The price of corn is heading higher thanks to record heat, lower production estimates and record ethanol production.

In 2016, U.S. farmers planted 94 million acres of corn. They harvested 15.1 billion bushels for a crop value of $51.5 billion. That was a record harvest, beating out the previous record, in 2014, by over 1.1 billion bushels.

It helped that the yield hit a record as well. In 2017, farmers have harvested 174.6 bushels per acre. That’s nearly 10 times the corn we got per acre in 1936.

It’s important to note that while most other crops are used in food and beverages, corn also becomes a fuel. Roughly 29% of the corn crop gets turned into ethanol to mix with gasoline. That demand is fixed: We need ethanol no matter what. In 2016, ethanol consumption hit a record 5.4 billion bushels … the most ever.

With the record-high heat plaguing the Midwest right now, the corn crop could be in trouble. In addition, farmers cut cornfields by 3.5 million acres. At the same time, the oil industry will need more ethanol than ever this year.

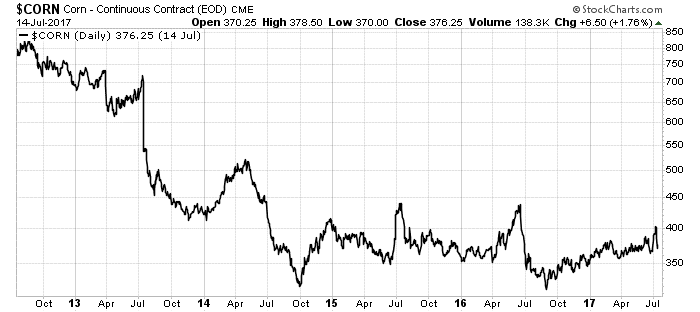

This could be a good time to go long corn.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist