Stock prices reflect the combined trading decisions of hundreds of millions of investors acting independently.

The same is true of market commentary. There seem to be more stock market writers than atoms in the visible universe. A big part of my job is to wade through the best of them. That’s why I spend most of my workday reading.

Because I’m such an eclectic reader — moving back and forth between specific and general, stocks and markets, data and commentary — interesting patterns and connections sometimes emerge.

On the morning I wrote this, for example, my reading included three sources I follow regularly:

- The Heisenberg Report: A prolific blogger, an ex-Wall Street trader with an acute understanding of the dynamics of modern financial markets (and a profoundly cynical view of those markets, and the world).

- GMO Research Quarterly: A regular newsletter from the investment firm of renowned investor Jeremy Grantham.

- Verdad Weekly Research: A newsletter published by Verdad Capital, a rigorous, fact-based investment research firm.

Putting it all together, I realized my instincts about the investment recommendations I’ve made to readers of my Bauman Letter since the market turned in early spring are spot on.

Each of my Monday morning reads contributed a distinct element to that conclusion…

Heisenberg: “Over-Optimized Markets”

First, Heisenberg’s weekend blogs emphasized how financial markets have become “over-optimized” around the policy framework that’s evolved since the Great Financial Crisis (GFC).

Abundant liquidity and super low interest rates have shifted the calculus of risk and reward.

For example, investors have become conditioned to “buy the dip” on every stock regardless of quality. The assumption is that central banks will always and forever be accommodative to the needs of the stock market.

Powerful quantitative strategies in options markets have reinforced this tendency, suppressing volatility and maintaining an upward ratchet in stock prices.

But the Bank of England’s recent moves to break from the global easy-money consensus threaten to disrupt this. If that happens, markets will have to readjust to a new paradigm.

The process could take a while … and could be very painful for investors.

GMO: Negative Average Annual Returns for Years

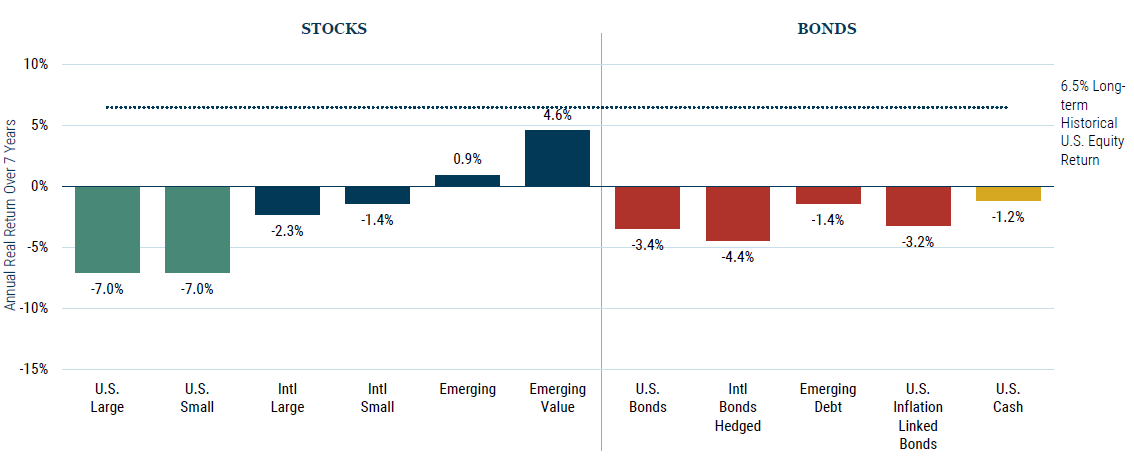

GMO research skips that background, and gets straight to the point, as illustrated by this chart:

(Click here to view larger image.)

GMO issues this every quarter based on a set of proprietary indicators. It currently shows that the average annual return to U.S. equities will be deeply negative over the next seven years.

Even if you don’t believe that figure — I don’t, and in any case, it changes quarterly depending on the markets — it reinforces something I’ve been saying for a while. Gains like the ones we’ve seen over the last few years, and even over the last decade, cannot continue indefinitely. We need a new strategy.

Verdad: Back to Basics

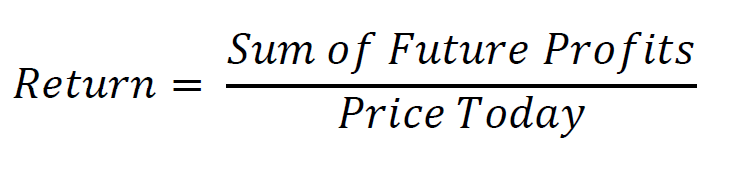

The third piece of the argument comes from Verdad. They remind us that before the GFC and central bank intervention, investors made money by following this equation:

Since the GFC, Heisenberg’s “over-optimized” markets have broken away from this. Investing has given way to pure speculation, supported by the assumption that the current paradigm will last forever. Earnings don’t matter, and prices only go up.

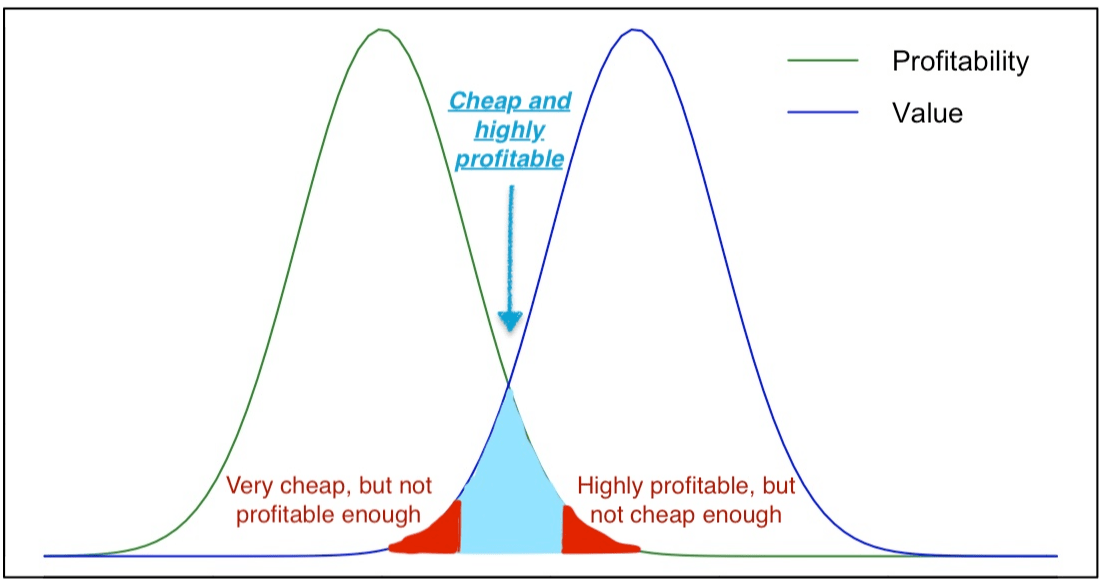

The results from Verdad’s recent research remind us that the best long-term returns come from companies that fall into the sweet spot of being both highly profitable and cheap:

(Click here to view larger image.)

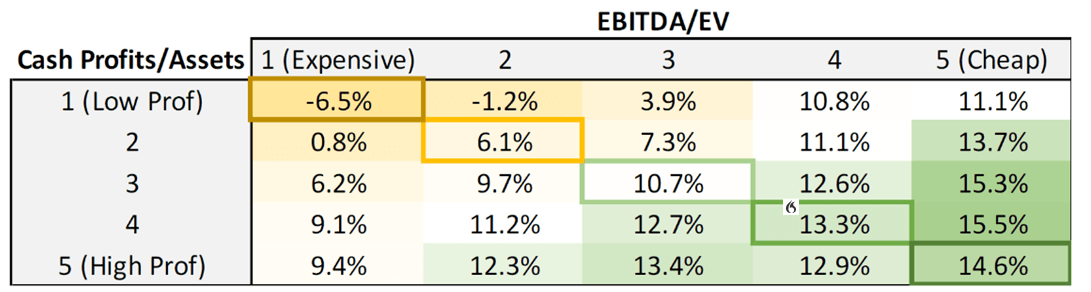

That’s true even during the last decade of super easy money. Using common metrics of raw profitability and valuation, they show conclusively that the best annualized gains from 2007 to 2021 came from companies that generate lots of cash flow compared to their assets, but are not excessively overvalued:

(Click here to view larger image.)

3 Principles for the Next Market Paradigm

Regular readers will know that I’ve been singing from this hymn sheet all summer. It boils down to three simple principles:

- Always remember that you’re buying a company, not just an abstract ticker. Eventually, that’s going to make all the difference. If the company can grow its revenues and profit margins faster than the market, then you’ll beat the market.

- The best companies to buy are those that generate a lot of cash. That’s because such companies are self-evidently in a good market and operating a good business model.

- Net profitability can be deceiving. Companies can produce substandard bottom lines for all sorts of reasons — including the decision to invest heavily in future capacity and therefore future revenue. Instead, pay attention to gross profits. A company whose gross profits are higher than its peers has more options, and is more likely to grow future revenues — and its share price — faster.

Recently I had a hard look at the performance of my recommendations to Bauman Letter readers over the last few years. With some exceptions due to the temporary impact of COVID, my picks demonstrate these principles decisively.

- Recommendations that combine rapid revenue growth with large free cash flow margins perform best. That’s true even if they’re currently unprofitable in net terms. It just means they’re investing in their own future … and in yours, since you’re an owner of the company’s stock.

- Recommendations that I made during a brief “rush of blood” in Q4 2020 and Q1 2021 have performed poorly. I made the fundamental mistake of confusing price momentum with potential quality. (Yes, I’m susceptible to the same manias as everyone else … but I’ve learned my lesson.)

- Overall, the companies best poised to survive the transition away from Heisenberg’s “over-optimized” QE-dependent markets … in which some version of GMO’s poor equity returns are likely … are those that fall into Verdad’s sweet spot of profitability and value.

Here’s the thing: You won’t find companies like that by spending all your time looking at price charts. You’ve got to do the hard work of diving into company fundamentals to ferret out those that are most likely.

That’s why we just doubled the size of the research team here at The Bauman Letter … so we can do exactly that for you.

Kind regards,

Ted Bauman

Editor, The Bauman Letter