Of course, Target Corp. (NYSE: TGT) didn’t have as rosy of a quarterly report a day later… (Both stocks still rate “Bullish” in our system.)

Improved holiday retail sales, along with a stronger economy due to lower interest rates, could push the consumer discretionary sector even higher into 2025.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets