I hate going to the doctor. Of course, I can’t think of anyone off the top of my head who actually enjoys visiting the doctor.

And it’s not the wasted time sitting in the waiting room before being ushered back to a freezing-cold private exam room for more wasted time waiting on the nurse and then the doctor.

It’s the mounting cost.

There are the health insurance premiums, the copays and the deductibles. Each year, all those costs go up and far faster than any potential increases that I’m seeing in my paycheck. Health care in America is eating up larger chunks of my income, forcing me to more often skip those doctor visits or cut spending elsewhere in my life.

I’m not the only American making these tough choices about where my money is being spent. Health care is taking a bigger bite out of the wealth of America, putting our entire economy in danger…

The Taxing Burden of America’s Health Care

Last week, my article took a closer look at the debt burden that Americans are struggling under that will soon have a significant impact on their spending habits despite the fact that we have a Federal Reserve crowing about how we’ve approximately reached full employment and that wage growth is sitting at 2.7% on an annualized basis.

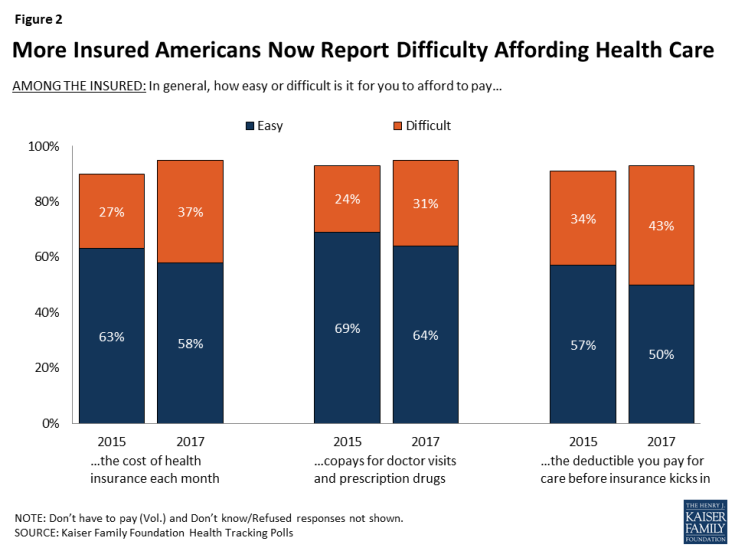

We are seeing more and more Americans reporting that it is difficult to pay their monthly premiums, copays and deductibles.

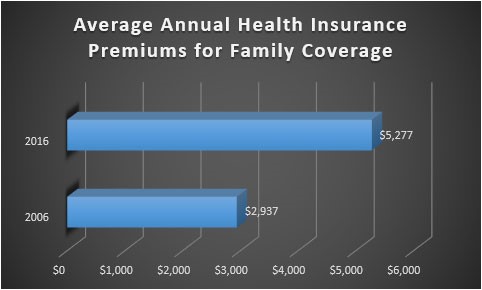

The Kaiser Family Foundation (KFF) revealed that insurance premiums soared 213% since 1999 for family coverage purchased through an employer, while wages grew by only 60% and inflation is up 44%.

In fact, health care spending now accounts for more than 17% of the U.S. economy compared to less than 9% in 1980.

Even with insurance coverage, more adults are struggling with health care expenses. A recent survey by the KFF revealed that 43% of adults with health insurance struggled with affording their deductibles, while approximately one-third are having difficulty affording their premiums and copays. Both responses are up from their 2015 levels.

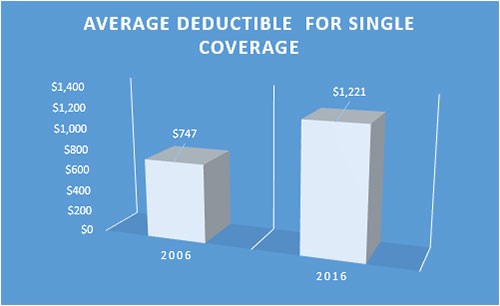

What’s more, the push for more Americans to have insurance coverage has resulted in an increase in what workers are paying for deductibles. In 2016, more than one-half of workers with single-coverage health plans paid a deductible of $1,000 or more compared to 31% of workers in 2011. The average deductible now sits at $1,221, up 63% from 2006.

In addition, health care insurance premiums continue to rise, jumping nearly 80% over the past decade.

Cutting Back on Spending

Americans are having trouble keeping up with rising costs. The KFF survey reveals that 29% of Americans are having problems paying medical bills.

And when we have trouble making ends meet, we start changing our spending habits.

Of those who reported having trouble paying medical bills, 73% stated that they have cut back on basics such as food, clothing and household items.

What’s more, 27% reported that they have delayed seeking health care they needed, 23% skipped a recommended medical test or treatment, and 21% failed to get a prescription for a medicine due to rising medical costs.

Washington is still at war over Obamacare and the next plan for America’s health care. Regardless of the long-term outcome, Americans are trapped in a situation where costs will continue to rise, and very likely faster than their own income is rising. In that situation, we are facing two possible outcomes:

- Americans pay their health care costs to stay healthy but start spending less on things such as clothing, restaurants, entertainment, vacations, household goods, etc. This will result in a decline in economic growth.

- Americans cut back on health care — skipping that needed test, doctor’s appointment or prescription medication — which results in poor health in America and an overall reduction in worker productivity. That, of course, leads to less income and less spending.

Either way, the economy is facing the potential for a sharp slowdown as Americans struggle under the increasing burden of health care costs.

Regards,

Jocelynn Smith

Sr. Managing Editor, Sovereign Investor Daily

P.S. While America’s health care costs continue to skyrocket, there are countries around the globe that offer the same high-quality health care but at a fraction of the cost. With Bob Bauman’s Passport Book, you can start learning about your health care options if you decide to get a second residence or second passport. To claim your copy, click here.