Investors love to buy beaten-down assets.

And nothing is more beaten down right now than oil and gas stocks. These companies have taken a beating as oil prices plunged 70% to start the year.

These stocks have a direct correlation to oil prices — oil prices are a way to measure their profits. That means oil prices dictate how much these companies can spend in the future.

So right now, these oil and gas companies don’t have as much money coming in the door.

As a result, the energy sector, tracked by the SPDR Energy Select Sector Fund (XLE), has fallen more than 60% from January through March.

The massive drop caused investors to rush to buy into these stocks, and they could have made a quick buck.

But it didn’t last long.

After a brief rally, the energy sector has fallen another 30% since June. Investors are once again looking to scoop up these stocks on the cheap … but now’s not the time.

Here’s why…

Oil Prices Are Falling — and They’ll Keep Falling

The correlation between oil prices and energy stocks started to break.

Oil prices are flat since June, while energy stocks have plunged 30%.

But now that we are into the last two months of the year, oil prices are set to start tumbling. This will only add to the pain that energy stocks have seen in 2020.

This is coming just as investors are looking at opportunities in oil stocks once again… It’s a beaten-down sector of the market that is almost too cheap to resist.

But we just may want to wait until 2021 before jumping in.

I study seasonal patterns for all sorts of sectors in the market. And right now, the patterns are showing that oil prices are set to drop as we head into the end of the year.

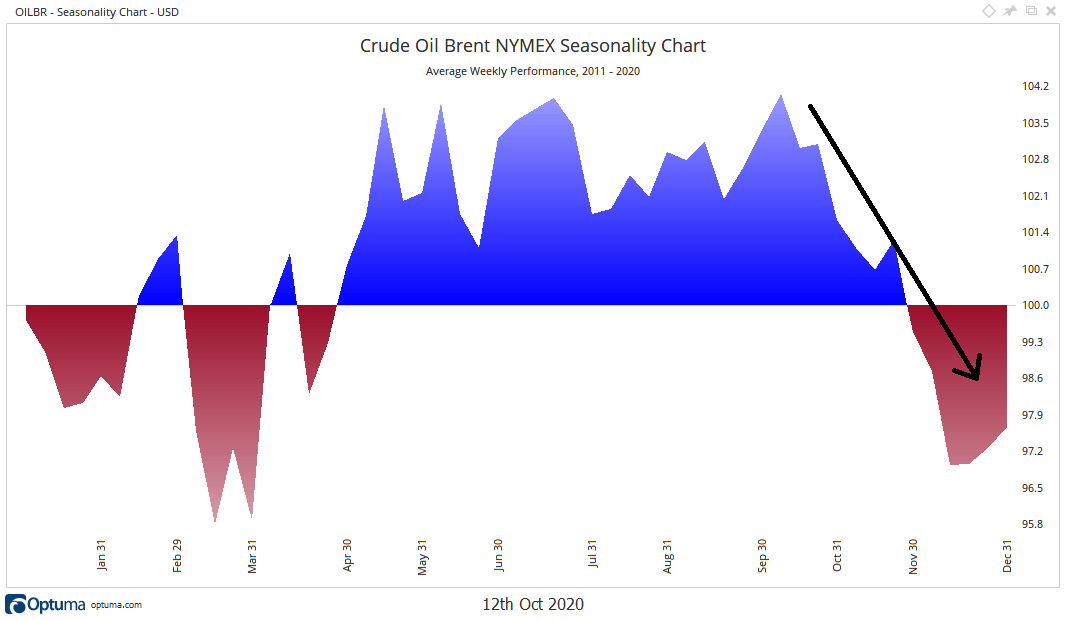

Take a look at this 10-year seasonal composite chart of Brent crude oil prices. This chart shows how oil has performed during each month out of the year for the past 10 years:

From October 1 through mid-December, we see a sharp drop in oil prices. It’s happened almost like clockwork.

Only two years really bucked the trend in oil prices — 2011 and 2017.

The other eight years either saw increased volatility or an outright plunge during these last two months. That’s why we have the clear trend on the seasonal chart this time of year. It’s the historically weak season for oil prices.

So if you wait until early 2021, you’ll more than likely have a better entry price into some of these beaten-down oil stocks.

We Saw This Coming

I track seasonal trends like this one on numerous sectors.

Right now, we are at the beginning of bullish trends for biotech stocks, consumer discretionary stocks, financial stocks and more.

Trends that, if you didn’t know they existed, could cause you to exit stocks at the wrong time or jump into a beaten-down sector like energy stocks just before they take another dip lower.

I use these trends throughout the year by following a strategy I refer to as Profit Stacks.

This is where we stay in a trade only for a few months at a time, then jump into another for a few months to stack our profits throughout the year.

I recently was interviewed on the concept that explains all the details. Click here to check it out.

Quick Takes — OKE, IPHI, CCI and More

In my latest YouTube video, I recorded my Quick Takes on five stocks in just five minutes. And we covered one oil stock a viewer asked me to look at, ONEOK Inc. (NYSE: OKE).

Just as I mentioned above, energy stocks are peaking everyone’s interest right now, and rightfully so.

I think they are a great opportunity to add to these stocks now that they are beaten up, but the seasonal weakness in oil prices makes me want to wait until 2021.

I talk about how that impacts OKE, plus we cover semiconductor company Inphi Corp. (NYSE: IPHI), Crown Castle International Corp. (NYSE: CCI) and more.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert