“Save it.”

I was about 6 years old when I got my first dollar. It was my loot for losing my first tooth. Like magic, it was just waiting under my pillow in the morning. When I ran into my mom’s room, squealing about tooth fairies, the sad state of privacy for kindergarteners and my big plans for my money, she repeated one line:

“Save it for something you really want.”

I didn’t quite get the concept. I barely understood the purpose of money. All I knew was that this green rectangle had a little man on it, and when my mom gave the little man to the lady at the movie theater, I got gummy worms.

I really wanted more gummy worms.

But my mom told me to squirrel it away, so I did. Fighting “instant gratification” urges as a kid is an exercise in willpower. Sometimes I failed miserably.

But for the most part, I was able to build up those dollars, week by week, month by month. I fought the urge for immediate payoffs. And, finally, I earned enough money to buy myself my own Furby (a popular talking toy at the time).

I’ve continued to squirrel away extra cash as the years have gone by. But, of course, I’ve grown in my needs. Now, instead of kids’ toys, I’m keeping an eye toward my retirement.

However, putting a dollar away every week just won’t make the cut for something of that magnitude. I needed to find a better way, a steady stream of income that I can rely on no matter what.

It’s something you’re probably thinking about too.

But as you and I both know, steady income is not an easy thing to come by lately. The Federal Reserve slashed interest rates to bargain-basement levels. Too many retirees were left scrambling for ways to either supplement their income or sharply cut their expenses.

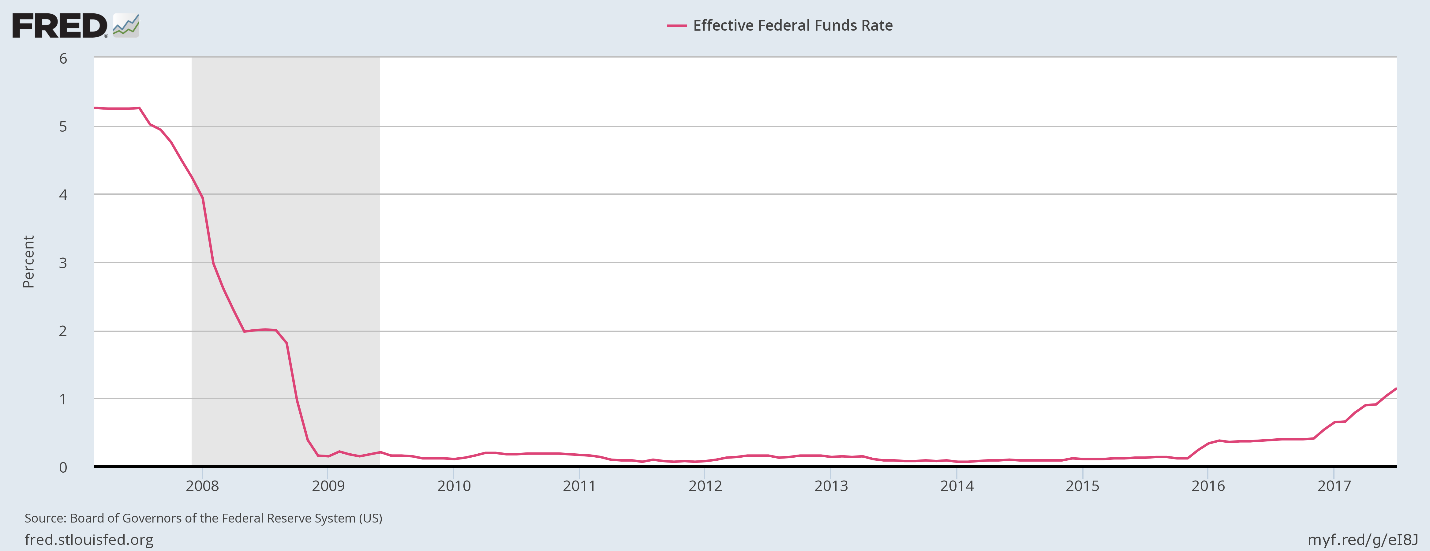

Yes, Janet Yellen and her team have embarked on a new schedule of lifting rates. And we are steadily inching higher. But slowly. So very slowly.

The Oh-So-Slow Rise of Interest Rates

In about two years, interest rates have increased from near zero to just over 1%. At the current rate, we are still years away from reaching 3% — which we haven’t touched since January 2008.

And it may take a frightening amount of time to get back to a more common income rate of around 6% — and that’s assuming we don’t take a few steps backward in the meantime with rate cuts due to economic problems.

So are there other income instruments to use?

Well, many people have relied upon dividends to provide a steady stream of income. But dividends aren’t quite as appealing as they once were.

The average annual dividend yield for the stocks of the S&P 500 from 1871 through 1960 never fell below 3%. And from 1970 through 1990, the average yield jumped to 4.03%.

Now? Well, from the early ‘90s through today, the average annual dividend yield has dropped below 2%. From 1991 through 2007 (the start of the Great Recession), the average yield was only 1.95%.

And today, the yield is 1.90%. This is barely better than the Fed funds interest rate.

Clearly, it’s not the kind of return you want to live on during retirement. And it’s certainly not going to help me build my retirement in the way I envisioned.

So I looked for another way.

And I found one…

An Income Strategy With a 93% Win Rate

It’s in a strategy our income expert Chad Shoop put together. And as crazy as this sounds, you could use it to collect up to $1,790 in 60 seconds or less … without buying a single share of stock.

Even better, over the past three years, Chad has used this strategy to show people how to collect income with a 93% success rate … giving them the chance to collect as much as $4,500 every month with it.

We call it using “Wall Street’s ATM.”

It’s something that stands out from the crowd of income-generating strategies because of its consistency and because of its speed. (It’s miles faster than relying on dividends for your income.) So I’ve been looking into adding it to my portfolio, and if you’re interested in building up your retirement, you might want to consider it too.

After all, you don’t often come across a strategy that not only lets you collect money in under a minute — but is also one of the safest trading strategies on Wall Street.

That’s the kind of quick-income strategy even my 6-year-old self would have been interested in.

So, to learn more about it, just click here.

Catch you next week.

Regards,

Jessica Cohn-Kleinberg

Managing Editor, Banyan Hill Publishing