Are you seeing the market action today?

It’s a whole lot of chop, chop, chop…

And that action is slicing up traders committed to a single direction in this market.

If you’re reading this, I’ll go out on a limb and say you’ve heard of a hedge fund. Hedge funds are made up of the smartest traders in the world.

But they call themselves hedge funds because they, well, HEDGE.

That means protecting yourself from the move you don’t see coming… and making sure that you’re set to profit in multiple scenarios.

Setting up a hedge is something every trader should know. Many folks think it’s complicated because of its hedge fund pedigree, but it doesn’t have to be.

Today, I’ll show you just how easy it is…

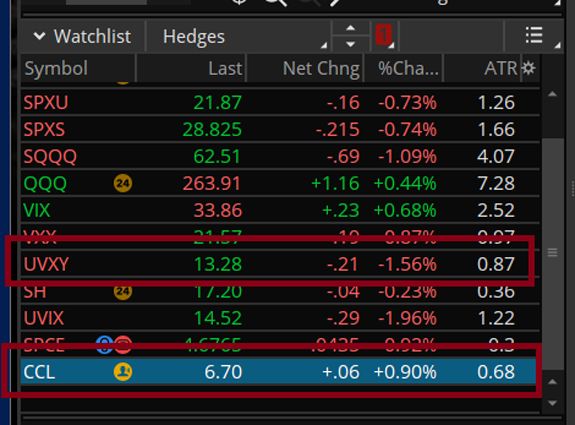

For this, I’m going to be using November 4, 2022 expiry options for the following two instruments: Carnival Corp (CCL) for my upside play, and the VIX ETF (UVXY) for my downside play.

Why these two?

Well, CCL was down almost 30% in a single week… so that screams “play the bounce” to me. If stocks rally, CCL should rally even harder.

And we’re hedging with UVXY because it’ll rise if the broad market continues to fall.

Plus, there are some technical reasons I chose these two tickers which I’ll get into shortly.

I’m shooting for the simplest possible hedge I can set up… So, to start, I’ll explain why I’m choosing November 4 expiry options.

As we all know, option contracts have theta decay (AKA time decay) when we buy them.

Theta decay becomes a major component of loss in an option contract about 8 days to expiry, so for this example, I’m picking contracts with 23 days to expiry to avoid theta decay.

I would hold this position about 13 days, and then close it no matter what, and if I wish to keep the position on I can just buy later-dated option — this is called “rolling” an option.

For the next step, I’d like the two instruments to be as similar in dimensions as possible: In particular, I want similar ATRs (Average True Range, or Average Trading Range) and I want similar deltas for each option (for a refresher on delta and how to use it, check out my piece from a few weeks ago).

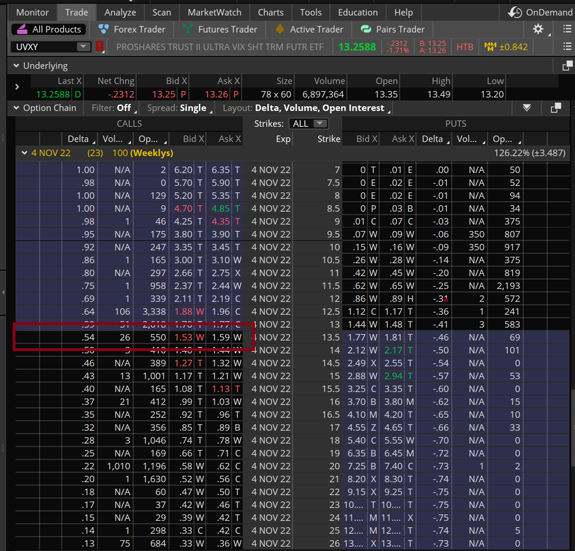

In this case, I’m going to keep it simple and use the At-The-Money options for both the upside and downside play here.

So, let’s take a look:

CCL has an ATR of 0.68, and UVXY has an ATR of 0.87, relatively close. (On thinkorswim, you can get ATR on your watchlist by clicking the small gear icon in the upper right of the watchlist header, choosing “Customize” and then typing ATR in the search box of the menu that pops up, then click “Add”).

Now that I have two tickers with similar ATR, the next thing I want to look at are the delta of each instrument:

CCL:

UVXY:

The CCL contract I’ve chosen has a delta of .47, while the UVXY contract has a delta of .54.

Again, pretty close for each of them.

Since these two stocks have similar ATRs, and since each has a similar delta, they should move in similar but opposite directions, on average over time.

CCL should move up when the market moves up most of the time, while UVXY should move up when the market moves down most of the time.

Now, all I have to do is set the “ratio” I want to be hedged by the number of contracts I buy for each instrument.

If I want to be 33% hedged, I can buy 3 CCL contracts and 1 UVXY contract. This means I’ll give up 33% of the gains on my CCL contracts in exchange for the protection from the UVXY contract.

If I want to be 50% hedged, I can buy 4 CCL contracts and 2 UVXY contracts. And so on.

The thesis of the trade here is that CCL goes up, of course. The UVXY position is purely protective.

And that’s the main takeaway. Whenever you put on a trade, you can avoid losing money by setting up a hedge that will go up if your main idea doesn’t take shape.

It really is that simple! All the ingredients I need can be found in TOS: ATR, Time to Expiry, and Delta.

Regards,

Bryan KlindworthSenior Analyst, Kings Corner

Bryan KlindworthSenior Analyst, Kings Corner