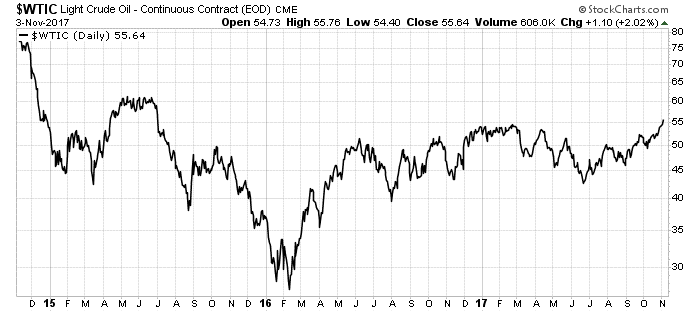

The West Texas Intermediate crude oil price, the U.S. benchmark, just hit its highest price in 2 1/2 years. We need to know what’s driving it to decide if we should put some oil producers in our portfolio.

It’s rising, in part, because of Saudi Arabia’s constant barrage of production-cut rhetoric. The kingdom was on a publicity blitz over the last couple of weeks. It told everyone who would listen that OPEC will maintain its production cuts.

The result was a rising oil price, as you can see in the chart below:

The rising price is more than just talk, however. Demand for U.S. distillate, or partially refined oil, is on the rise. The whole first part of the year, exports to Europe were increasing. Total exports set records in May, June and July.

While distillate went to Europe early in the year, this summer, U.S. exports to Mexico and Central and South America are much higher than last year.

Last month, the majority of these barrels went to Mexico (228,000 barrels per day), Brazil (183,000 barrels per day) and the Netherlands (102,000 barrels per day).

This demand means that fundamentals support the rising oil price. It’s time to buy oil companies.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist