For decades, investors have counted on a Santa Claus rally to boost their portfolios.

That refers to the last days of December and the first few days of January. Historically, this has been one of the best times of the year for stocks.

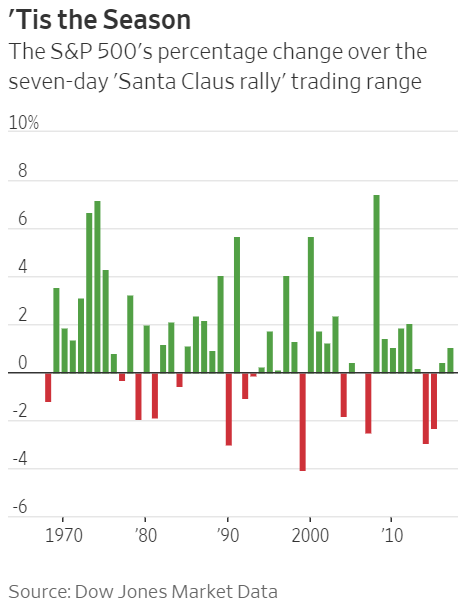

Since 1969, the S&P 500 Index has gone up an average of 1.3% over this magical seven-day span.

And as investors suffer through the worst December since the Great Depression, they need a Santa Claus rally now more than ever.

Without it, it could mean bad tidings for 2019…

The Best Month of the Year

December has historically been the best month for stocks.

(Source: Financial Times)

December has a lot going for it.

The holiday shopping season boosts retailers and the economy.

Workers get bonuses, which they can invest in the stock market.

Some investors also sell struggling stocks to deduct the losses on their tax returns. That frees up cash for buying stocks.

And many investors believe in the “January Effect,” when stock prices rise in the first month of the year. They buy stocks in December to get ahead of the trend.

So, if this December comes and goes without a Santa Claus rally, it means investors are seriously pessimistic. And that would be bad news for 2019.

The last six times it happened, the market either dropped or went nowhere in the following year.

(Source: The Wall Street Journal)

In 1999, the year ended with a 4% plunge before the market crashed in 2000. And in 2007, we saw a 2.5% drop ahead of 2008’s crash.

Is a Christmas Stock Rally Coming?

This is it. After 12 months of nerve-wracking ups and downs, the 2018 stock market has one last chance to give investors hope.

If it doesn’t rally … if we see another bad week for stocks, it would be a terrible sign for 2019.

The S&P 500 Index is down about 10% in December. Unless there’s a massive surge in the final week, it will be the first time since at least 1950 that December has been the worst month of the year for stocks.

That’s why the market desperately needs a Santa Claus rally.

Regards,

Jay Goldberg

Assistant Managing Editor, Banyan Hill Publishing