When was the last time you looked at home prices? Or checked the value of your house on sites like Redfin or Zillow?

For the last year, I’ve said housing would go up. I got a lot of flak for that.

Still, even I was surprised when I checked what my house could sell for. I have no intention of doing so … I was simply curious.

Housing prices are seemingly out of control. But there’s still a massive opportunity for profit.

That’s why I recommended two housing plays to my Profit Switch subscribers a week ago. I also added three similar investments to our Bauman Letter model portfolio … one of which is already up around 6%.

So why is the hot real estate market only going to get hotter?

Let’s have a look at two of the bigger tailwinds…

Tailwind No. 1: Surging Demand

Demand far outweighs supply in real estate right now. A home in Sacramento recently sold for $100,000 over its listing price … after receiving 122 offers!

No matter the market, when demand is up and supply is down, smart investors can get very, very rich. It’s Economics 101.

From 2002 to 2008, for example, the global economy grew rapidly, especially in emerging markets such as Brazil, Russia, India and China. This created demand for industrial materials such as copper, steel and aluminum. But there wasn’t enough to go around.

Like clockwork, top mining companies jumped off the charts. Rio Tinto went up 505% … BHP went up 600% … and Vale S.A. went up 1,610%.

The same dynamic is at work in today’s real estate market. In the same way those mining companies handed investors triple-digit (and more) gains, housing-related stocks will do the same.

All this demand is coming from millennials.

At 72.1 million, they’re the largest generation in U.S. history. They’re storming into their homebuying or upgrading years.

According to the National Association of Realtors, 1 out of every 4 homebuyers in 2019 were a millennial household. That’s more than any other demographic. And that proportion almost surely increased in 2020.

Another recent report from Realtor.com said millennials now make up the largest share of loan applicants — nearly half!

Tailwind No. 2: Mortgage Rates Are Still LOW

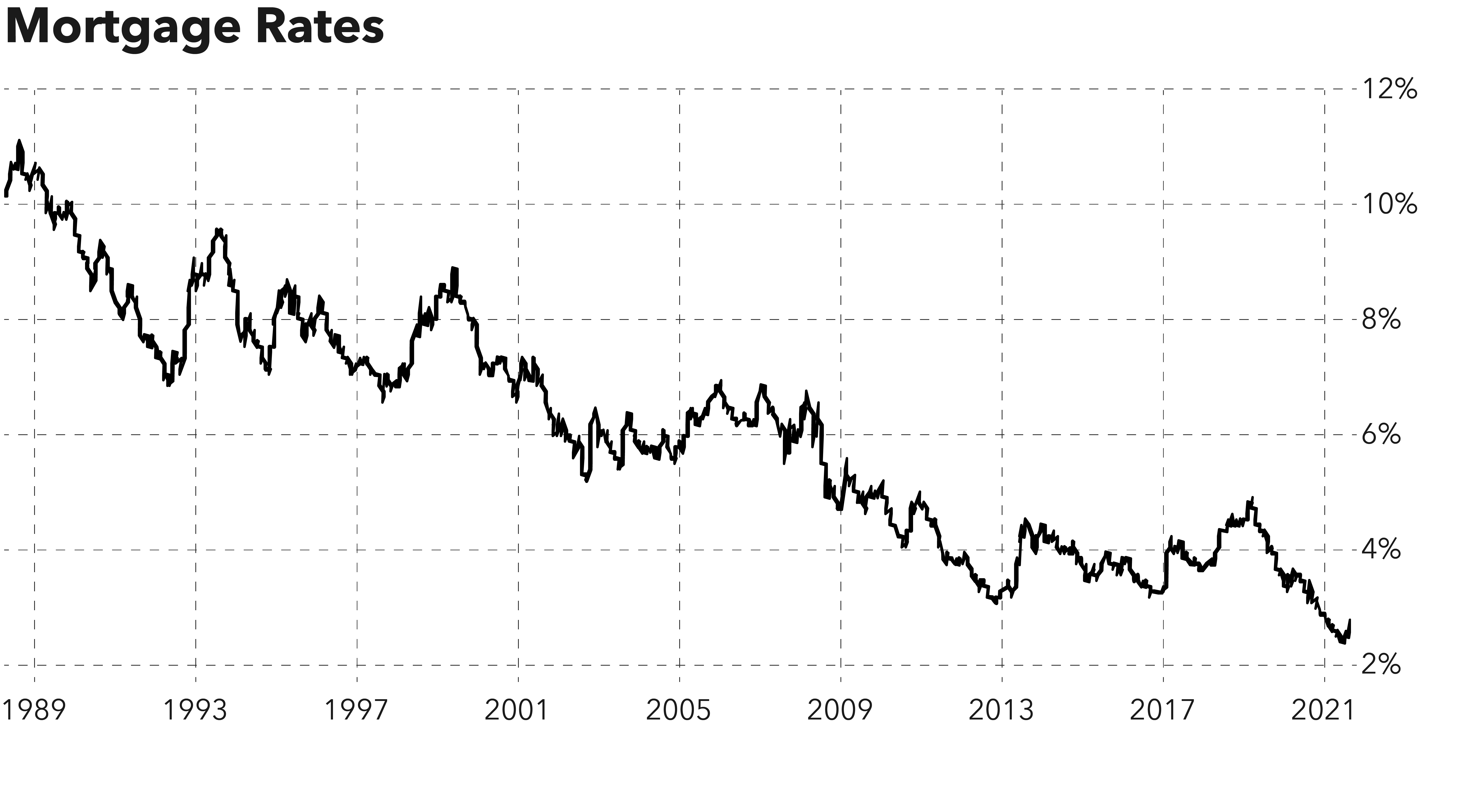

That brings me to the second major tailwind: The lowest mortgage rates in history have made buying a home easier.

On July 16, 2020, the rate on 30-year fixed mortgages fell below 3% for the first time ever.

Rates have since ticked up slightly as interest rates rise, but they remain historically low. That’s a reality that won’t change in a hurry.

Rates have since ticked up slightly as interest rates rise, but they remain historically low. That’s a reality that won’t change in a hurry.

That’s a HUGE incentive for buyers. Here’s a rough, “back of the envelope” calculation.

If you bought a home for the median U.S. price of $285,000, you would save $50,000 in payments over the life of your loan compared to mid-2019. On a half-million-dollar house, that’s nearly $100,000 in savings!

Demand for housing has always gone up during low-interest rate environments. Basic math, and buyers know it.

Bottom line: Housing is the investment of the decade. Hopefully you got in when I first recommended it in Bauman Daily a year ago!

But if you’re looking for a more specific way to play it, make sure you check out the special reports I put together for my Bauman Letter subscribers. If you’re not a member, consider joining.

Kind regards,

Editor, The Bauman Letter

P.S. There are many additional reasons the housing market will continue to boom, and the best ways to profit do NOT involve buying physical real estate. I reveal three of the best ways to profit here.