Stocks don’t care who sits in the Oval Office…

Data shows that the market has performed well regardless of who the president is.

That’s why … I’m not going to change one thing about our investing approach.

In fact, I built a system that takes all the guesswork and noise out of the equation.

Quant Trading to a New System for Today’s Market

I started my career on Wall Street as a quant trader.

That means I was building systems based on mathematical equations to eliminate the guesswork involved in making money in the stock market.

But, when I turned 22, I set out to build my quant money management firm.

We rented a one-room, 400-square-foot office … on the seedy side of NYC … where dozens of mice freely roamed the hallway.

It was from those humble beginnings that I started to build my track record and business.

Over the next decade, we were doing well. Really well.

And in 1998, we climbed the Wall Street mountain and found ourselves at the top … Barron’s ranked us the No. 1 trader!

Fast-forward 26 years…

I’m seeing dislocations in the market that are ripe for the taking.

So, I took out my old quant hat and started building a system to take advantage of these opportunities. I felt like I was 22 years old again!

My new system is built with over 20+ years of data and has the power to grow an investor’s net worth by 3,514%…

Since launching the system last December, we’ve closed gains of 51%, 123% and 176%. And we’ve consistently beat the market.

How?

Don’t Cut the Flowers!

We invest and make decisions based on being rational, unbiased and making money.

But in real-time, that’s not how we behave.

The disposition effect is when investors sell their winners and hang on to their losers.

Legendary investor Peter Lynch framed it as “cutting the flowers and watering the weeds.”

Investors sell their winning trades in order to book a profit, which gives them a great feeling.

Here’s an example…

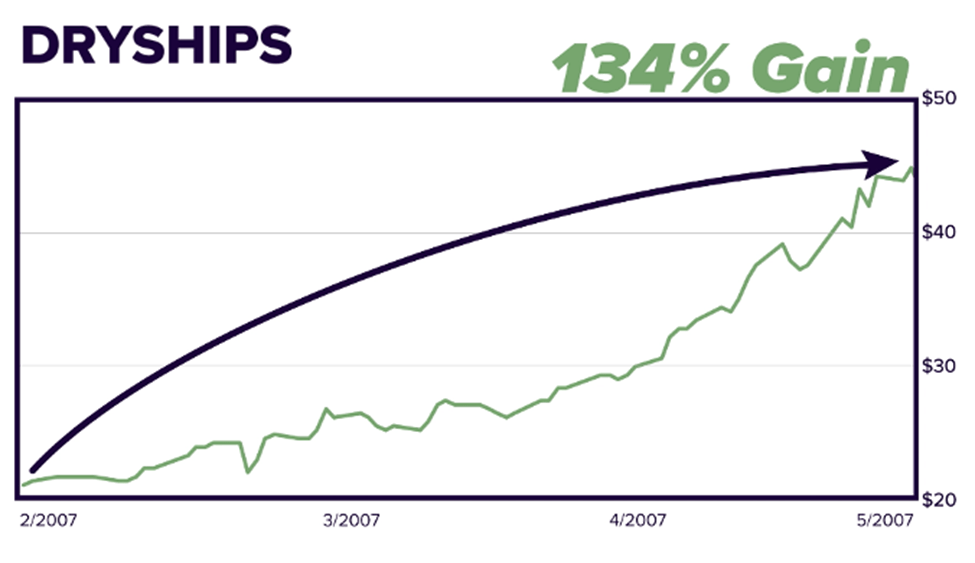

This is from DryShips. The stock goes up 134%. Most people think it’s as high as it can go, right?

DryShips stock goes up 134%

People look at that gain and say I doubled my money. Now is the time to take profits.

So what do they do instead of letting it grow? They cut the flowers! They sell.

They are pessimistic in the face of strong, short-term performance.

But my new system doesn’t have feelings. It doesn’t have emotions. And that means it doesn’t have the urge to sell a stock too soon.

Here’s how DryShips would have performed by using it:

The hardest part is to trust the system and not to override it.

When you override a system, you throw away your testing and are left with a new model with a one-day track record.

That makes no sense.

Jim Simons is the founder of Renaissance Technologies and the most successful quant fund in history.

He said: “The best decisions are often made with data and evidence, not gut feelings.”

That’s our approach — follow the system.

By sticking to our system, we’ve outperformed the market this year by 4X, even when most professionals are struggling to keep up with the S&P 500.

To find out how you can start using the system today, click here.

Regards,

Charles Mizrahi

Founder, Alpha Investor