Last week, I wrote that in its quest to defeat inflation, the Federal Reserve wants to make investors like us poorer.

The “wealth effect” says happy and bullish investors tend to spend more money than sad and bearish ones. So, as far as the Fed is concerned, plummeting portfolio values are a good thing.

But that’s only part of the story.

As I explained in my article, few American consumers own enough stocks to have their spending decisions influenced by the wealth effect.

That leaves everyone else. Of course, the Fed has a way to get them to cut back on spending as well.

It’s something it hasn’t used since the early 1980s. When it did, the S&P 500 fell by 26% in 18 months:

(Click here to view larger image.)

Right now, the stock market is flashing warning signs that we may be in for a repeat of that episode.

Fortunately, a lot has changed since then.

One of the biggest changes could help you make money hand over fist … even if the Fed does its worst.

If You Go Into the Woods Today…

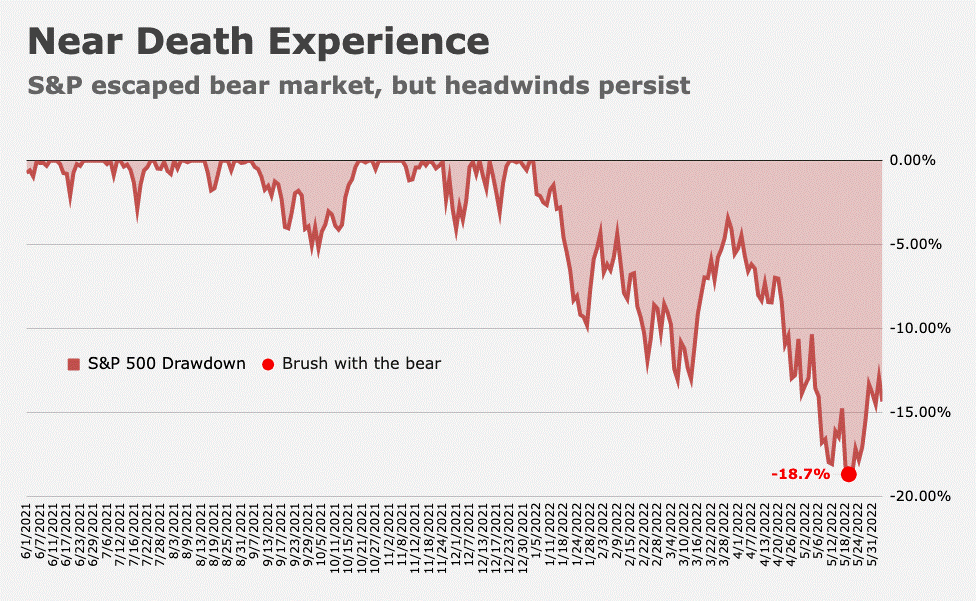

The stock market has had a rough time of it so far this year. The S&P 500 bottomed out at 3,810 on May 20. Although it closed at -18.7% from its previous peak, it came perilously close to a -20% “bear market” drawdown on that day:

(Click here to view larger image.)

But last week, the market enjoyed its best weekly run since November 2020. That helped it claw back a 7% gain from its May bottom.

That’s got a lot of people speculating whether the worst is already over. Most encouraging for bulls is that risk-on stocks led the bounce back, particularly in the growth/tech space.

The most optimistic voices claim the Fed may engage in a “dovish pivot,” dialing back its interest rate increases later this year.

Sadly, that’s wishful thinking.

The Fed is laser-focused on one thing: consumer prices. And on that front, it faces a similar problem to the wealth effect.

The wealth effect is a blunt policy tool because it only affects a handful of U.S. households.

One of the biggest changes since the 1980s is that the same is true of raising interest rates to cool consumer inflation … and that could make the Fed’s medicine particularly bitter.

You Asked for Globalization, You Got It

Besides the relatively small wealth effect, rising interest rates attack inflation by making investment more expensive for businesses and households. We’re already seeing this in the housing market, where soaring mortgage rates are causing a significant drop in demand.

Although less visible, similar processes are unfolding across the economy.

Chief financial officers everywhere are calculating the impact of higher borrowing costs on their companies’ future earnings. Consumers are rethinking purchases of durable goods they might buy on credit.

All these individual decisions together, based on relatively small changes in interest rates, can have a huge impact on spending and prices. The Fed’s goal today is to influence these decisions to cool the economy — enough to kill inflation, but not enough to cause a recession.

That’s easier said than done. A key obstacle is a huge change in our economy since the last time the Fed tried this in the early 1980s.

Back then, imports were about 7% of U.S. gross domestic product. Today, they are close to 15%. That makes a big difference for inflation … and for the Fed’s ability to bring it under control.

In 1980, the flow of money and investment within the economy was primarily domestic. Most everyday consumer products were made by U.S. companies. When the Fed raised interest rates, those companies made decisions that eventually led to a fall in the prices of their products, labor and other inputs.

Today, Chinese imports dominate many consumer markets. The Chinese companies who make those products respond to policy signals from their own government, not the Fed.

Right now, their government is telling them to focus on preventing the spread of COVID. Entire industrial cities have been shut down to achieve that impossible objective. Whilst the rest of the world is rapidly ramping up back to full manufacturing capacity, China is heading in the opposite direction.

In other words, the flow of money and investment — where inflation operates — has been globalized. The Fed can only influence some of the economic decisions that could lower inflation. The rest will be made by foreign businesses and governments who don’t care whether factory shutdowns cause shortages that contribute to U.S. inflation.

That’s why, when it comes to reducing demand and cooling prices, the Fed confronts a similar problem to the one I described last week.

As you may recall, because U.S. wealth is so unevenly distributed, only a small proportion of U.S. households are susceptible to the wealth effect. To get them to reduce spending enough to have an effect on inflation, the Fed must raise interest rates higher than it would if wealth was more evenly distributed.

The same is true in its attempts to cool consumer demand. The more consumer prices are determined by the decisions of foreign businesses, the less influence the Fed has over them.

So, as with the wealth effect, to slow inflation, it’s going to have to raise interest rates higher than it would have otherwise.

That raises the risk of recession … to a point well beyond what most market observers recognize.

Time to Play the Market Both Ways

I don’t know whether we’re going to experience a full-fledged recession in the next few quarters. But globalization suggests the Fed may be forced to engineer a recession to achieve its inflation goals.

If so, the stock market may have further to fall. The Fed has arguably wrangled down most of the excessive valuations that built up during the COVID bull market. But signs of declining future earnings are all over the place. That’s starting to pull the market down even further.

One way to deal with it is to invest in dividend-producing companies.

Another is to brush up on your options trading skills. That’s because one of the best things about options is that you can play stocks on the way down by buying puts. Smart options trades can make a lot of money, even if the market is declining.

That’s one reason why a couple of years ago I hired a guy named Clint Lee. He’s one of the smartest technical traders I know. His Flashpoint Fortunes options service has a tremendous win rate. For the last couple of months, he’s generated some big gains via puts.

If I’m right that globalization increases the risk of recession in our near future, do yourself a favor and let Clint make some money for you as the market declines further.

Kind regards,

Ted Bauman

Editor, The Bauman Letter