I used to enjoy playing poker quite a bit, at least until I had my first kid.

I would hit up the local tournaments and try to win a few bucks. If you have ever played poker, you know the main thing to look for is “tells” in how a person plays. Tells help you identify when they are bluffing … or when they are actually holding a full house.

A tell is a change in a player’s behavior that gives you some clues. This is how you know when to slide in more chips.

The best poker players are excellent at hiding their tells, and also at identifying others’.

These same tactics can be used in the stock market. Today, we’ll look at a tell you can find on earnings calls.

If an executive of a company becomes long-winded and uses bigger words than usual on an earnings call, it’s a telltale sign that things are not going so well for the company.

Take a look:

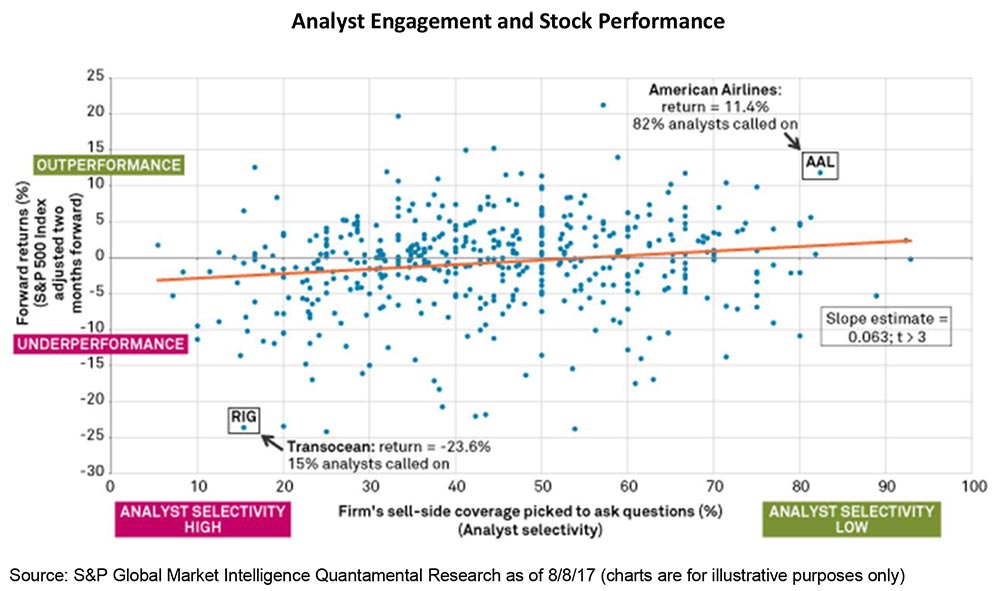

You will notice the orange line going across the chart.

This is the slope of all the data points. The idea here is that as an executive talks more and gives analysts fewer chances to ask questions, the stock tends to underperform.

The slope indicates this. It starts lower on the left side of the chart, indicating underperformance and few analyst questions. Then it rises, indicating a correlation to outperformance with more analysts being given the chance to ask questions.

So, whenever you hear an executive being long-winded on a conference call and not getting around to all the analysts on the line, consider it a tell that the company’s woes are going to put pressure on the stock.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert