Wall Street Gone Wild

We call them “Problem child!” With gains they are beguiled. Fundamentals are reviled.

They are Wall Street gone wild! (Man, I miss ‘80s rock.)

Today, Great Ones, we’re drilling down once again, hammering on the theme that Wall Street is more than a little out of control.

If you missed my market manifesto on the topic this weekend, go read it now! It’s not all doom and gloom … in fact, I detail how this coming market correction could be the biggest moneymaking opportunity of your life!

All right, Mr. Great Stuff, what’s got you all riled up this time?

I’ll tell you what’s got me all riled up this time: Digital World Acquisition (Nasdaq: DWAC).

In case you missed last week’s hullabaloo, Digital World Acquisition is the SPAC taking Trump Media & Technology Group (TMTG) public.

What’s more, TMTG is in the process of launching Donald Trump’s new social media company TRUTH Social.

If you’re so inclined, TRUTH Social is currently available for preorder on the Apple App store, and you can get on the waiting list for an invite by visiting TruthSocial.com.

The site is set for a beta launch for invited guests next month, with a full nationwide rollout in the first quarter of 2022.

Why TRUTH Social? I’ll let the Don himself take this one:

Well … that was, umm … something. I can’t say I don’t disagree with the whole “Big Tech bad!” part … but that isn’t even the problem here.

The problem is that TRUTH Social values itself at $1.7 billion … but there are no revenue projections anywhere to be found. Not in the above press release. Not in the official SEC filings … not even in the “Company Overview” on TruthSocial.com. Not a single dollar sign or mention of future projections at all. Nada.

Back in the early days of SPACs, even pre-revenue companies provided future revenue guidance. Many promised the moon, others were more realistic … but all SPACs had some kind of forward-looking statement. Hopes for revenue. Promises of massive sales and money, money, money!

TRUTH Social has none of these. It reminds me specifically of the end of the dot-com bubble, where businesses would file for IPO with nothing more than a “.com” behind their name — and raise massive amounts of cash.

We have the exact same thing going on here with Digital World Acquisition and TRUTH Social. “Big Tech Bad!” isn’t a business model, no matter how much any of us want it to be.

But, Mr. Great Stuff, Trump is massively popular with millions of Americans! This seems like a no-brainer!

I get that. Even before his time as president, Trump’s name carried a certain amount of clout and moneymaking ability. After being president … doubly so. If it were just that, I’d almost be willing to overlook that $1.7 billion valuation for TRUTH Social. Cult of personality goes a long way these days … I’m looking at you, Elon Musk.

But, as of the open this morning, DWAC stock was trading at roughly $101, giving the SPAC a market cap of more than $3.4 billion.

Clearly, a pre-revenue company with no business plan and no revenue guidance at all is not worth $3.4 billion. So, what gives? Are people just that excited about Trump?

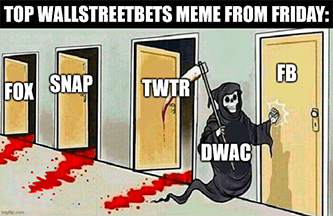

Yes and no. The initial surge in DWAC stock from $10 to about $40 was the Trump bump. Everything after that was … you guessed it … Reddit’s WallStreetBets.

On Friday, DWAC was mentioned more than 420 times on the WallStreetBets subreddit. In fact, DWAC was the most popular stock on WallStreetBets after the SPAC announcement. More popular than Tesla. More popular than AMC Entertainment. Even more popular than the meme stock king, GameStop.

The TRUTH Social and Digital World Acquisition SPAC merger embodies everything wrong with Wall Street right now. As I said this weekend:

Now, the big fish on Wall Street — the so-called market insiders — will be just fine when all of this comes to a head. But, Great Ones, there’s something that you oughta know. I’ll tell ya, Park Avenue leads to Skid Row. We’re going to get eaten alive when the correction finally comes.

That is, unless we take action to protect ourselves now! And tomorrow night — Tuesday, October 26 — I’ll show you how. But only if you sign up for The Final Run Up event! And best of all, it’s FREE!

What are you waiting for? Click here now to register FOR FREE for The Final Run Up event!

The Good: Tesla’s So Good, It Hertz

If you thought Tesla (Nasdaq: TSLA) was done after last week’s stellar earnings report … think again.

The financial media is literally flooded with Tesla news this morning:

We have Tesla raising prices across the board, with some models getting a $5,000 bump.

We have the Model 3 becoming the first electric vehicle (EV) to top European monthly sales.

And, finally, we have a 100,000 vehicle order — valued at $4.4 billion — from rental car company Hertz.

That last one is quite a doozy, not only for Tesla but also for the EV market. It shows just how serious the EV market is right now, in case you still needed some convincing.

According to Wedbush Analyst Dan Ives: “While Hertz is in the early stages of electrifying its rental car fleet, Tesla getting an order of this magnitude highlights the broader EV adoption underway … as part of this oncoming green tidal wave now hitting the U.S.”

What’s more, Hertz is pulling out the big guns to promote its new fleet, enlisting seven-time Super Bowl winner Tom Brady as its new hype man in ads featuring Teslas. I wonder if the tires are all properly inflated?

Anywho, the end result is a continuation of last week’s earnings-induced rally. TSLA stock gained more than 9% on the open before moderating those gains into the close.

Tesla is now only about seven DWACs away from being the next $1 trillion U.S. company. Think about that for a minute: Tesla, once derided as a failure and “sure to crash” by short-selling hedge funds across the market, is closing in on a $1 trillion valuation.

I don’t know whether to cheer or run for a bunker.

The Bad: Faux Meat, Real Shame

Take it from Beyond Meat (Nasdaq: BYND) plant-based meat means plant-based problems … and a ton of ‘em.

Just last month, Piper Sandler Analyst Michael Lavery said he believed Beyond Meat’s “current all-channel retail momentum lags consensus expectations, and our foodservice estimates may be high, too.”

Wouldn’t you know, as it turns out, those foodservice estimates were too high … like, Tommy Chong levels of “too high.” On Friday, Beyond Meat confirmed analysts’ worst fears, dropping its current-quarter revenue projections from a range of $120 million and $140 million down to just $106 million.

The reason? Take your pick: Beyond Meat lost retail orders in Canada. Some orders that Beyond expected just … never arrived. And finally, Beyond blamed its inability to expand in the restaurant biz on customers’ labor shortages that are “believed to be driven by the effects of the COVID-19 delta variant.”

Ah, yes, blame the food service industry … typical.

Before we slip further down the “labor shortage that isn’t a labor shortage” rabbit hole … the broad-scale restaurant adoption that Beyond Meat has always bragged up as its biggest market is now its make-or-break point. I mean, nobody’s buying this stuff on the retail side when regular meat is already expensive enough, and it’s starting to show in Beyond Meat’s sales.

Perhaps the worst part of Beyond Meat’s news is that, despite analysts having their doubts on the stock confirmed time and time again … Wall Street still loves to bat for Beyond Meat stock. Boris Schlossberg over at BK Asset Management says:

Why didn’t anyone think of that before? If Beyond Meat could just change everything about what it’s doing … it’ll be massive! This is Beyond Meat’s bull case? And you want to be my meatless Mac salesman…

The Ugly: PayPal Doesn’t Need Any Pals

In the PINS, in the PINS, where the sun will never shine, Pinterest (NYSE: PINS) investors are left shivering the whole night through.

Just last week, Bloomberg spun up the rumor mill and said PayPal (Nasdaq: PYPL) had approached Pinterest with talks of a buyout for $70 per share, according to “people with knowledge of the matter.”

PINS shot upward of 10% on the news because, frankly, when was the last time y’all heard good news about Pinterest?

As luck would have it, those people Bloomberg talked to didn’t quite have the right knowledge of the matter. The deal simply … does not exist. There is no spoon — er, deal.

Today, PayPal squashed all the rumors that it was pursuing Pinterest in what would’ve been the biggest-ever deal for a social media company at $45 billion. But PayPal has no time to ponder the “would’ve beens” and “remember whens.”

Like a teenager’s secret crush caught out in the open, trying to play it cool … PayPal’s plan is deny, deny, deny: “Pssh, no, I wasn’t interested in Pinterest. I mean, not like that. Maybe we’ll link up in the future? Yeah, that sounds good, leave it open-ended…”

PayPal soared 6% today while Pinterest plummeted about 14%, which if you couldn’t tell by now, shows that this was a much bigger deal for Pinterest than it was for PayPal.

See, PayPal already has its revenue streams all squared away … though an extra bit of ad and social networking revenue wouldn’t hurt.

Pinterest has amped up its marketing game over the past year, reveling in the waning reign of Facebook’s ad dominance. But having PayPal’s e-commerce support would’ve cemented Pinterest’s plans to make its pinning platform that much more “shop-able.”

Pinterest’s plight to monetize its platform is still ongoing … albeit a bit slower now that PayPal’s lined pockets are out of the picture.

It’s on, Great Ones!

I’m not just talking about the run-up to The Final Run Up — Great Stuff’s first-ever online special event that debuts tomorrow night.

Earnings season … we do that every now and then, remember? It’s back ‘round again … and this time, earnings season is on fire!

Just take a quick peek at this week’s stunning lineup, courtesy of Earnings Whispers on Twitter:

Big Tech? Big check. Also, go ahead and cover up that “OMG muh chip shortage!” free space on your earnings bingo sheet now before we move on…

All of FAANG showed up to this week’s free-for-all, save for that early bird Netflix (Nasdaq: NFLX), which reported last week. Throw in Microsoft (Nasdaq: MSFT) and Advanced Micro Devices (Nasdaq: AMD), and you have a whole feast of tender big tech entrées before you.

Judging by the market today, everyone’s looking at these earnings this week with eager anticipation for the bull market to rage on into that good night. Because a rising Big Tech earnings tide lifts all boats or something along those lines.

I’m personally watching AMD to see if it easily steps over the abysmally low bar that Intel’s (Nasdaq: INTC) earnings set last week. As much as I still want to like Intel, the company’s not doing itself any favors on the chip production front … and for a competitor like AMD, that’s an open goal.

Up next, how about some big-name manufacturers and an array of aerospace stars? This week, we’ll hear from the likes of Lockheed Martin (NYSE: LMT), Raytheon Technologies (NYSE: RTX) and Great Stuff Pick Boeing (NYSE: BA).

Elsewhere, you have Ford (NYSE: F) with its factory closure troubles and Caterpillar (NYSE: CAT), which can help us get a gauge on industrial/construction growth. You already know what everyone wants to hear about with these reports: supply chain.

It’s all about the supply chain this quarter — which companies are caught in the supply crunch, which ones are holding up the supply chain and which players are doing just fine to keep their cogs of production a-cranking.

Last but not least … Robinhood (Nasdaq: HOOD), oh, Robinhood. The company is still trying to prove it can chill with the brokerage big boys come earnings time, but it’s yet to handle the quarterly reporting spotlight with any grace.

This time, we’re keeping a close, close eye on how Robinhood’s revenue streams shake out. How much is Robinhood making off of crypto now compared to stock/option trading? And will we hear anything about how Robinhood plans to deal with the “constantly evolving regulatory landscape” surrounding, well, any of its moneymaking ventures?

And that’s that, Great Ones! The biggest earnings week of the season thus far — and we didn’t even mention the oil barons and the oil-dependent airlines…

What reports are you looking forward to most this week? Are any of your personal portfolio picks headed into the earnings confessional as we speak?

Let us know in the inbox what you think about earnings season, Tesla’s deal with Hertz and Beyond Meat’s faux-beef defeat. I already know you’re writing in your thoughts on the Trump Media SPAC … and I welcome all hot takes and perspectives on the matter!

We’d love to hear from you, so don’t forget to write to us. In the meantime, here’s where else you can find us:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff