A lot of investors rely on “gut feel” to make decisions.

We’ve all made at least one investment like this. Maybe you bought Apple stock when you saw the iPhone starting to take over the U.S. mobile market. Or you bought Berkshire Hathaway simply for the fact that Warren Buffett is the man in charge.

Don’t get me wrong, instincts like these can sometimes work out well for you. But for every success story an investor can attribute to their intuition, there may be dozens of mistakes they can blame on the same source.

That’s why I don’t use a whole lot of “gut feeling” in my investing approach.

Instead, I use my proprietary six-factor model: the Green Zone Power Ratings system.

This system considers 75 individual metrics across six proven investment factors to give a clear indication about a stock’s potential to beat the market.

Three of those factors are price-based, telling us whether a company’s stock is, in layman’s terms, “behaving nicely.” The other three factors are based on the company’s fundamentals and operational results. They tell us if we’re buying a good business. The best investments are the ones where both of those line up positively.

Overall, we get a complete picture of the health of the company and the behavior of its stock. And we do this all with quantitative analysis, allowing us to rate thousands of individual stocks, with updates on a daily basis. This would require a small army of analysts if we didn’t have such a powerful system at our fingertips.

As a result, my team and I are able to “slice and dice” the market every which way to find the best stocks to suit every need.

Let me show you…

1 Highly Rated Slice of the Market

Paid-up subscribers of my Green Zone Fortunes advisory routinely receive a curated Weekly Hotlist, where we “slice and dice” the market using my Green Zone Power Ratings system.

We highlight the week’s 10 highest-rated stocks across the entire stock universe in my Weekly Hotlist. Stocks rated at this superior, “Strong Bullish” level have historically gone on to outperform the market 3-to-1.

Our Green Zone Fortunes community finds this Weekly Hotlist immensely valuable. And it generates a lot of interaction among Green Zone subscribers who do their own research and stock-picking … And we’re working on a broader selection of top 10’s based on various sectors, themes or anything else we can think of!

Just last week, one subscriber named Gordon shared a great idea of how we could structure a list based on dividend stocks.

Gordon suggested:

It would be awesome if you would include a “Dividend Stocks” top 10…

May want to ensure that there is a minimum SP Rating of, say, 85 in the list of top 10, to truncate the list, just in case there are very few dividend stocks at any given moment that score high enough. May also want to filter the list based on a minimum current dividend yield of, say, 4%.

Thank you for your email, Gordon! We think this is an excellent idea, especially since the recent increase in bond yields has made some of the slimmer-dividend paying stocks look less attractive. What investors are really looking for is a high-quality company that pays a Treasury-beating yield.

Normally, I’d reserve this type of analysis for my Green Zone Fortunes subscribers. But I’m making an exception today, because I know how much Banyan Edge readers appreciate dividend-paying stocks!

If you’re one of those folks and you want more of this type of research, learn more about a Green Zone Fortunes membership here.

Anyway, here’s what we found when we dug in to fulfill Gordon’s request, for the top 10 rated stocks paying at least a 4% dividend:

Green Zone Power Ratings Dividend Hotlist

I hope this helps get you started on your quest to identifying rock-solid companies that pay bond-beating yields.

I understand why so many people are looking for these types of stocks right now. With inflation at elevated levels, folks need higher levels of investment income just to keep pace. And we don’t want you to have to go too far out on the risk curve to get paid a respectable yield!

And that’s where my Green Zone Power Ratings system comes in…

A Dividend Is Step Two

As I trust you know, dividend yield is only one way you can get “paid” as an investor. Capital appreciation is just as important. And not all dividend-paying stocks are solid capital-appreciators.

Some folks perceive a dividend to be an indication of a safe investment. If the company offers a routine yield to shareholders, it must make enough money to deliver that payout at a consistent rate, right?

Well, that’s the case for a well-run company, like you’ll find in the list above.

But not all dividend stocks are created equal. Some stocks issue high dividends for the express purpose of “marketing” the stock and getting income-hungry investor eyeballs onto it.

But if you buy a stock with a high dividend and it falls, capital losses can easily erase whatever benefit the dividend brought in the first place.

That’s why it’s so critical to buy well-rounded stocks — ones that are identified by an objective, data-driven tool like my Green Zone Power Ratings system, as being a favorable blend of quality business and market-beating stock.

In short, stock selection should be your first consideration, then the stock’s dividend yield should come after that. It’s the cherry on top of an already excellent investment, not the initial draw.

The list above, with its near-perfect positive ratings across the board, is an indication that you’re likely to enjoy a strong dividend payout AND capital gains — a winning combination.

And again, if you’re looking for more of this type of research — either my data-driven Weekly Hotlist or in-depth model portfolio stock recommendations — you can find all of it in Green Zone Fortunes.

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets

Debt Downgrade: What Took Them So Long!

Well, it finally happened.

Credit ratings agency Fitch downgraded the United States to AA+ from AAA. The United States is no longer a risk-free borrower.

Of course, we’ve been here before. The S&P downgraded the United States back in 2011, focusing on the near default, due to the all too familiar debt ceiling standoffs.

I only have one question: What took Fitch so long?

How many years of trillion-dollar deficits do you need to see to accept the obvious … that Uncle Sam is about as far from a risk-free credit as you can get? But let’s take a deeper dive.

The U.S.’s $32 Trillion Debt

Our country has managed to spend itself $32 trillion in debt. Yes, trillion, with a “t.”

We added $1.4 trillion dollars to that total this past year, and will be adding over a trillion dollars per year to it, every year for the foreseeable future … with no obvious end in sight.

The U.S. government brings in $4.9 trillion a year in revenues. You would think we could run a government on that. Every other country somehow manages to get by on far less. Yet we manage to spend $6.3 trillion a year, forcing us to borrow $1.4 trillion to cover the difference.

And perhaps the worst aspect of all: $970 billion of the total is interest due on the debt accumulated in prior years. That’s 15% of the total budget, which is used to pay the debts for money long since wasted on “investments” with zero return.

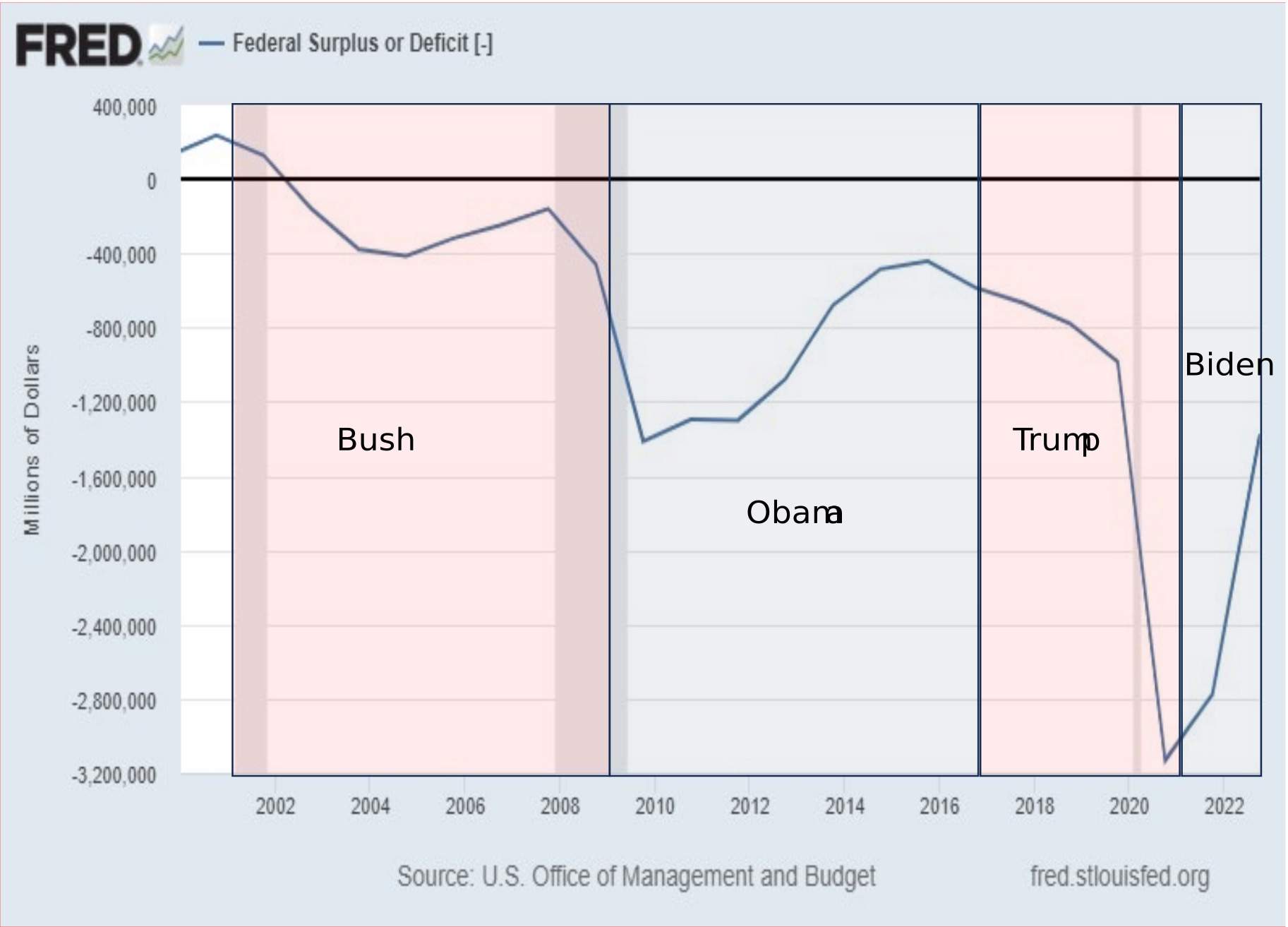

President Biden carries his share of the blame for this, of course, but he’s not alone. Debt exploded under Trump’s presidency, and we can’t blame it on the pandemic. The deficit was already snowballing years before anyone had ever heard of COVID-19.

“Draining the swamp” clearly had no effect on deficit spending.

George W. Bush was also particularly egregious in blowing out the deficit under his presidency, with Vice President Dick Cheney famously declaring that “deficits don’t matter.”

If anything good came out of the constant infighting between President Obama and the congressional Republicans, it would be that the budget deficit shrunk. And to an almost reasonable amount during his presidency from 2009 to 2017 — or at least, by the standards of the past 20 years,

But I’d hardly call $400 billion deficits a model of responsibility.

When I look at the history of deficit spending, I alternate between blind rage and deep depression. I’m angry that it’s come to this, and depressed that there is no obvious way out. Neither political party is serious about deficit reduction, and neither one has a plan to stop this madness.

But what can we actually do about it?

Eventually this mess will become unsustainable, and the government will be forced to balance its books. When does that happen? Your guess is as good as mine. But in the meantime, it makes sense to protect yourself the best you can.

Consider adding hedges like gold or bitcoin to your portfolio. And be prepared to take a more active approach in your trading.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge