Johnson & Johnson’s Restaurant

You can get anything you want at Johnson & Johnson’s (NYSE: JNJ) restaurant.

Walk right in, it’s around the back, just a half a mile from the railroad track. You can get anything you want at Johnson & Johnson’s restaurant…

Now, it all started 127 years ago — not on Thanksgiving — when Johnson & Johnson started selling baby powder made from crushed talc. Unfortunately for Johnson & Johnson … and Alice, for that matter … talc is frequently found in the earth right next to asbestos.

Obviously, this raised some critical concerns, especially after it was found that talc containing asbestos caused cancer and other various health problems. Go figure.

But Johnson & Johnson has a plan. It’s called the Texas two-step. And, if successful, it could shuffle off all its responsibility for the baby powder debacle onto a shell company. But more on that in a bit…

First, I want to tell you about small-town West Virginia where this happened. Here, they had 67,367 drug overdose deaths due to opioids in 2018.

That’s gonna happen when you have roughly 69 opioid prescriptions for every 100 citizens … and Johnson & Johnson was at least partly responsible. It used to be a very big opioid producer, you see … and we all know how that went down, especially if you lived in rural America.

But when we got to the “Scene of the Crime,” Johnson & Johnson was able to settle its involvement in the opioid crisis by paying just $5 billion as part of a larger $26 billion settlement.

And the judge wasn’t going to look at the 27 eight-by-ten color glossy photos with the circles and arrows and a paragraph on the back of each one explaining how each one was to be used as evidence against Johnson & Johnson.

But the opioid situation pales in comparison to Johnson & Johnson’s talc problem. In fact, the baby powder issue is potentially the biggest crime of the last 50 seconds, and everybody wants to get in a newspaper story about it.

Earlier this year, 22 people won a $2.12 billion award from Johnson & Johnson — an award that was reduced from an initial jury award of $4.69 billion. And that’s “just” 22 people. There are more than 30,000 claims against Johnson & Johnson for its talc troubles.

In other words, Johnson & Johnson could be on the hook for trillions in damages and awards. Can you say “Ouch!” Sure, you can.

But Johnson & Johnson isn’t screwed just yet. Remember the Texas two-step?

Yeah, Johnson & Johnson is looking to split in two … or rather, spin off its baby powder assets as a standalone company. This would assign potentially trillions in talc liability to the spun-off company, allowing it to file bankruptcy … and Johnson & Johnson to emerge unscathed.

Typically, this kind of thing is very illegal. It’s officially called a “fraudulent transfer.” But deep in the heart of Texas … it’s only called a “divisive merger,” and it isn’t illegal.

Whether or not a judge allows Johnson & Johnson to go ahead with this smoke-and-mirrors escape plan remains to be seen … but the fact that Johnson & Johnson is considering it speaks to the severity of the problem.

But that’s not what Johnson & Johnson investors came to talk about today. They came to talk about earnings. They got a building in New York City called the New York Stock Exchange where you walk in, you get injected, inspected, detected, infected, neglected and, if you’re lucky, selected.

Johnson & Johnson reported earnings there today, and the results were largely in line with expectations. Revenue rose 10.7% from last year, and earnings were up 18.2% at $2.60 per share — largely due to the company’s COVID-19 vaccine. What’s more, Johnson & Johnson boosted its full-year 2022 earnings guidance above Wall Street’s expectations.

And so, in the middle of all this hoopla, JNJ stock gained more than 3%. So, just waitin’ for it to come around on the guitar again is what we’re doing.

You can get anything you want at Johnson & Johnson’s restaurant. Excepting Alice. You can get anything you want at Johnson & Johnson’s restaurant. Walk right in, it’s around the back, just a half a mile from the railroad track. You can get anything you want at Johnson & Johnson’s restaurant…

I suppose I should end this on a serious note. In my opinion, Johnson & Johnson’s earnings don’t matter … not when the company is faced with potentially trillions in liability surrounding its baby powder.

If — and it’s a pretty big if — the company can pull off its little spinoff stunt, then JNJ stock is poised to rally big. If not, then no amount of draft-dodging or earnings reports are gonna help the shares.

Don’t Forget…

For the first time ever, I’m stepping out from behind my desk at Great Stuff headquarters to sit down with market expert Keith Kaplan, CEO of TradeSmith, to show you first-hand details on what could become one of the biggest moneymaking events in the market — ever.

You’re invited to claim your exclusive access — and it’s free too!

Who Vapes A Cigarette? Honestly?

Of all the companies to blame the chip shortage for lowered guidance … Marlboro-maker Philip Morris International (NYSE: PM) was way down the list. I mean, like, down near cereal maker General Mills kinda low on the list. Who knew they were putting chips into cigarettes now? I’ll be right back, need to go check my Lucky Charms for chips…

Anyway, PM’s excuse checks out: The IQOS system — which in itself sounds hipstery beyond belief — is Philip Morris’s take on heated tobacco products, or HTPs. These work by heating up the tobacco just enough to release nicotine-containing vapor without burning the actual tobacco.

So, it’s a quasi-vape, where instead of putting in vape e-juice (not to be confused with appy-juice), you just put in tobacco leaf. Sorry I’m late to the party, but what? Who in Sir Walter Raleigh’s name is this product for — the health-conscious cigarette purist?

“Bro, let me get a hit off your IQOS!” said no one ever. Cotton candy-scented clouds are passé; the Marlboro Man is now shrouded in a fog of rich Virginia-blended ‘baccy vapor. And somehow … Philip Morris is selling these, with HTP volume up 23.8% on the quarter.

Or at least, it’s trying to sell these worst-of-both-worlds devices: Philip Morris beat earnings and revenue expectations, but the company was quick to blame supply chain woes and — get this — the chip shortage for not meeting consumer demand.

It’s OK to say no one likes the IQOS, Philip Morris. Just own it. Everybody has their flops and problematic products and asbestos-ridden baby powders … right?

As much as I love my hydrogen stocks (and yes, I’m gonna keep hammering this point home from now until the end of time), lithium-ion batteries are undoubtedly the easiest source of energy for electric vehicles (EVs) right now.

And with everyone and their mother making EVs these days, lithium demand keeps soaring to new heights. Hence why I recently added the world’s top lithium producer, Albemarle (NYSE: ALB), to the Great Stuff Picks portfolio to help us kick off October.

In the two weeks since I recommended ALB stock to you Great Ones, we’re already up a cool 11.6% on our position. Huzzah!

Now, I’m not just blowing smoke by bringing up Albemarle today. I told you two weeks ago that it was only a matter of time before other investors started paying attention to the world’s No. 1 lithium lackey … and boy, was I right.

Just this morning, RBC analyst Arun Viswanathan upgraded Albemarle to buy from hold, citing the same rising lithium demand I’ve already told you about:

While Viswanathan upped his price target to $280 per share from $246, I’m still sticking to my $240 buy-up-to price. After all, ALB’s been volatile lately, and I want to account for any inflationary fears that could fuel a short-term sell-off.

If you didn’t get into ALB stock when I first recommended it and lithium’s your jam, you can use temporary pullbacks to your advantage to get in under $240. Just remember to set your stop-loss at $170.

And if you’re a gold-star Great One who’s already sitting on that 11.6% gain, go ahead and give yourself a pat on the back. You done good.

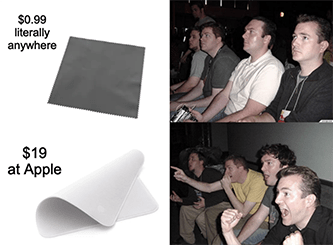

It’s no secret that I love to rag on Apple (Nasdaq: AAPL). Between its exorbitant pricing, shady third-party app developer shenanigans, middle-of-the-road hardware and superfluous iOS updates … there’s plenty for me to harp on.

But after skimming Apple’s big online event yesterday — where it showed off all the new products it’s been working on this past year — I just ended up feeling sad for this once-mighty innovator instead of my usual mirth.

Apple enthusiasts were left to ogle over minimally redesigned MacBook Pro models, upgraded AirPods, a handful of colorful HomePods that are essentially Apple’s version of Amazon’s Alexa speakers … and that’s about it (unless you want to count Apple’s $19 screen-cleaning cloth as a new product).

I’ve said for years now that Apple’s glory days of innovation are long gone. But yesterday’s 50-minute keynote goes right to the core of Apple’s problem: The company has run out of creative steam.

Fortunately for Apple, diehard AAPL investors are tough to dissuade. Apple’s stock is now trading about 2% higher following the event, which I think says a lot more about the power of investor sentiment than it does about Apple as a company.

Never one to miss an opportunity to flaunt its own altruism, Amazon (Nasdaq: AMZN) released new data this morning heralding the success of its third-party sellers amid ongoing scrutiny of its private-label piracy.

According to Amazon, sellers who used Fulfillment by Amazon — a service that packages and ships third-party orders from Amazon’s warehouses — experienced an average of 20% to 25% more sales than those who didn’t.

Pardon my French, but what the actual hell does that have to do with Amazon’s “seedy” search results and its straight-up theft of other peoples’ products?

Last I checked, those two points weren’t mutually exclusive. Third-party sellers could still be “doing great” and making money even though Amazon copied their products. And it’s dead insulting to try to say otherwise.

To me, this sounds like more of a distraction tactic than anything else. Pimp up a few good-looking sales numbers and pray to God it distracts from the possibility that Jeffrey Bezos lied under oath about Amazon’s malicious malfeasance. But that’s … like … just my opinion, man.

What do you think, Great Ones? Is Amazon the real victim here, or is that damning Reuter’s report just the latest far-flung attempt to kill the retail king? You tell me: GreatStuffToday@BanyanHill.com.

When we first told you about the first-ever ETF to track bitcoin futures — two tastes that taste awful together — you could almost hear the echoing retches from our inbox. Disgusting, vile — obscene!

Turns out, not that many of you were thrilled with trading derivatives of a derivative of a crypto. Who’d’a thought? You can’t even get such a crypto-based monstrosity in Alice’s Restaurant.

Nevertheless, the ProShares Bitcoin Strategy ETF (NYSE: BITO) broke the ice with its risk-fueled abomination this week. But now? Well, not even ETF managers want in on the bitcoin futures market anymore…

Invesco was right on ProShares’ coattails with its own bitcoin futures ETF but backed out at the last second:

What’s with the sudden cold feet? I mean, ProShares was confident enough in its bitcoin futures ETF to go through with its NYSE launch today. And a slew of other bitcoin ETFs are supposedly still in the works from other ETF hot shots like Van Eck.

The difference is that, frankly, Invesco’s product was hot garbage. Invesco planned to be knee-deep in bitcoin futures but left some wiggle room for other loosely related investments, such as Canadian ETFs containing bitcoin and the Grayscale Bitcoin Investment Trust (OTC: GBTC).

We found all the garbage in there, and we decided it’d be a friendly gesture for us to take the garbage down to the city dump. And if Invesco didn’t pull the plug on its half-ton of garbage disguised as an ETF … a certain regulatory agency would’ve.

See, ProShares’ ETF showed that the SEC is willing to accept a crypto-related investment product as long as it’s still relatively tied to already-established markets.

SEC Chairman Gensler feels fine and dandy with bitcoin futures ETFs … because the futures market is heavily regulated and relatively controllable in the SEC’s purview.

But Canadian ETFs? Grayscale’s bitcoin trust? Oh no sir, we’ll have none of that ‘round here, thank you very much!

It’s about control. It’s always been about control. And Invesco read the room, probably met Gensler’s crypto-hating gaze, and gave up on its bitcoin futures fantasies before the shebang even began.

But how about you, Great Ones?

Are you biting on the bitcoin futures ETFs? Will Johnson & Johnson own up to the liability of its asbestos escapades … or will the “Texas Two-Step” trounce its talc troubles? Have you heard of this loophole before?

Tell me what’s on your mind this week: GreatStuffToday@BanyanHill.com. We’d love to hear from you! In the meantime, here’s where else you can find us:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff