Book reports … ahem, I mean quarterly earnings season is fast approaching. And buried within the press releases and conference calls, there are key nuggets of information.

For example…

While financial results handily beat analysts’ estimates for the most recent quarter … they could have been better.

Much better.

That’s because many companies suffered delayed shipments. As a result, they had less to sell to customers or lacked key components to manufacture their goods.

Nike (NYSE: NKE) and Peloton Interactive (Nasdaq: PTON) are just two of the businesses to see revenues impacted due to delays.

Supply chains are seeing massive disruptions, but it’s unexpected consumer demand that is driving the issue. (We, however, expected this demand, which is why we added the perfect company to our Bauman Letter model portfolio to profit from it. It’s still a buy so click here to subscribe and learn more. )

The World Trade Organization originally thought that global trade would plummet by a third following the pandemic. Businesses planned accordingly.

Instead, it only dropped by 5.3% for the year.

That’s because consumers shifted their purchases away from services and toward goods. Plus, e-commerce sites made buying stuff more convenient than ever before.

As a result, freight volumes shot to the moon. Now key ports such as Los Angeles and Long Beach are drowning under relentless, record-breaking waves of cargo.

This lack of freight capacity is hurting financial results for some companies. For others, it’s a boom that’s delivering record profits.

Who?

A Windfall for Logistics Companies

Logistics companies that move goods to their destinations are enjoying more demand than they can handle.

Collectively the group is referred to as transports, and includes trucking firms, railroads, ocean freighters and airlines.

As evidenced by industry behemoths FedEx (NYSE: FDX) and United Parcel Service (NYSE: UPS), business has never been better.

Just last month, UPS reported record fourth-quarter revenue as package volumes jumped over 10%.

FedEx saw record shipments in its most recent quarter, while analysts expect the company to post its highest revenues ever this fiscal year, ending May 31, 2021.

For investors, a key question is whether e-commerce demand for freight carriers will subside once the economy starts to normalize.

That’s not a worry for transportation companies though. The boost they’re enjoying is just getting started.

More Catalysts on the Way

There are two other factors set to boost freight volumes:

- Global trade. The recent $1.9 trillion stimulus package is so big that the Organization for Economic Cooperation and Development is lifting growth forecasts outside the U.S. as well. Spending is expected to boost global growth through increased U.S. demand for imports, meaning more shipments.

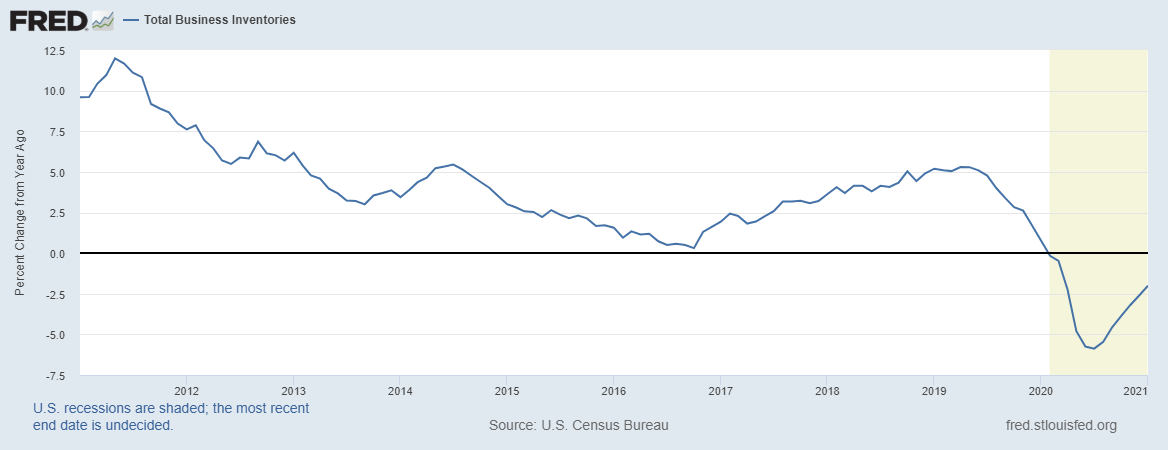

- Inventory restocking. As I said above, during the pandemic, many companies decided to draw on inventories and not restock due to the uncertain demand outlook. In fact, business inventories plunged by the most since the 2008 financial crisis, as you can see in the chart below. But with the quick consumer rebound and reopening just around the corner, companies are now scrambling to restock their shelves. That translates to more freight demand as goods are moved.

That’s how the global economic revival will keep demand for freight services elevated, and you can leverage those catalysts with the iShares Transportation Average ETF (NYSE: IYT). It holds the types of companies that will profit from demand to move goods by land, sea and air.

Another unique play on freight is the one we added to our Bauman Letter model portfolio recently (as I mentioned earlier). You can find out how to subscribe here.

Best regards,

Best regards,

Research Analyst, The Bauman Letter