If you had any success investing this year, there’s a good chance you owe it to the Magnificent Seven.

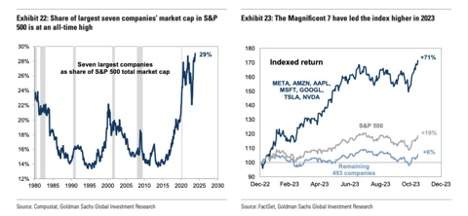

These seven mega-cap tech stocks (META, AMZN, AAPL, MSFT, GOOGL, TSLA and NVDA) accounted for over two-thirds of the S&P 500’s total return.

On the wings of 2023’s unprecedented AI boom, they averaged 71% gains compared to just 6% for the other 493 companies.

As a result, the Magnificent Seven now make up nearly a third of the index’s total market capitalization:

(From YahooFinance: The top seven tech stocks dominated 2023 returns, but what about 2024?)

I wrote about how and why this is happening in this Tuesday’s Stock Power Daily, and I’m going to expand on that here today — because this topic affects almost every stock investor.

Here’s what you need to know…

Magnificent Seven of Tech: Cause for Concern?

First of all, I want to be clear that the Magnificent Seven are great companies.

They’re market leaders with a whole array of competitive advantages.

So a higher valuation is justified. At least in part.

But index and exchange-traded funds (ETFs) have surged in popularity over the last 20 years. And investors are pouring an absolute fortune into the market’s biggest stocks.

They’re chasing shares into the stratosphere — hoping to capitalize on the red-hot AI mega trend with a “safer” tech stock like NVDA or GOOGL.

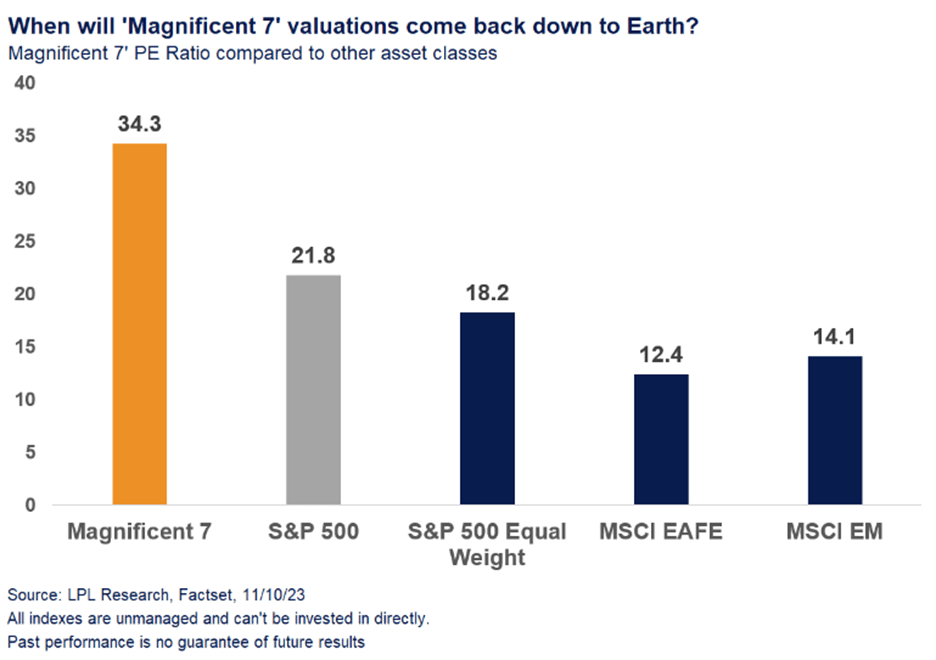

But how much safer are the Magnificent Seven when valuations are nearly twice that of the S&P 500 equal-weight average?

(From LPL Financial Research: Astronomical valuations for Magnificent Seven stocks.)

I’m sorry, that’s just too expensive.

These stocks make up almost 30% of the S&P 500 Index, too.

So when you buy into an index fund like the SPDR S&P 500 ETF (NYSE: SPY) at today’s prices, you’re essentially buying into these seven stocks at an average price-to-earnings (P/E) of 34.

That’s too rich for me, even after this year’s rally!

Right now, these Big Tech stocks are essentially “priced for perfect performance.”

It’s as if investors assume all of this year’s boldest AI predictions will inevitably come true.

If that doesn’t happen — if AI falls even a little bit short — then those who invest at today’s prices could be stuck with the bill in 2024.

And it wouldn’t be the first time Big Tech fell short of its own giddy projections, either…

Investors Paid the Price for 2021’s EV Hype

Prior to 2022’s bear market, electric vehicle (EV) makers reached the same kinds of high valuations we see in today’s AI stocks.

Hugely bullish projections propped these valuations up — with EV sales expected to grow as much as 70% year over year by some industry professionals.

Sure enough, EV sales growth has been phenomenal.

Yet numbers are still well short of those astronomical projections (by half, in fact).

As a result, smaller EV automakers have continued to sink even as the broad market recovered.

Onetime EV breakout Nikola Corp (Nasdaq: NKLA) is down more than 58% in 2023 alone.

Fisker (NYSE: FSR) investors have lost 77% since January.

On the one hand, this recent experience is part of the reason why investors are flocking to larger tech stocks.

Investing in larger stocks is simply more stable … at least in general.

It gives you exposure to an emerging mega trend with less volatility.

But even EV mega-stock (and Magnificent Seven member) Tesla Inc. (Nasdaq: TSLA) is still down nearly 40% from its high in 2021.

A “Yellow Flag” for 2023’s Top Performers

Once again, the Magnificent Seven are great stocks.

But in the words of investing legend Howard Marks:

It’s not what you buy, it’s what you pay. And success in investing doesn’t come from buying good things, but from buying things well.

Investing in these stocks at today’s prices leaves you with zero margin of safety.

The market’s currently pricing in “Blue Sky” projections…

At a time when AI projects are coming back down to Earth in terms of their overall scope and results.

I’m as big an AI supporter as anyone out there — it’s at the core of some of my most powerful investing systems.

But even I expect some stumbling blocks along the way. None of which are currently priced in with a P/E of over 34.

Of course, most of us paid far, far lower prices for our shares in MSFT, GOOGL and NVDA.

If that’s the case for you, then congratulations on a truly wonderful year in the stock market!

Seventy-one percent returns for doing nothing is living the dream, as far as an investor’s concerned.

But it might also be a good time to think about pumping the brakes…

Really consider the price you’ll be paying before adding to your ETF holdings over the next few months.

Look into setting a few stop-losses on some of your most successful positions, effectively locking in your long-term gains in case next year takes an unexpected turn.

That might seem like excessive caution now, with AI excitement at its peak.

But things can turn around very quickly in tech.

Shares of META Platforms Inc. (Nasdaq: META) infamously tanked 26% in a single day, on February 3, 2022.

It was the largest single-day decline in market history at $232 billion.

All it took was one bad earnings report.

New AI tech will likely still surprise to the upside in 2024, driving shares of NVDA higher by 20% to 30%.

But it’s extremely unlikely any tech giant will repeat this year’s 230%+ gain all over again.

Instead, you’ll have to broaden your horizons to find next year’s biggest breakout investments.

And I know EXACTLY where to start…

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets

I would like to get access to mext generation coins, ad read about what Ian says, ut I cannot find anything.

Yes I have subscription to strategic fortunes. Please advise