The S&P 500 is up about 2.1% in the month of October — its best month since February of this year.

But it wasn’t an even rally in the market.

For example, the technology sector accounted for more than 75% of the gain. In fact, just five stocks (four tech stocks and one consumer discretionary stock) made up 52% of the entire S&P 500 rally.

Facebook was up 15.5%. Apple was up 8.2%. Google was up 6.1%. Microsoft was up 6%. And the lone consumer discretionary stock, Amazon, was up 12.5%.

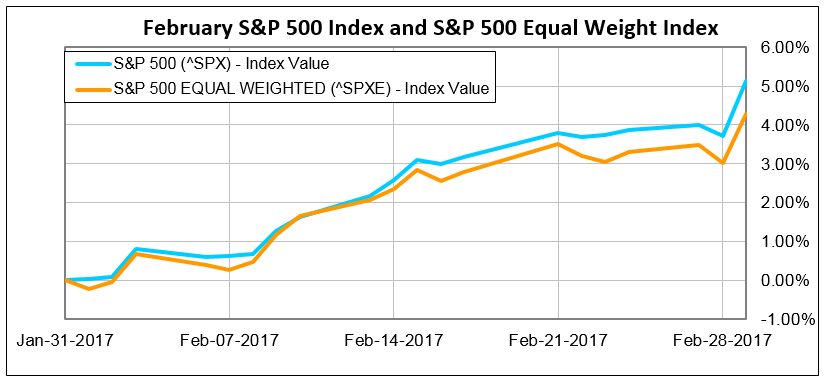

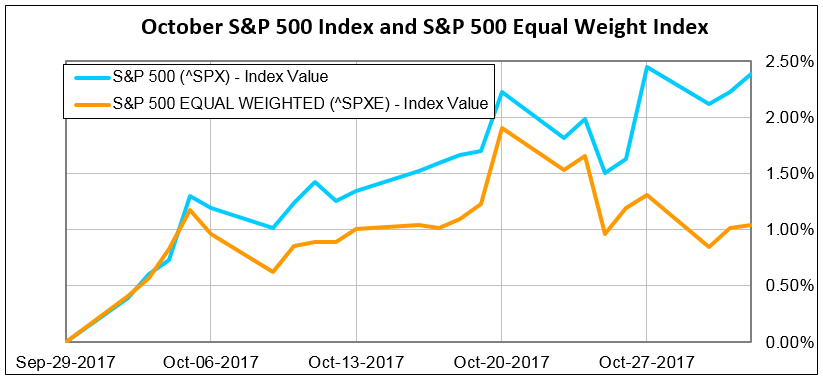

To put this in perspective with the rally in February, we can look at the S&P 500 on an equal-weighted basis. Since the S&P 500 is a market capitalization weighted index, the biggest stocks by market cap have a greater influence. With an equal-weighted index, all the stocks have the same impact.

Take a look:

In February, the difference was minimal, just a few percent off.

But in October, the gain was less than half the normal S&P 500.

That means the health of the rally is not as strong as it looks on the surface, since just 1% of the stocks made up 52% of the rally.

The rest of the market will have to carry the weight now. It’s time to see how 99% of the stocks in the S&P 500 perform through the end of the year — do they follow the Big Five in October or continue to basically trade flat?

I’ll keep you posted.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert