Every 365 days, 5 hours, 59 minutes and 16 seconds, we ring in a new year.

But intelligent investors know that, other than the IRS — which uses December 31 for tax reporting purposes — it’s really a nonevent.

Our investments aren’t aware of our planet and its orbit. So, why make an investment decision based on celestial observations?

That’s why this year — just like every other year — I’m recommending that you do nothing different.

In fact, I want you to do more of the same: Buy businesses that have a strong industry tailwind and are run by rock-star CEOs, and buy them when they trade at bargain prices.

All you really need to do is stick to this proven approach, no matter what day or month of the year it is.

Here’s why…

Use This Simple Approach

Over the long term, there’s only one main reason stock prices rise or fall. Prices follow the underlying worth of the business, not the other way around.

So, my yard stick for measuring the quality of a company is how much it continues to increase the underlying worth of its business.

And that’s why you should be ignoring all those silly headlines like “Buy These Stocks in 20XX” or “Winners of the New Year.” Because your yard stick shouldn’t be based on the calendar or new year.

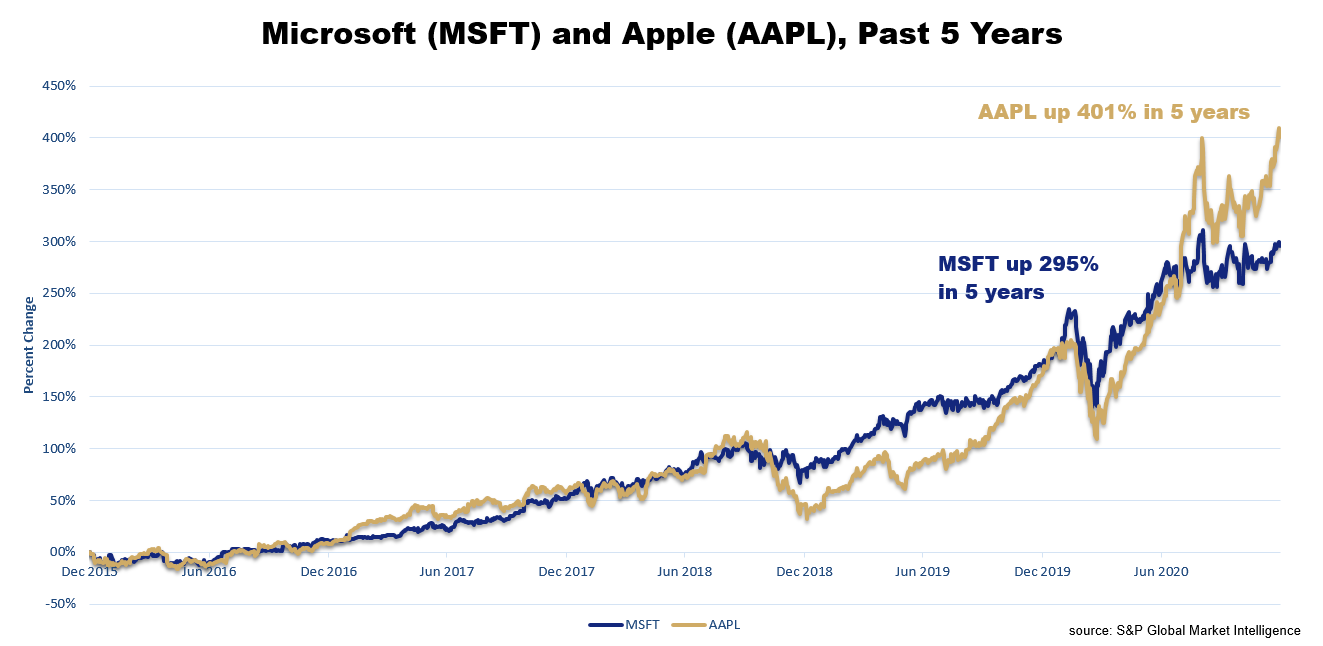

Think of how much you would’ve missed out on if you sold in and out of Microsoft or Apple at the end or beginning of each year.

All you needed to do to make a boatload of money on them was just make one decision: Buy them, then sit and wait…

It’s just the most logical course of action. Stick with this solid approach that’s withstood the test of time. Even in the year we just had, it’s produced excellent results.

Despite the pandemic-related recession, subscribers of my Alpha Investor and Lifetime Profits services have seen great gains…

At the end of the year, my Alpha Investor model portfolio had nearly all winners. Almost every open position was up.

Lifetime Profits, which focuses on special situations, had an outstanding performance as well. In fact, we have several stocks in that model portfolio showing triple-digit gains.

And in both newsletters, we use the same simple approach…

In Alpha Investor, I apply it to well-known companies that are being ignored by Wall Street for some reason or another. In Lifetime Profits, we use it on special-situation stocks that Wall Street doesn’t want to take the time to figure out.

The bottom line is this: If you buy businesses that have a strong industry tailwind and are run by rock-star CEOs … and buy them when they trade at bargain prices … who cares if it’s January, June or December?

At the end of the day, it’s about making money and achieving your financial goals.

So, in the new year, I’d like to wish you and your loved ones wealth and good health. And I’ll continue to focus on making you money, while you focus on enjoying life.

Regards,

Charles Mizrahi

Editor, Alpha Investor

P.S. My team and I have made it our mission to help make you money. So, we’re working on several big projects in 2021 to make sure everyday American investors like you can achieve your retirement goals.

That’s why we’ve created our American Investor Alliance…

We want you to be first in line to take advantage of these new ventures as soon as we launch them. And becoming an exclusive charter member of this Alliance gives you early-bird access to them.

Find out how you can join us on this wealth-building path — click here for all the details. But don’t delay. This could be your last chance before we close the doors on this special membership.