In 1955, Warren Buffett taught an adult education course on investing.

One evening, a student asked him how to make money in the stock market.

But Buffett didn’t go into a long explanation.

He didn’t spend a single second on how to calculate cash flow or give his insights on the importance of a margin of safety.

Instead, his answer was short and sweet. He said:

Be fearful when others are greedy, and greedy when others are fearful.

When there’s fear in the market — and investors sell indiscriminately — those are the times to be greedy.

And I believe we’re pretty close to one of those times…

Hold Tight

On Monday, the New York Stock Exchange was closed for Presidents Day.

And that was the day Russia invaded Ukraine.

In overnight trading, the stock market sold off.

At the opening bell on Tuesday, the stock market went down, rallied higher and then fell sharply.

Fear had gripped the market.

But it didn’t make any sense to me why stocks should be falling.

So, I asked myself: “How will this conflict impact the businesses in our portfolio?”

Will the largest hospital chain in the U.S. have fewer patients this week because of it?

Or what about the leader in cloud software and hardware? Will it sell less of its products to Microsoft and Facebook because of it?

You see what I’m getting at…

I don’t look at stocks as wiggles and jiggles. Instead, I see them as pieces of a business.

And nothing fundamentally changed in any of our businesses over the past 48 hours.

So, why would you want to sell over this geopolitical market shock?

Standing Still

LPL Research recently looked at how the S&P 500 has reacted to these kinds of market shock events.

There have been at least 22 geopolitical events over the past 80 years.

From the Pearl Harbor attack on December 7, 1941 to the U.S. withdrawal from Afghanistan in August 2021…

In between, there was the Cuban missile crisis in 1962, Iraq’s invasion of Kuwait in 1990 and the Boston Marathon bombing in 2013.

And LPL found that, on average…

- The S&P 500 Index fell 1% on the days of the events.

- Less than three weeks after the events, the total drawdown was under 5%.

- And around seven weeks after the bottom, the S&P 500 traded higher.

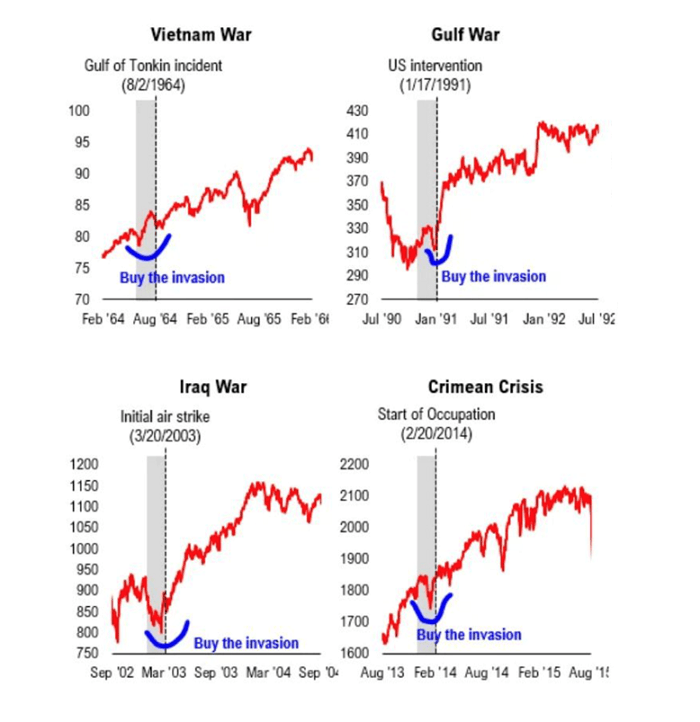

The charts below show this trend as well…

Initially, there’s a sell-off … and then, cooler heads prevail.

The right decision during any of these events was to buy, not sell.

And it makes sense for the current situation with Russia and Ukraine, too.

Yet, right now, most investors are acting with their emotions instead of their heads…

Flip the Switch

Trying to sidestep downturns is a fool’s errand.

And when trading decisions are based on emotion, they’re usually wrong.

The way to make money is not by timing the market, but your time in the market.

That’s why I look at the facts and analysis to make investment decisions.

Every stock I recommend is a quality business that should be worth a lot more in five years — regardless of market shocks.

So, right now, investors should not be reacting to this current market shock or selling. Not a chance.

Instead, they should see this sell-off for what it is — a buying opportunity — and take advantage of it.

For example, my most recent recommendation is quickly approaching my buy-up-to price. While the market has been heading lower, this tech leader continues to move higher.

Alpha Investors still have the opportunity to buy shares at a bargain price today. But prices won’t stay attractive forever.

So, if you’re not an Alpha Investor yet, don’t hide under the covers and miss this opportunity that Mr. Market is giving you. Find out how to join the family right here.

Regards,

Founder, Alpha Investor

P.S. I don’t want you to miss out on our Alpha Investor shopping list. So, if you’re not a part of the family yet, be sure to check out how you can join us right here.