Story Highlights

- On December 31, President Trump promised a trade deal with China.

- This will jump-start economic growth and end the bear market in basic metals.

- Anthony Planas tells you how to profit from Trump’s trade war victory with an exchange-traded fund.

On December 31, President Trump sent out a tweet that promises to strengthen the global economy. And one metal in particular will benefit the most.

The trade deal is great news for commodities. Open trade drives economic growth. And commodities are the fuel for this growth.

But there is one metal that has suffered the most under the trade war. And it is set to benefit the most with this new deal.

Even with the news out, investors have the chance to get in on the trade and see a 62% return this year.

China’s Growth Drives Copper Prices Higher

Copper’s strength is tied directly to China. That’s because of China’s swelling middle class.

More than 1 billion people are marching toward a Western lifestyle. That means huge demand for electronics, all built on the backbone of copper.

Singapore’s DBS Bank sees copper demand growing by 3.1% over the next two years. By 2030, we will need an extra 2.65 billion metric tons of copper per year.

That’s about 15% of the world’s current production.

But basic metal miners are beaten down. With years of low metal prices, they are in survival mode. That means cutting costs wherever they can.

And the easiest way to save money is by cutting out exploration.

The uptick in copper demand will drive a deficit of 193,000 metric tons by 2022.

Here’s how you can profit from this.

Traders Turn Bullish on Copper

After two years of escalating trade tensions, traders are starting to warm up to the idea of a new deal.

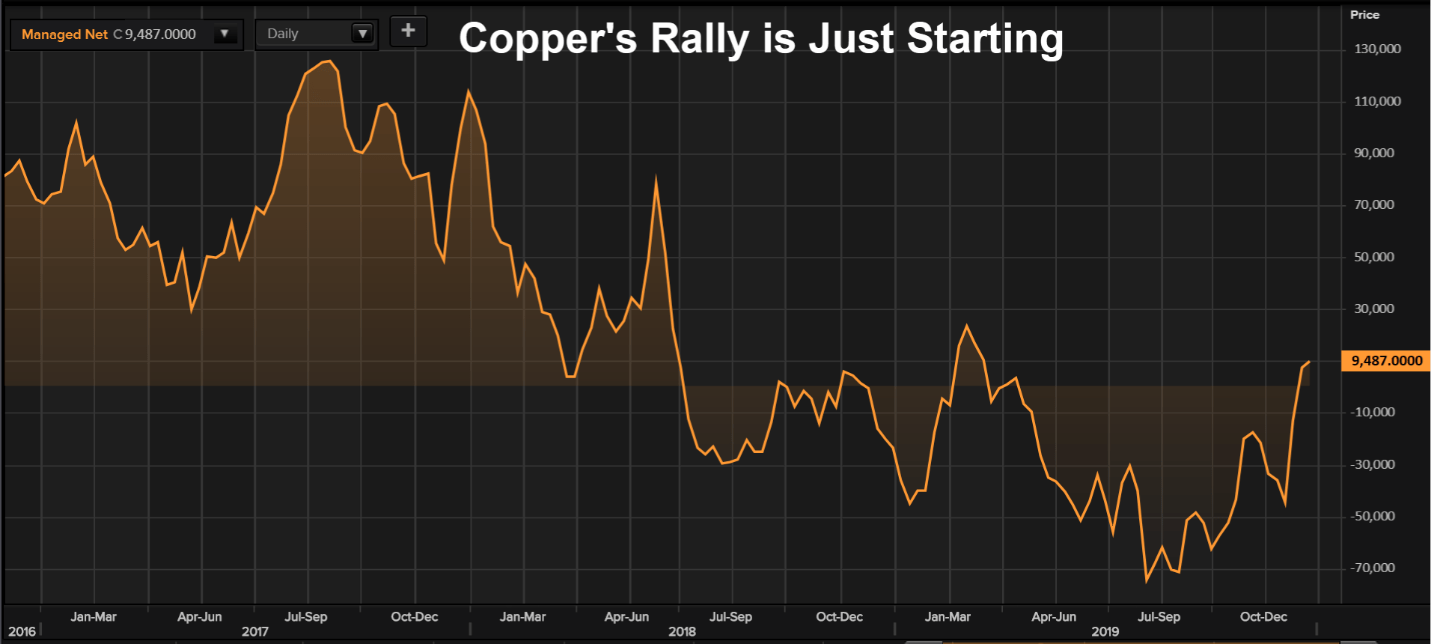

I like to use the Commitments of Traders chart to gauge Wall Street’s sentiment on copper. At extremes, it tells me that copper is overbought or oversold.

(Source: Refinitiv Eikon)

But right now, sentiment is just barely turning positive. That tells me that the price of copper has much further to run.

Copper has rallied 12.7% since its low in September. Even at $2.83 per pound, copper is well below its 2011 high of $4.60.

Consider the Global X Copper Miners ETF (NYSE: COPX) to gain exposure to the upward trend in copper. The exchange-traded fund (ETF) holds a basket of the world’s largest copper miners.

Copper needs to rally 62% to get back to its 2011 high. A price move like that could deliver a triple-digit return for COPX.

To learn more about the best metals and miners to invest in, you need to watch Matt Badiali’s presentation here.

Good investing,

Internal Analyst, Banyan Hill Publishing

P.S. Check out my latest video below for this week’s marijuana market update. Also, don’t forget to subscribe to my YouTube channel. I provide a fresh take on the most exciting opportunities in cannabis for 2020. Just click the play button below!