Editor’s Note: Welcome to our week-long special series! Our editors for both the Sovereign Investor Daily and Winning Investor Daily are looking ahead to 2018 and providing their insights into what they believe will be the big movers and shakers for the new year. They are also looking at critical steps you can take to preserve and grow your wealth. Happy reading! — Jocelynn Smith, Senior Managing Editor

Most people know the 1967 World War II film The Dirty Dozen … at least by name. It’s become shorthand for any set of 12 things that can be advantageous to do, even if they seem a bit disreputable.

The IRS, for example, publishes a Dirty Dozen list of tax scams every year. It includes both scams perpetrated against taxpayers, and those perpetrated by taxpayers against the IRS.

For my final Sovereign Investor Daily article of 2017, here’s my Dirty Dozen list of tax steps you can undertake before December 31 to wring the maximum amount away from Uncle Sam before the law changes in 2018.

Every one of them is a direct consequence of the Republican Party’s looming federal income tax changes. And every one of them is perfectly legal.

Good Federal Income Tax News … and Not So Good News

Let’s start with a review of the structure of the new federal income tax system — good and bad.

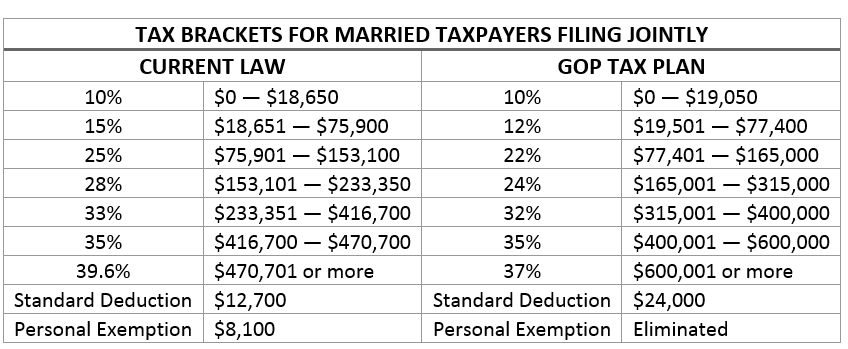

On the plus side, as of Friday last week, the GOP tax plan included lower marginal tax rates for all income brackets, at least until 2027.

All else being equal, that will reduce most people’s taxes at first:

In addition, owners of pass-through businesses such as limited liability companies (LLCs), partnerships and S corporations will now be able to deduct 20% of their profits from their personal income taxes, up from 17% at present.

For example, if your LLC earns $100,000 in profits, $20,000 of that will be tax-free. The remaining $80,000, plus whatever you draw in salary for yourself, will be taxed at the rates above.

The increase in the standard deduction will result in far fewer households itemizing their deductions. Currently about 30% of households do; under the GOP plan only 5% would do so, since the standard deduction would be higher. Many lower-income households will benefit from the higher standard deduction.

Make Hay While the Sun Shines

That’s the good stuff. But for many of us, the news isn’t all good.

Above all, the combination of the elimination of the personal exemption, a cap of $10,000 on deductions for state, local and property (SALT) taxes, and a limit on mortgage interest deductions will mean that many households — especially in high-tax states — will end up paying more tax.

Nevertheless, this creates simple tax moves that you can undertake between now and the end of the year. They are all based on the principle that if you maximize your itemized deductibles now, lowering your 2017 federal income tax bill, you’ll come out ahead … because you won’t be able to deduct them in 2018.

If you anticipate that your itemized deductions in 2018 will be less than $24,000, you won’t benefit from itemizing.

But if you prepay some of 2018’s deductible expenses now — adding them to your 2017 itemized deductions and reducing your federal income taxes this year — you’ll be able to benefit from them one last time. For example:

1. Give more to charity before December 31. (Note that if you’re thinking about donating stocks to charity, and you own different lots of the same company’s stock, donate the most valuable lots this year. Under current law, you can donate the shares that have appreciated the most to get the largest charitable deduction. Under the new law, you will have to sell the shares first in, first out.

2. Prepay your 2018 property taxes in full. (Under the final version of the tax bill, you are unfortunately not allowed to prepay 2018 state and local income taxes, but property taxes are fair game.)

3. Prepay next year’s mortgage interest.

4. Prepay any outstanding student loans.

5. Prepay medical expenses that you know you will incur next year, such as a scheduled procedure.

6. If you live in a state that charges sales tax on automobile purchases up front, buy a car before the end of 2017 so you can add that tax to your 2017 itemized deductions.

The same logic also works in reverse. For example:

7. Since you’ll face a $10,000 cap on SALT tax deductions next year, if you live in a high-tax state like New York or California, try to move some future earnings into 2017, boosting your SALT taxes — and thus your itemized deduction — for 2017.

8. Similarly, if you expect to get an annual bonus early next year, ask for it to be prepaid in December.

9. If you’re a consultant or on retainer, see if you can get clients to prepay some of next year’s invoices now to boost your 2017 earnings.

There are also some more arcane strategies you can adopt:

10. If you’re planning to undertake a 1031 swap in 2018 for something other than real estate — say, business equipment or artwork — do it now. From 2018, 1031 swaps will be limited to real estate only.

11. If you’re thinking of converting a traditional IRA into a Roth IRA, run the numbers to see if you will be better off doing it before the end of 2017 to increase your taxable income, which you can offset with some of the itemized deduction strategies above. (Bear in mind that you can do a Roth conversion even if your income exceeds the cap for Roth contributions.)

12. For the pièce de résistance, consider converting yourself into a limited liability company. Depending on your income level, you could double your tax savings by quitting your job today and returning tomorrow as a paid consultant.

Remember, these are all perfectly legal.

But I’d go ahead and look for an experienced tax attorney anyway … after all, with the train wreck that’s headed our way because of this hasty change to the federal income tax law, we’re all gonna need all the help we can get in 2018.

Kind regards,

Ted Bauman

Editor, The Bauman Letter

P.S. If part of your plan for 2018 is to make a move overseas or even if you’re just exploring your options, check out Bob Bauman’s The Passport Book. This massive book offers great insights into more than 80 countries. Click here to claim your copy.