Many, many years ago — before I started my financial career — I dreamed of becoming a doctor…

It wasn’t just a dream, either.

I studied. I volunteered. I was even accepted to medical school, which I briefly attended before realizing it wasn’t meant to be.

But I never lost the sense of fascination, the passion I have for medical technology.

During our lifetimes, we’ve witnessed nothing short of a miracle when it comes to the evolution of medical technology.

When you were a kid, they used a glass thermometer under your tongue to check your temperature.

Now they just shoot your forehead with a laser, like something out of Star Trek.

And the biggest advancements have been made in the field of biotechnology …

We’ve seen a radical evolution in the types of medication and available diagnostics for treating different diseases.

This really came to a head back in 2020, when the race to find a cure for COVID-19 triggered a tidal wave of new interest in biotech stocks. New investment flooded in, and the industry grew by $284 billion.

Prices quickly got ahead of themselves, and these new investors didn’t stick around for long. As post-COVID “reopening” trades came to dominate, biotech and genomics stocks got left behind.

This brief spike in COVID-era interest was especially damaging for the hyper-growth stocks that dominate the biotech space.

Most of these stocks were already expensive by traditional value metrics.

In a typical biotech investment, expected earnings and revenue are years in the future, and often depend on a successful drug trial or FDA approval (more on how to value these stocks in just a moment).

But despite the sector’s post-COVID setbacks, we know the 2020s will be the decade where market-leading stocks come from biotech and DNA technology…

Biotech’s Big Revival

Biotech valuations and investing peaked in late 2021, with investors surging into the sector at the height of the COVID-19 pandemic.

Interest in the sector waned over the last few years — due in part to sharply increased interest rates and the rapid emergence of the AI mega trend.

But now, the smart money is starting to flow back into the sector.

JPMorgan Bank just launched a team to invest in companies that have new biotechnologies.

Blackstone Group has quietly invested $137 billion into biotech.

Goldman Sachs recently led a $100 million round of funding into biotech.

Family offices, which typically manage money for families who have over $100 million, are even pouring money into it…

Just this summer, the Financial Times reported…

“Biotech is the ultimate impact investment — family offices can’t get enough of it.”

And Warren Buffett is even a believer…

When the potential of DNA technology became apparent, Berkshire Hathaway made its first biotech investment ever … to the tune of $192 million.

The writing on the wall here is clear: this is just the beginning of a huge new wave of growth…

I’m not alone in making this conclusion, either.

Vanguard, the world’s largest investment fund, confirmed my prediction in an exhaustive, multi-report study of upcoming megatrends.

This report covered EVERYTHING — every mega trend from AI to Big Data, solar and lithium-ion batteries …

And in the words of Vanguard’s Global Head of Investments:

“If I had to pick one field that was going to be bigger than the Internet…

It would be DNA technology.”

So — what’s the best way to invest in this rapidly emerging sector?

Your Green Zone Guide to Biotech Fortunes

My Green Zone Ratings system rates stocks on six objective, measurable factors to help identify stocks that my research proves will beat the market:

- Momentum.

- Volatility.

- Size.

- Quality.

- Value.

- Growth

We divide the value factor into subfactors such as the price-to-earnings ratio and price-to-sales ratio.

We break down these subfactors further to cover different timelines and other specific criteria.

All that to say, our value factor rating is robust. It picks apart a stock’s financial statements then rates the stock relative to stocks in our universe.

Now — given the nature of biotech stocks, I’m willing to be somewhat flexible on the value factor.

When your expected payoff from a blockbuster drug is years in the future, your traditional value metrics based on earnings and sales won’t look perfect in the here and now.

Finding top-rated stocks in this sector that also rate well on value gives us an extra degree of confidence. But it’s not always going to be possible when we’re looking for the next biotech breakout.

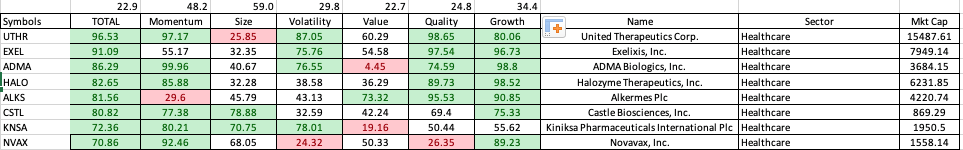

With that in mind, my team conducted an “X-ray” of the iShares Biotechnology ETF (Nasdaq: IBB)

Here’s a look at some of the ETF’s most promising holdings, rated by their Green Zone Power Rating:

The Top Green Zone Biotech Stocks for March 2024

These are some strong across-the-board scores … and I say that as someone who looks at Green Zone Power Ratings for hundreds of different stocks every day.

Most notably, we’ve got six different stocks in “Strong Bullish” territory …

You might notice that we’ve got some weak scores for value here. Size scores suffered as well, since they’re based on similar metrics. In both cases, this is just something that comes with the territory.

At the same time, it’s important to remember that IBB has a total of 211 different holdings, with an average Green Zone Power Rating of just 22/100.

So it’s probably best to take a ‘wait-and-see’ approach with this volatile sector of the market…

To good profits,

Chief Investment Strategist,

Money & Markets