Article Highlights:

- This Wall Street giant is the world’s largest private equity firm.

- Its assets under management increased by more than $100 billion over the past year.

- It pays about a 4% dividend and is in the midst of a $1 billion share buyback program.

The rich get richer.

It’s a long-held belief that also happens to be true.

Every quarter, I review the holdings of the top hedge funds. Financial institutions that manage more than $100 million in assets must report what they own four times a year.

They file their holdings within 45 days of quarter end, so the most recent filing just occurred.

I have reviewed the filings of many hedge funds since. It’s interesting when you review data such as this because you start to see some patterns.

One of the names I reviewed is the epitome of the financial industry. It reported solid second-quarter numbers … even though it recently went through a big change.

When thinking about investments — really about Wall Street itself — this is one of the few names that nearly everyone considers. I feel obliged to make sure you know about this company too…

Not a Traditional Hedge Fund

The Blackstone Group Inc. (NYSE: BX) is the world’s largest private equity firm.

It isn’t a traditional hedge fund … it’s bigger than that. It invests and manages assets in many disciplines: public securities, private equity, real estate and more.

This chart is from the firm’s investor day last September. It shows Blackstone’s lines of business and the returns each has generated over its history:

These numbers are impressive. The S&P 500 Index has generated about 11% per year since 1985.

Blackstone has been growing for years. It was founded more than 30 years ago with $400,000 in seed capital.

Today, it has $545 billion in assets under management. That’s more than six times greater than at its 2007 initial public offering.

Generating outsized returns on a one-off bet is one thing … but doing so on a set of portfolios worth more than a half-trillion dollars is another.

How Did This Happen?

Blackstone is full of smart people.

It got that way by being super selective.

In 2018, it received nearly 15,000 applications from aspiring analysts. It hired 86 of them. That’s 0.6%.

But there are other reasons too.

For one, rich people and institutions have access to capital that costs them next to nothing. In April, Blackstone raised more than $600 million of debt at a 1.5% interest rate.

Try doing that on your credit card.

But it’s more than that. Blackstone’s business model is special.

It gets paid to invest most of the funds it manages. It’s not uncommon for the industry, but the sheer amount of funds Blackstone raises is.

Blackstone is paid fees on two-thirds of the assets it manages. That means clients pay for the privilege of Blackstone investing their money.

Management expects to generate $2 per share in fee income within the next few years. Fee income is special because it recurs year over year. And Blackstone likes to lock up investments for as many years as it can.

So long as Blackstone continues to perform, its clients will continue to entrust it with their funds. This will lead to more business lines … and more opportunities.

Blackstone’s assets under management increased by more than $100 billion over the past year … and by more than $200 billion since the end of March 2016.

Capital flows to where it’s treated the best.

How Blackstone Unlocked Value

Blackstone converted from a publicly traded partnership to a C corporation on July 1.

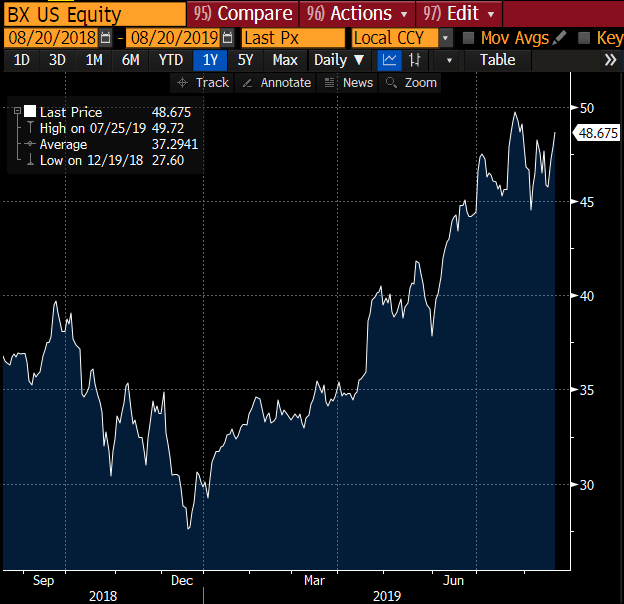

It’s now easier to buy Blackstone shares. And the market reflects that.

Shares started the year on an uptrend and continued to rise after the firm announced the conversion in mid-April.

Blackstone used to trade at a 30% discount to the earnings multiple of the S&P 500. Today, it has recouped that lost value.

It’s also seeing a larger group of investors buy its shares. And it has been — and will continue to be — added to various market indexes, mutual funds and exchange-traded funds.

The rich do get richer. Especially when interest rates approach zero.

Luckily, Blackstone likes to share its riches.

It pays about a 4% dividend at its current price. And it’s in the midst of a $1 billion share buyback program.

I like Blackstone. Its conversion has been a success, and it is trading at its highest price ever.

Do yourself a favor. Invest like the rich … but don’t pay too much.

If you’re patient and can buy shares at $46 or less, that would be a more attractive entry price. It has traded there several times this month.

2 Bonus Stocks

As a bonus, I recommend you watch for some of Blackstone’s peers to convert to C corporations in the near future.

Apollo Global Management LLC (NYSE: APO) will begin trading as a C corporation on September 5.

And The Carlyle Group LP (Nasdaq: CG) will convert on January 1.

Blackstone’s share price has jumped more than 10% in the month and a half since it converted. These two names could see a nice bump as well.

Invest like the rich.

Good investing,

Brian Christopher

Editor, Insider Profit Trader