Artificial Intelligence (AI) has taken the world by storm since the parabolic interest in ChatGPT that began this year.

OpenAI is the company behind ChatGPT. It’s a private company, so you can’t invest in it.

But I’ve found a “backdoor” … through an overlooked and already highly profitable company.

I recommended the stock to my 10X Profits subscribers in the first quarter. You can buy it today with a single click … and I’ll give you the ticker symbol and all the details today.

First, though, this may surprise you that I’m writing about a very exciting way to invest in the AI trend … seeing as last week I espoused the opportunity in investing in “boring” businesses, like Sterling Infrastructure (STRL), the construction company that builds warehouses and data centers for e-commerce and cloud-computing giants like Amazon and Microsoft.

To clarify, you don’t have to limit yourself to “boring” businesses to make market-beating returns in the stock market. You can invest in exciting, innovative businesses as well.

The key is to find little-known or overlooked opportunities. And unique, sometimes “backdoor” ways into a massive, high-growth mega trend.

That’s what I found my subscribers in Sterling Infrastructure, which we’ve ridden to gains of 350%-plus since late 2020.

It’s also what I’ve found in Opera Limited (OPRA), which has already handed my 10X Stocks subscribers a gain of more than 100% in just a handful of months.

This is the AI stock you never knew you should buy…

The Web3 stock you probably never heard of…

And the rare opportunity to 10X your money in an established tech company, all in one.

A Web Pioneer Breaks Out

Chances are high you’ve never used — maybe never even heard of — the Opera web browser.

It currently sits at just above 1% market share of the U.S. web browser market, well behind Chrome, Safari and Internet Explorer … despite first launching all the way back in 1995.

The core web browser is where Opera gets its namesake. It monetizes the browser through advertising, revenue share agreements with popular search engines like Google, as well as the use of extra, premium features accessible through a subscription.

But you’d be mistaken if you think that’s the only place it makes it money. And clearly, so are even the most sophisticated investors on Wall Street.

In recent years, Opera has dived headfirst into making two dominant tech trends — blockchain and AI — simple and accessible for its users.

Back in January 2022, the company released its blockchain-focused Opera Crypto Browser. This offers users a ton of different tools for interacting with the blockchain ecosystem — non-fungible tokens, tokens, wallets and decentralized apps.

Crypto isn’t making headlines today the way it was in 2021, but Opera clearly sees a resurgence on the horizon and is smartly laying the groundwork for future users.

The company also just waded into the AI frenzy with the integration of Aria, its browser-based AI. Aria uses current information to help users research and collaborate on a practically endless range of topics.

This is where that “backdoor” I mentioned comes in…

Opera’s AI integration is a direct result of its partnership with OpenAI, which it announced in February, just as ChatGPT was starting to take off.

So, by buying OPRA stock, you’re effectively placing a stake in an industry-leading AI company… OpenAI itself. As it said in the announcement:

Through access to OpenAI’s API and its first official generative-AI collaboration announcement, Opera gains access to OpenAI’s state-of-the-art AI models, as well as personalized support from OpenAI’s research team. This will allow the Oslo-based browser company to reshape the upcoming versions of its PC and mobile browsers towards the needs of the future versions of the Web. Opera browser users will be able to benefit from everything AI-backed browsing has to offer.

These changes put Opera on the cutting edge of the web browser market, attracting both advanced and everyday users to monetize in the future. Indeed, since 2019, the company has grown its users in Western markets (its highest-value cohort) by 68% and the revenue it gets from all of its users by 3X.

And because of its relatively small size for a profitable tech company operating in these spaces, it has a much greater chance of multiplying your money than anything you’d see at the top of the Nasdaq 100.

I put it to my 10X Stocks community like this:

Despite its now-dominant position in the web browser and digital advertising spaces, Google will never grow 10X again. It’s just too big now.

It’s far more realistic to expect a, say, $780 million small-cap company to grow 10X into a $7.8 billion mid-cap company … than it is to expect Google to grow 10X into a $12 trillion company.

That’s the real standout metric when it comes to Opera. It’s operating on a level of tech that rivals companies like Google, Meta, Apple and Amazon … but it’s doing so with a market cap that’s a slim fraction (0.01%) of their size.

But these reasons alone aren’t why you should buy consider buying OPRA today.

A combination of winning fundamentals and a recent pullback in its stock price are giving investors an attractive entry point today…

Excellent Rating at a Fire-Sale Price

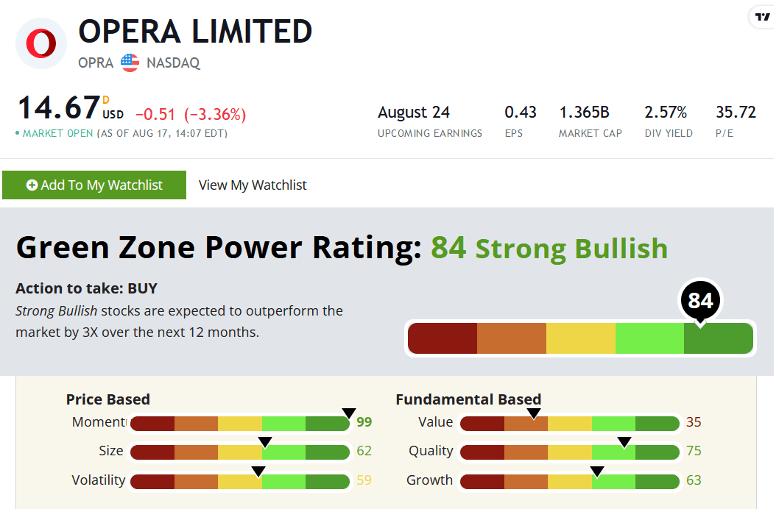

At writing, OPRA stock rates a “Strong Bullish” 84 on my Green Zone Power Ratings system, where stocks rated 80 or above are historically positioned to beat the market by 3X over the next 12 months:

This rating is what tipped me off to OPRA to begin with, and got me to recommend the stock to my 10X Stocks subscribers for about $8 per share earlier this year.

Then, the stock went on a wild run higher.

By the start of July, OPRA shot up all the way to $28 per share amid the frothiest part of the AI stock frenzy.

Since then, though, it’s retreated significantly — trading hands at $14.64 per share as I write.

Why, outside of a broad-based slowdown in the tech sector over the past month?

One piece of news broke that, on its face, gave OPRA shareholders and would-be buyers some pause … but reveals a huge opportunity with a deeper look.

In mid-July, at the peak of OPRA’s share price climb, the company filed a “mixed shelf securities offering.”

This is when a company files with the SEC to issue and sell new common and preferred shares, as well as bonds, over a length of time.

Often, offerings like these raise concerns of share dilution, which are valid. Essentially, when a company’s earnings, free cash flows or dividend payments are spread across a larger number of shares outstanding, each individual share “receives” a bit less, and therefore may be perceived as a bit less valuable.

But this offering also represents something else: A new pool of capital that Opera can tap into to fund future growth.

In other words, this downturn is a reaction to a management team that’s committed to OPRA’s growth trajectory … and an opportunity to buy shares.

Opera is a profitable company with a ton of experience in the market. It’s grown its adjusted EBITDA margins from 15% in 2020 to 21% today, with revenue doubling over that same time.

It’s growing its market share into a high-tech future it’s aggressively laid the groundwork for … while its mega-cap competition is asleep at the wheel.

And it’s just one of dozens of opportunities to 10X your money that I bring my subscribers every single month.

I’d urge you to consider taking advantage of the recent pullback in OPRA’s shares and start building a position soon.

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets

P.S. If you liked what you read today, you owe it to yourself to learn more about a 10X Stocks subscription.

My strategy is all about finding unique, “backdoor” ways to play world-changing mega trends. AI is just one of them.

Earlier this year, I clued my readers into what may be a decade-plus bull market in energy stocks — specifically fossil fuels.

This was shocking for some, especially as the U.S. government just plugged $369 billion into renewable energy.

But I share all the proof of why fossil fuels are positioned to dominate — and the best stocks to buy — right here.

…And the Other Half I Wasted

“I spent half my money on gambling, alcohol and wild women. The other half I wasted.” — WC Fields

An August report by the Federal Reserve Bank of San Francisco made me think of this timeless quote by the comedian, actor and overall bon vivant, WC Fields.

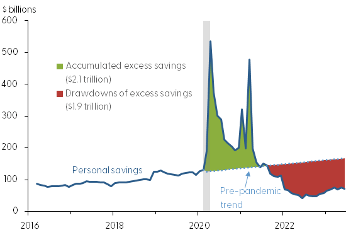

The San Francisco Fed crunched the numbers on “excess savings” during the COVID-19 pandemic … and how we’ve mostly burned through it at this point.

I don’t believe the average American blew half their savings like Fields did. But hey, sounds like a good time. We can probably substitute Amazon boxes, Peloton bikes and expensive vacations for most of us.

But the other half we wasted!

At any rate, the Fed found that we collectively accumulated $2.1 trillion in “excess” savings above and beyond the normal amount. And through June of this year, we had already burned through about $1.9 trillion of it. The Fed expects the windfall to be officially spent before the end of this quarter.

Now, as I have been writing for months, inflation has been a big driver of this trend. Expenses have risen faster than income, and something had to give. That “something” was the savings rate.

This is my main concern. The nest egg is now spent. And now U.S. credit card borrowing is already back to new all-time highs at $1 trillion.

Where is the money going to come from to keep spending at current levels, if we’ve burned through our savings and have already borrowed aggressively?

There is no good answer here.

Another point to remember is that student loan payments start again within weeks … sucking several hundred dollars out of the budget of the average borrower.

I don’t know when this comes to a head. But if the Fed’s data is any indication, it’s likely soon.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge