“Rig count doesn’t matter anymore.”

The room grew quiet and turned their attention to the speaker. He went on to tell the audience of energy executives, investors and journalists about the evolving oil services sector.

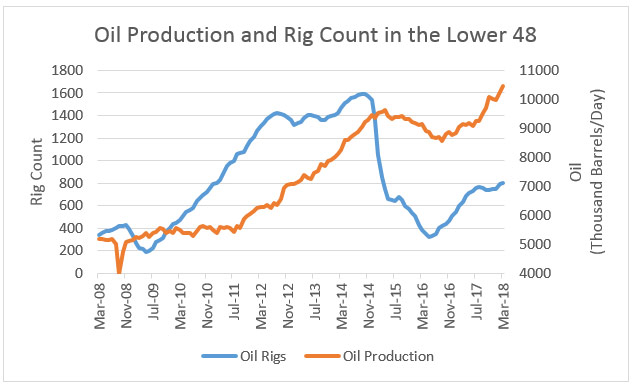

Rig count has long been a great proxy for oil production. Simply put, the more oil rigs, the more oil they can pump.

All of that has changed now.

Take a look at the chart below of rig count and oil production in the lower 48 states.

Rig count leads production volume. Starting in 2014 with the collapse of energy prices, the two begin to decouple. Rig count drops far greater than production.

Oil Rig Profits

That was the start of the revolution in oil rigs. Producers put the pressure on drillers to tap into only the best reserves at lower prices.

Necessity is the mother of invention.

The oil services sector evolved. Engineers and geologists turned into computer programmers as retooling brought rigs into the 21st century. Artificial intelligence and machine learning are used to drill smarter.

One modern rig can do the work of a dozen old rigs. All with fewer workers, less resources and at cheaper costs.

Modern oil rigs are precision tools. New technology allows these drills to bore through the earth, collect data and tap pockets of rich reserves. Directional drills can bore for distances thought to be impossible not long ago.

During the 1990s, a two-mile drill was considered exceptional. Just last year a new drilling record was set at nearly 10 miles.

These advances are great for production. Operators can get to pumping wells faster and produce more from each.

The oil services sector is seeing greater margins as a result of the advances in the field. Meanwhile, investors see lower rig counts and think that business is drying up.

The story from the field is much different. Drillers are so shorthanded that they are offering workers 100% pay hikes, according to Bloomberg.

Talks of OPEC increasing production spooked investors out of American oil services and producers. Meanwhile, the International Energy Agency forecasts a shortage of oil due to growing energy demand, and falling supply from Iran and Venezuela.

This pullback is a great buying opportunity. The oil services sector will have no shortage of work drilling for oil and gas as the U.S. closes in on becoming a net energy exporter.

The VanEck Vectors Oil Services ETF (NYSE: OIH) holds some of the best names in drilling and energy exploration.

Good investing,

Anthony Planas

Internal Analyst, Banyan Hill Publishing