My mother-in-law is on a mission to find the best one-year certificate of deposit (CD) rate available.

For the past few years she’s been unimpressed with the yield her local bank is offering.

My mother-in-law is a very wise and practical woman, especially where finances are concerned. Simply put, she knows the value of a dollar.

That’s why the trade-off of locking her hard-earned savings away for months on end only to earn a pittance of income is discouraging to say the least.

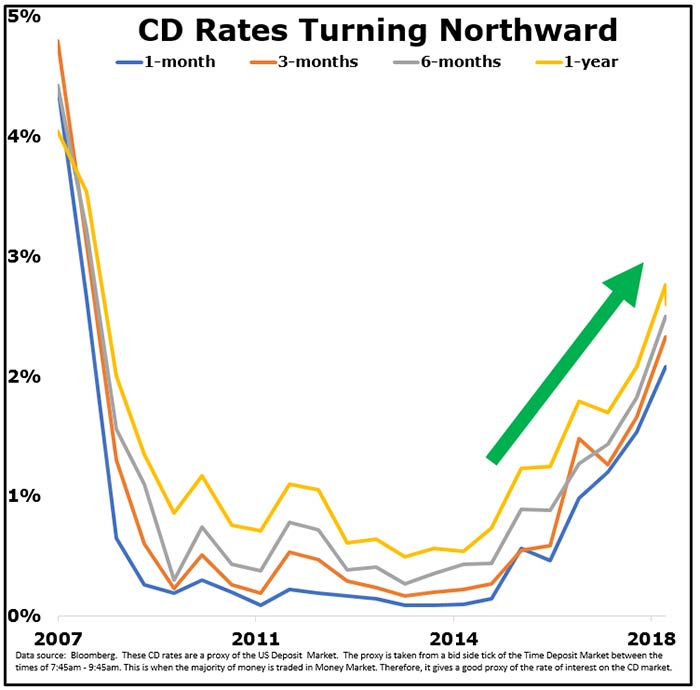

But I have good news for her. Looking at the chart below, you can see that CD rates are climbing steadily.

Since the start of the Great Recession in December 2007, CD rates of varying terms tanked and languished for several years.

This collapse is understandable given the state of the economy and the federal funds rate being close to zero.

However, in 2017, rates took a significant turn for the better and began to climb month-by-month.

Now, investors like my mother-in-law can begin to implement CD investment strategies that earn yields not seen since 2008.

And if she employs the following strategy, she’ll be well on the path toward earning the yield she seeks.

This strategy can help investors generate a return on investment that is five times greater than a single maturity date CD, 17 times greater than a savings account and 85 times greater than a money market account.

Here’s How CD Ladders Work

CD ladders are ideal for investors who want to earn a robust CD yield while still having more frequent access to their funds.

Instead of placing your funds in one CD, they can be placed in multiple CDs of varying maturities and varying terms.

For example, using a three-year investment time frame, your first CD could mature in one year, the second CD in two years and the third CD in three years.

When the first CD matures in one year, you gain full access to those funds. Then you can put your money in a new CD at a likely higher interest rate. Or you can liquidate all or part of your funds to pay for a long-term goal like a child’s college tuition, or even have a bit of fun and take a cruise vacation.

And that’s just one example. CD ladders are customizable to your financial needs. If you want to, you can choose to build one with CDs that mature at three, six, nine or 12 months.

Shopping Around for Income

As with any investment, there are some downsides to CD ladders.

Keep in mind that interest rates can fluctuate up or down at any given time. If for some reason interest rates decline, that could lower your returns.

And if for any reason you need to break your CD term before maturity, financial institutions can charge a penalty fee up to six months’ worth of interest or more. (As with any financial agreement, please read the fine print or consult with a financial professional before signing.)

Once you’ve weighed the pros and cons, the ideal way to make CD ladders work for you is to find the best CD rates available.

Initially, many investors may open a CD at their local bank. But like my mother-in-law experienced, sometimes these rates are quite low. That’s why it is a great idea to shop around.

Bankrate.com maintains a database of current CD rates. Click here to view the best CD rates by varying maturities across the nation. In many cases, online banks like Barclays, Synchrony Bank, Ally Bank and Capital One 360 offer the most competitive rates.

Once you’ve done your homework and selected the financial institution that works best for you and your CD ladder, you can then run various investment scenarios using this calculator from Dinkytown.net, a first-rate source of online financial calculators.

If you’re on a mission like my mother-in-law to find a higher-yielding CD, a CD ladder can be added to the list of possible financial instruments to help you meet your monetary needs.

Until next time,

Amber Lancaster

Senior Research Manager, Banyan Hill Publishing