It seemed like every third booth at this year’s Prospectors & Developers Association of Canada (PDAC) meeting was either a lithium company, a graphite company or a cobalt company. Those are the flavors of the month in mining speculation.

This follows a long-standing tradition of fad investing in mining: uranium, potash and rare earth metals.

Today there are 60 lithium companies, 23 cobalt companies and 25 graphite companies listed on the TSX Venture Exchange. That’s the incubator for junior mining companies.

Those three groups make up 11% of the 988 listed mining companies.

The Lure for Junior Lithium Miners

Lithium’s popularity comes from the massive demand for lithium-ion batteries today. Demand from car companies surged, catching the industry unprepared. The price of the white metal doubled from 2016 to today, from $8,000 per ton to $16,500 per ton.

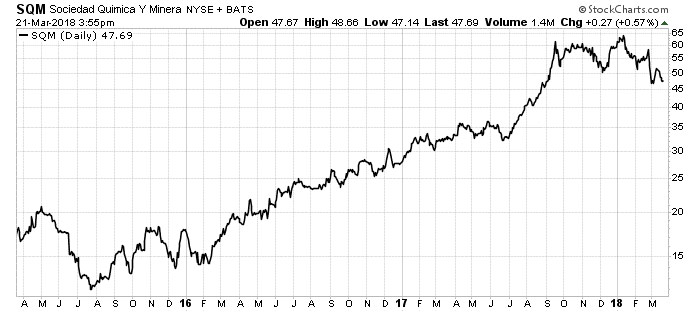

Companies that produce lithium soared in value along with it:

Sociedad Química y Minera de Chile (NYSE: SQM) is the world’s largest lithium producer. It produces lithium from brine in Chile. Shares roared up 396% from July 2015 to January 2018.

That’s the lure for these junior lithium miners. You see, lithium, cobalt and graphite are popular materials because they make up lithium-ion batteries. These are the batteries that power everything from cordless drills to electric cars.

Unfortunately, there is an upper limit to the utility of lithium-ion batteries.

Unlike computing speeds, which double on a regular basis, lithium batteries have a cap. The most efficient of these batteries can hold about two times the electricity as the current version. That’s it. They are limited by the very chemistry that makes them so useful today.

That limits lithium’s dominance as the battery metal.

Companies that want to make the next generation of batteries are looking at other substances, like silica and zinc. That effectively puts a cap on lithium demand.

We’ve Seen This Story Before

In addition, there is a lot of supply on the horizon. Mining giant Rio Tinto’s (NYSE: RIO) Jadar project in Serbia should come online in 2023. It is the second-largest lithium project in the world.

Today the lithium price is high. However, projects like Jadar will pull it back to earth in a hurry.

I’m highly skeptical of lithium investments today.

We’ve seen this story before. Miners rush into a commodity as the price peaks. They develop projects, regardless of cost and quality. Then, as the price falls, those projects become uneconomic.

Shareholders usually pay the price as the share price collapses. My advice: Stay away from junior lithium companies, and be cautious of paying too much for producers too.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist