What Is a Trailing Stop-Loss?

There is one simple thing that will save you thousands of dollars over the life of your investing career. It’s proven to beat the best money managers’ track records every time.It could’ve saved them millions of dollars…It’s just a simple trick … so simple most folks won’t do it.The trick is to ditch your “intuition”… your “gut”… or whatever other emotional response you use to figure out when to sell stocks.

Forget the news. Forget the Fed rates. Forget China. Forget the rising Dow and the fear of a market correction. Do it. Do it now. Using any of that nonsense will cost you money in stocks.

The trick is to rely on simple math to tell you when to sell. If you do it, you will improve your trading. Not a little bit. A lot. An enormous amount.

That’s because the market doesn’t care what you think. It doesn’t care what you are afraid of. It doesn’t care what happened today on Wall Street or in Washington D.C. or in Beijing. The stock market is made of millions upon millions of individual trades. Millions of different drivers.

The only thing that can unravel all that is simple math.

We call it a trailing stop, but it acts like a guide for the stock market. It’s like hiring a Sherpa before climbing Mount Everest. The trailing stop tells you when it’s safe to go up the mountain. It also tells you when to get out before the storm hits.

What is a trailing stop?

Trailing stops tell us when to exit a stock position. In the beginning, they are about risk management.

A trailing stop is a simple mathematical formula that determines when to sell a stock. It’s based on risk. Knowing our risk is the single most important part of investing. You must understand how much risk each investment poses. Balancing risk with reward is critical.

That’s why trailing stops are critical.

For example, when we buy a stock, we must decide how much of our capital we are willing to lose before we sell the stock. If the shares fall 10%, do we sell? If they fall 25%? 50%?

For most stocks in Real Wealth Strategist, we’ll use a 30% trailing stop. That means we are willing to risk one-third of our capital before we sell. If we lose one-third of our capital, we need to earn a 43% gain to recover it.

If we start with $1,000 and we lose 30%, we are left with $700. It would take a 43% gain (43% of $700 is $300) to get back to our starting point. That is a reasonable gain in natural resource investing. That’s why we use a 30% stop.

For riskier stocks with higher volatility, like small mining companies, we’ll use a 50% stop. However, if we hit that stop, we’d need to double our money to get back our capital. For less volatile stocks, like giant oil producers, we’ll use a 25% stop.

Once an investment rises in price, the stop becomes our exit strategy. As the value of the position rises, we can reduce the risk to our gains by simply tightening the stop. A 30% stop becomes a 20% stop or a 10% stop.

How do trailing stops work?

A trailing stop acts like a ratchet. As the stock price rises, the trailing stop price does too.

For example, if we bought a stock for $5 per share and used a 25% stop, we would sell if it fell to $3.75. (100% minus our stop percentage, 25%, is 75%. So we multiply our buy price, $5, by 75%, and we get $3.75.)

We would leave the position with 75% of our capital still intact. That’s important because if we lose 25% of our capital, we only need a 33% gain to recover it.

Let’s say our share price rose from $5 to $10 per share. Our new stop price would be $7.50 per share ($10 x 0.75%).

As you can see, the stop value rose from $3.75 to $7.50 as the stock price rose. That’s why trailing stops are so important … and why we can’t put these in at the market.

Can I put my stops in at the market or through my broker?

We don’t ever want put our stops in at the market.

That’s because we don’t want them to be public. You may not believe this, but if the order is in the market, it is visible. And when 30,000 or 40,000 people all have roughly the same stop, it becomes a target for manipulation. I’ve seen this happen.

Stock prices can be manipulated. And if the prize is large enough, they will be. Market makers can see what our stops are and can short the stock so that we hit our stops. Then they can swoop in and buy the shares more cheaply, grabbing a quick profit.

These stops should be internal — so you won’t set a stop with your broker.

We track our stops on a spreadsheet — this is part of our homework as investors. Or you can simply use the numbers we publish in the buy recommendation. If the stock falls below the stop value we’re tracking in our spreadsheet, then we sell.

How do I track stops in a spreadsheet?

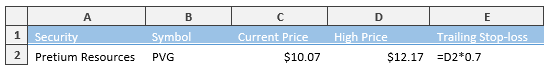

We recommend using Microsoft Excel for creating a spreadsheet to track your trailing stops. Below is an example of how we use a trailing stop.

We can use a handy function — a formula to perform a calculation — in Excel to make the math even easier. This is easy to do, even if you haven’t used Excel much. Simply follow the steps below.

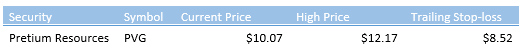

As of January 2018, since we entered our position in Pretium Resources (NYSE: PVG), share prices saw a high of $12.17 on October 12, 2017. Using a 30% trailing stop, our stop-loss would be $8.52. That means that if PVG closes at or below $8.52, we will put in a sell order the following day. (If it trades at or below $8.52 during the day but closes above it, we won’t sell. We watch closing prices for our trailing stops.)

Under our trailing stop-loss column, we enter the following equation in column E, row 2: =D2*0.7.This calculates 70% of our highest closing price in PVG (column D, row 2).

So if you have a 25% trailing stop, you’d use 0.75 in place of 0.7 (100% minus 25% = 75%, or 0.75). With a 20% trailing stop, you’d use 0.8 in place of 0.7. You get the idea.

Now, for Pretium, every time you enter a new high price for the stock in column D, row 2, the equation will recalculate your new stop-loss.

You can follow these steps for each of the stocks you’re tracking. Just be sure to change the function to reflect the correct row — D3; D4; D5; etc — and the correct percentage to reflect your trailing stop (0.7; 0.75; etc.).

Will the trailing stop percentages change?

As share prices climb, we will tighten our trailing stop-losses to preserve our gains. We might ratchet down the 30% trailing stop that we use when we enter a position to 25% or even 20%. This allows us to endure a moderate amount of market volatility while still being in a position to see gains — sometimes far greater than we even expect!

Can I ignore the trailing stops?

We don’t recommend it. A trailing stop-loss tells us exactly when to exit a position. Emotion can cause us to hold on too long or to sell too early. We let math make the hard decision of when to sell. Trailing stops keep our losses modest and allow us to experience big gains!

Where can I access the portfolio if I want to follow your stops?

Since not everyone enters their positions at our buy recommendations, we encourage you to track your own trailing stops. However, if you follow our recommendations closely, you can track your stops through our model portfolio. We will also send out alerts if we hit our stops based on this portfolio.