The remains of the Spanish galleon Nuestra Señora de Atocha sat on the bottom of the ocean for over 380 years. The famous treasure-laden ship sank in 1622. In 2005, Capt. Jack Jowers of the R/V Dare lifted a 4-foot-long golden chain from the sea floor.

The gold sparkled in the sunshine as if no time had passed.

It was a fantastic discovery that whetted the appetites of treasure seekers all over. There’s nothing more alluring than seeing a diver, still in the sea, holding up sparkling gold.

The fact that gold keeps its luster even in the ocean speaks to the secret of its longevity and desirability.

The Superman of Elements

There aren’t many substances that don’t break down in seawater. Most metals in seawater become something else. Silver, zinc, copper and iron all happily combine with oxygen and rust.

Gold, on the other hand, does not rust. It takes high temperatures and pressures to make gold form compounds with other elements. The reason is simple: It’s a happy element.

Most elements are unhappy with themselves — they need to add or drop electrons to feel good. That means they turn into something else by combining with other elements. Most metals want to join with oxygen to get those extra electrons. The result is metal oxides — rust.

Gold isn’t like that. It’s happy all by itself, which makes it the Superman of elements. It’s so durable that nearly all the gold ever mined is still around today. That’s roughly 187,200 metric tons, according to the World Gold Council.

To put that in perspective, we produced about 3,100 metric tons of gold in 2015, a record volume. That means, on our best year ever, we added just over 1% to the total gold available.

For investors, that means we can’t rely on fundamentals such as supply and demand to give us hints on the direction of gold prices. The price of gold is much more about economic conditions around the world. To understand the price of gold, we have to understand money.

Scraps of Paper and Cloth

Money is actually just a fiction that we all agree upon. We say that this scrap of paper and cloth with writing on it has value, so it does. The price of gold, on the other hand, is set by people hedging their bets on that fiction.

Sometimes we feel less confident about the value of a currency. When that happens, we want to own fewer scraps of paper and more “stuff.” Gold is a good choice. It has a long history of being a store of value because of its appearance and utility.

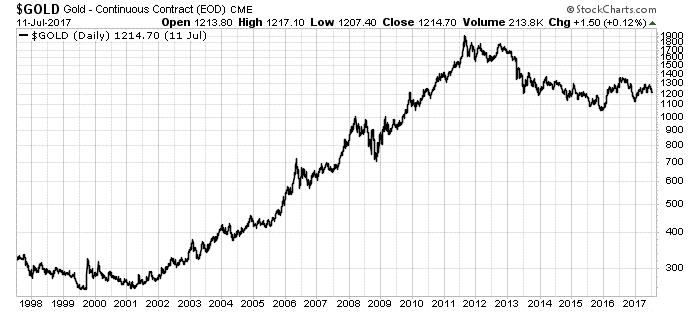

The price of gold shows the long-term confidence of investors versus their faith in the dollar:

As you can see, gold is more than four times more valuable today than it was in 2001.

The reason is simple: There is a finite pool of gold. The amount added to the total every year is minimal. On the other hand, the number of new dollars in circulation is unlimited. The stated goal of most governments today is to create inflation. They do that by flooding the world with currency.

Think of the volume of gold in the world as a big pie. There are only so many pieces of that pie. The more money we add, the smaller the slice of the pie you can afford becomes. On the other hand, if you already have a slice, it becomes worth more and more money.

That’s why owning some amount of gold is critical for every investor. It’s insurance against inflation. It doesn’t have to be bars or coins either. Jewelry makes a great investment … and it looks nice too.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist

Editor’s Note: EverBank created the non-FDIC insured Metals Select® accounts to help you purchase metals the smart way. Choose from owning bars, coins or bullion with no annual account fee. There’s also an automatic purchase plan available so that you can buy metals at your own pace. To get all the information, click here.

For the sake of full disclosure, we receive a marketing fee based on our relationship with EverBank. But, honestly, we’d work with them regardless.