This week, we saw some of the most extreme performances in the history of the stock market.

It all started with a few cryptic tweets from a man named Keith Gill.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

Better known by his internet handle “Roaring Kitty,” Gill was the man responsible for triggering 2021’s colossal meme stock rally.

Just like 2021, his latest posts sent shares of Gamestop (NYSE: GME) and AMC Entertainment (NYSE: AMC) soaring.

And the resulting rally has been truly epic in scale…

On Monday alone, GME share prices more than doubled — a 100% gain in a matter of hours — before pulling back towards the end of the day. By the closing bell, short sellers lost more than a billion dollars.

Meanwhile, AMC’s trading volume exceeded 388 million shares. That’s more than the company’s entire outstanding float — meaning that every single available share effectively traded at least once that day.

Then on Tuesday, trading was halted 14 times due to abnormally high volumes triggering the market’s built-in “circuit breakers.”

AMC was halted 22 times!

Make no mistake — you’re witnessing history in the making. And for meme stock investors, it probably feels like “the good old days” all over again.

But it’s not, and you shouldn’t touch these stocks with a 10-foot pole.

Here’s why…

Dumb Money Revival

As I explained earlier this week in Money & Markets Daily, this week’s rally isn’t the same as 2021’s legendary meme stock breakout.

Gamestop’s gains in 2021 were triggered after Keith Gill noticed GME’s “short interest ratio” was over 100%.

That meant Wall Street’s biggest short sellers would need to buy back all the available shares on the market (and then some) just to cover their bets.

So Gill realized that if he and other investors simply bought and held some of these shares, they’d have the short sellers over a barrel — causing share prices to skyrocket.

Gill’s posts snowballed online before growing into a revolution.

Before it was over, an army of underdog “Main Street” investors wrecked their Wall Street adversaries — the Wall Street hedge funds and hotshots who’d heavily shorted the stock.

One of GME’s biggest short sellers, a hedge fund named Melvin Capital, was even forced out of business in the aftermath.

The crazy affair was eventually made into a big-budget Hollywood blockbuster called “Dumb Money,” which ironically bombed at the box office last year.

Fast-forward to today, and that short ratio has tumbled to 24%.

That means a key catalyst for the stock’s 2021 breakout is conspicuously absent this time around.

And as far as fundamentals go, GME is still a nightmare.

Brick-and-mortar retail isn’t exactly thriving after all.

And the company’s core business (selling physical copies of video games) is dying even faster.

Is it possible that this week’s rapid gains are actually justified by the underlying business?

Sure, anything is possible.

Technically, it’s possible that Gamestop traded a few old copies of Super Mario for the secret to cold fusion.

But it’s far more likely that the company’s cultish following was pining for the “good old days” of sticking it to Wall Street.

And Gill’s cryptic tweets gave them just the excuse they needed to go all-in.

If that’s the case, then this week’s feverish hype will soon give way to disappointment … and then serious losses for investors who came in late.

So instead of getting sucked into an overhyped sequel to Hollywood’s “Dumb Money,” I’m sticking with my favorite “Hype-free” picks as always…

Your “Hype-Free” Green Zone Portfolio

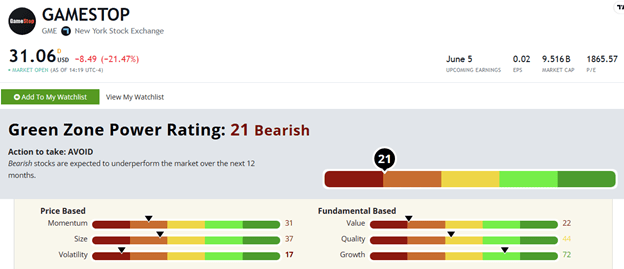

A critical strength of Green Zone Power Ratings is its ability to filter out biases, hype and other “human” factors that can get in the way of growing your portfolio.

By consistently applying both fundamental and technical analysis, the system is able to consistently outperform the S&P 500 3-to-1.

So … what’s GME’s Green Zone Power Rating?

See for yourself right here:

(Click here to view GME’s stock ratings page.)

The rating — 21 out of 100 — speaks for itself.

I’ll only add that the company’s P/E ratio is currently over 1,860.

That means shares of Gamestop, a brick-and-mortar video game store, are currently 22 times more expensive than Nvidia, the world’s leading AI hardware developer.

So feel free to enjoy watching the fireworks, but stick to the system when it comes to real-world investing.

To good profits,

Chief Investment Strategist, Money & Markets