Timing a stock market crash can be difficult.

No, I’m not talking about the 10% correction we just experienced, though timing those is difficult too.

I’m talking about major stock market crashes that send portfolios down more than 50%.

We all know a crash of at least that magnitude is coming. It is just a matter of when.

Knowing whether this is the start of the crash or if we have a few more rallies left is the question everyone is asking.

And as of today, I don’t think this is the start of the next massive crash.

But my viewpoint can change daily based on data and technical indicators.

Timing a Stock Market Crash

So how does one navigate a market when its ultimate direction could either be on the cusp of a significant crash or another surge higher?

I have one sector that you can own to be prepared regardless of what happens…

Is Your Portfolio Ready for a Crash?

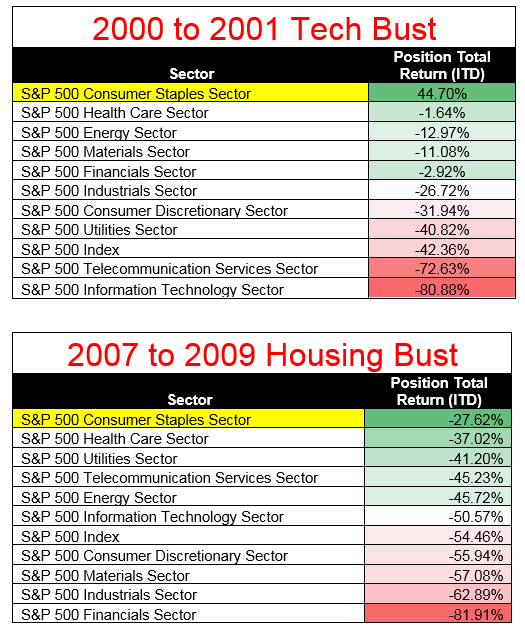

This sector, the one to own regardless of a bull or bear market, has outperformed all the other sectors in the last two market crashes.

That’s a remarkable statistic considering both of these crashes were unique, with the one starting in 2000 led by a technology bubble, and in 2008 a housing bubble.

Still, one sector outperformed the market on both occasions — the consumer staples sector.

Consumer staples are items that you and I are either unable or unwilling to cut out of our monthly budgets. That means even if our economy is in a recession and we lose our jobs, these goods or services are still necessary.

This includes items like shampoo, soap, toothpaste, beverages and food, as well as addictive items like cigarettes. These are items that we simply can’t live without. At least, we try not to.

So stocks that operate convenience or grocery stores, or make grocery items or bathroom products, tend to be more stable in nature — both in bull and bear markets.

Don’t get me wrong, these stocks still react to the tides of the overall market and economy. Just less so than other sectors.

A Great Spot to Be In

Take a look at how that sector has done compared to the rest during the last two market crashes:

These charts show that the consumer staples sector outperformed all the other sectors on both occasions. It was up 44% during the tech bust while the S&P 500 was down 42%. And it was only down 27% during the housing bust, compared to an S&P 500 decline of 54%.

So the sector wasn’t up during the second crash. But it would have cushioned your portfolio significantly.

Plus, there’s an added benefit.

You always get to see the sector rally if a stock market crash isn’t inevitable at that very moment.

So buying this sector is a great spot to move to if you think we could be near a stock market crash, but also want to benefit if the market continues to climb.

If you jump into cash when you have these worries, you will always miss out on any stock market rebound.

The easiest way to gain exposure is with an exchange-traded fund (ETF) that owns a basket of consumer staples stocks — Consumer Staples Select Sector SPDR ETF (NYSE: XLP).

You can buy this ETF and rest easy knowing you are in a great spot regardless of the market direction.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert

Editor’s Note: Just days from now, cryptocurrency expert Ian King expects a major event to send cryptos soaring to record highs. And in a free webinar presentation, he’ll show you how to position yourself before this event happens … giving you the opportunity to turn every $1,000 into $25,000 — and likely more. To learn the secret trick Ian uses to spot trades that can make you 25 times your money, click here to sign up for his free webinar.